Crypto’s Black Friday: A Tale of Woe and Wipes

You’re reading Crypto Long & Short, our weekly newsletter featuring insights, news and analysis for the professional investor. Sign up here to get it in your inbox every Wednesday.

You’re reading Crypto Long & Short, our weekly newsletter featuring insights, news and analysis for the professional investor. Sign up here to get it in your inbox every Wednesday.

Mayor Eric Adams, ever the visionary, has birthed a new bureaucratic beast: the Office of Digital Assets and Blockchain Technology. A final flourish in his tenure? Perhaps. Or maybe he’s just trying to outwit Wall Street’s old guard before his time runs out. Either way, New York now boasts a blockchain office like it’s 1929 and he’s betting on the next stock market crash. 🚀

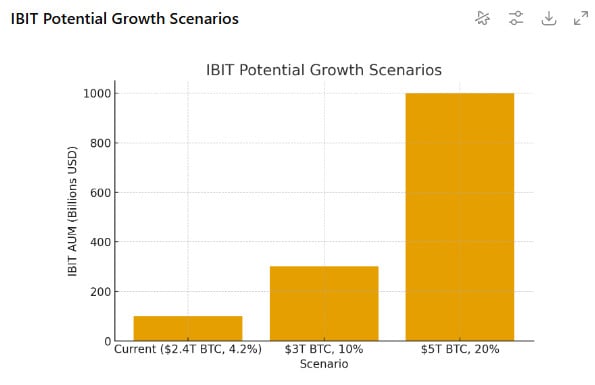

So there I was, sipping my coffee, minding my own business, when suddenly BlackRock’s iShares Bitcoin Trust decides to go all Gabriela Sabatini on the finance world and breaches the $100B AUM mark. Boom – institutional crypto adoption, they call it, but I call it a bunch of suits finally texting emojis instead of banning them. Am I right?

Wall Street’s Benchmark decided to throw confetti on CompoSecure (CMPO) and call it a “buy.” Why? Because their crypto wallet unit, Arculus, upgraded from “basic safe” to “Wall Street’s new favorite toy.” Classic.

Yet, as with all masquerades, the masks soon slipped. The recovery, it seems, was but a gilded exit for the astute. Key holders, those wily custodians of fortune, seized the moment to lighten their burdens, leaving one to wonder: was this optimism born of conviction, or merely the froth of hype? In the past 24 hours, the price has languished in a flat stupor, prompting traders to scrutinize the 4-hour chart with the zeal of a detective at a crime scene.

On a Wednesday that will surely be etched in the annals of blockchain lore, the vigilant eyes at Lookonchain spotted the movement. A wallet, dormant for three long years like a bear in hibernation, suddenly awoke and transferred 9,757 Bitcoin (BTC), valued at a cool $1.1 billion. But the drama did not end there! Hours later, another 2,129 BTC, worth $238 million, was shuffled off to new wallets. The grand total? 11,886 Bitcoin, or roughly $1.3 billion. One can almost hear the faint echo of a cashier’s till closing. 💼💨

Why? Oh, who knows! Maybe they’re hedging against the market’s existential dread, or maybe they’re just front-running another round of liquidity stress. Either way, it’s like watching a luxury yacht sink while the captain sips champagne. 🥂

According to the oracles at crypto.news, XRP (XRP) was last spotted trading at $2.52, a figure as diminished as its holders’ hopes, down 12% over the past 7 days and a staggering 30% from its fleeting all-time high this year. 📉