PENGU’s Regency Rally: 17% Rebound Amid Whimsical Wallets! 📈🐧

Open Interest hath rebounded to $160 million with volume surpassing $1 billion, intimating a renewed esprit de corps for bullish pursuits. Ah, the dance of fortunes! 💸

Open Interest hath rebounded to $160 million with volume surpassing $1 billion, intimating a renewed esprit de corps for bullish pursuits. Ah, the dance of fortunes! 💸

If you thought institutional investors were already obsessed with crypto, hold my coffee. Grayscale just filed Amendment No. 1 for their XRP Trust, and it’s basically Wall Street’s makeup tutorial for investing in XRP without actually owning crypto (thanks, Coinbase Custody!).

On the fateful Monday of October 13th-mark it in your calendar, alongside meteor showers and national biscuit day-Bybit, the crypto colossus that ranks just below “who’s the biggest?” debates, joined forces with none other than UBS, the banking titan that still sends faxes to Geneva just to feel alive. Together, they declared: “Let there be bridges!”, and thus, the great confluence of traditional finance (TradFi) and Web3 commenced, like two rivers-one filled with gold, the other with memes-meeting in a foggy estuary of innovation. Or something.

As the phishers grow slicker, SEAL counters with cryptographic sorcery, ensuring reports are as trustworthy as a grandmother’s pie recipe. 🥧🔐 No more cloaked sites or fake “clean” versions-this tool strips away the illusions, leaving scammers naked in the harsh light of truth.

So, on October 10-mark your calendars, folks!-Aljarrah strutted onto X (that’s Twitter for the rest of us) claiming that gold is staging a comeback as the world’s headliner asset! 🎤 And what’s XRP’s role in this rocket launch? Why, it’s the bridge that connects Real-World Assets (RWA) like gold to the modern digital jam that everyone’s dancing to. Think of it as the DJ spinning records at a financial rave!

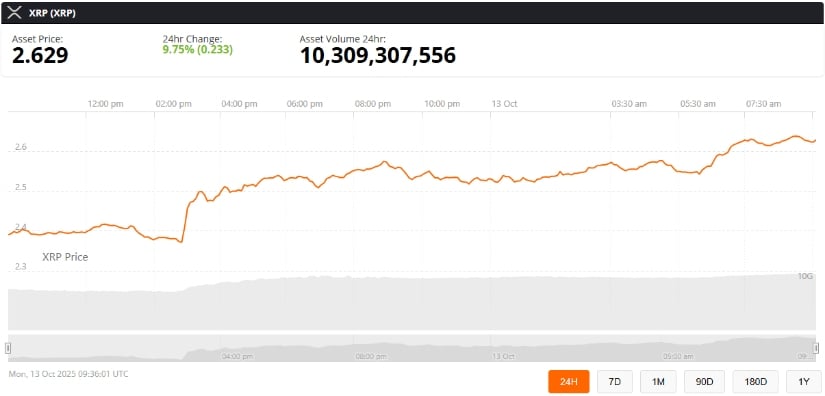

This veritable tempest of a surge arrives post a week of melodramatic U.S.-China trade follies and a liquidation event of biblical proportions, sweeping away the overzealous like dust in the wind, only to restore XRP’s market capitalization to a princely $30 billion. Investor confidence rekindled? Or merely the folly of hope eternal? 🤔

Now, amid the smoke and the broken portfolios, some so-called experts (who clearly missed their morning coffee) are calling this chaos a “perfectly executed trade”-as if wiping out almost all leveraged positions at once is just a Tuesday, not a slapstick episode of financial slapstick. Apparently, they think this wipeout was part of some grand plan. You know, like a cosmic prank or a very boring game of Monopoly with real money.

But wait, it doesn’t end there. Ash Crypto, ever the optimist (or perhaps a secret contrarian), also foresaw that the last quarter of the year would be Bitcoin’s grandest hour. He boldly stated that Bitcoin would surge to $150,000, ushering in a glorious altcoin season. A truly thrilling ride… assuming you survive the initial plunge.

BeInCrypto has pinpointed three altcoins that might just break their own records next week, assuming the crypto gods are in their favor. Let’s dive into the madness, shall we?