Markets

What to know:

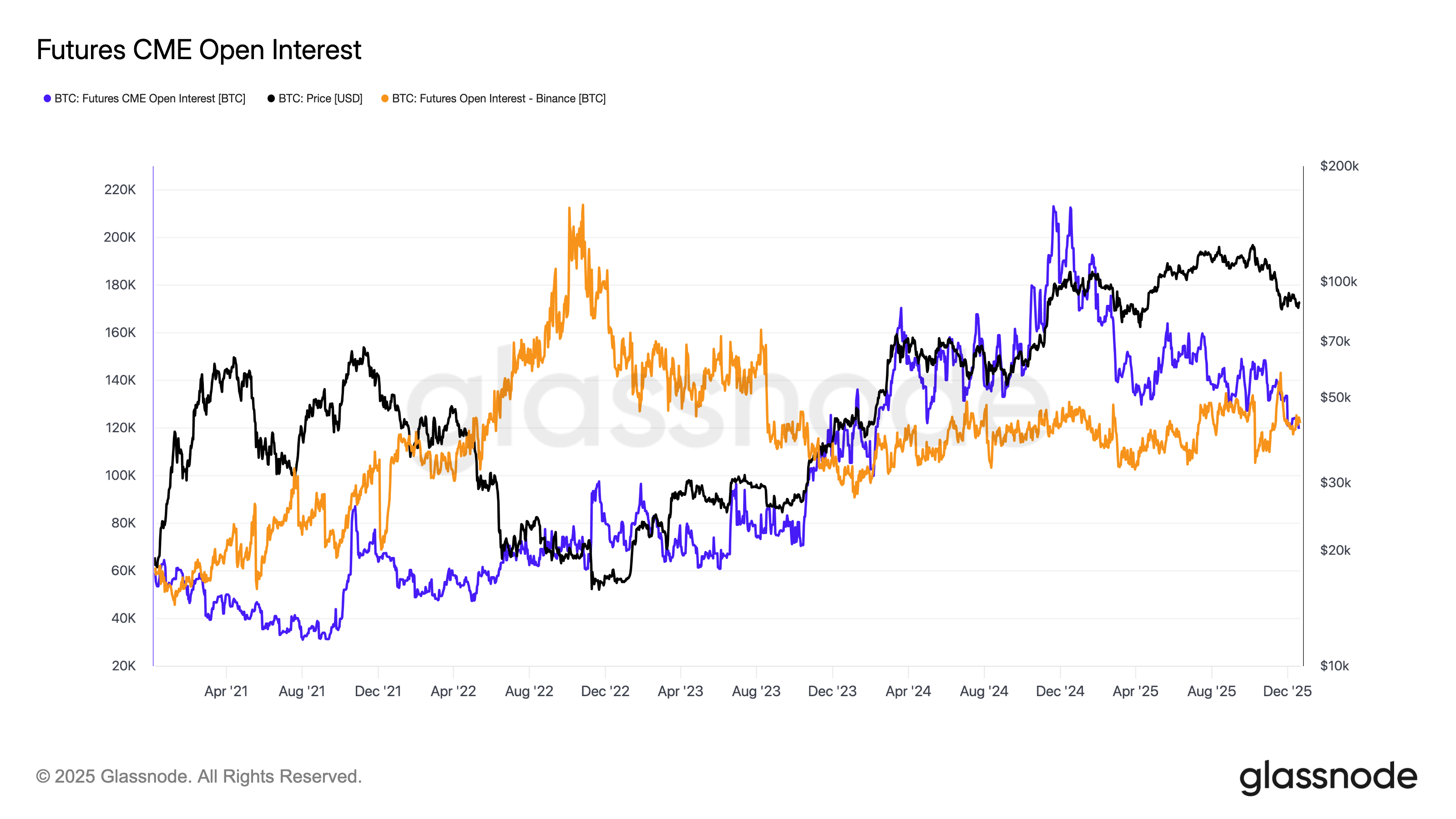

- Behold, the throne has shifted! Binance, that brash upstart, now reigns supreme with a bitcoin futures open interest of 125,000 BTC-a cool $11.2 billion, if you’re counting. 🏰💰

- CME, once the darling of institutional whimsy, has tumbled to a mere 123,000 BTC, its lowest since the halcyon days of February 2024. A fallen monarch, indeed. 👑↘️

- Tightening spreads, unwinding trades-the basis trade, once a lucrative dance, now lies in tatters, leaving institutional demand as cold as a Russian winter. ❄️💔

Ah, the fickle nature of markets! The CME, once the grand maestro of bitcoin futures open interest (OI), has been dethroned by Binance, that enfant terrible of the crypto world. According to the ever-watchful CoinGlass, Binance now holds the scepter with 125,000 BTC ($11.2 billion), while CME languishes with a mere 123,000 BTC ($11 billion). A difference of 2,000 BTC, you say? In this game of thrones, it’s enough to crown a new king. 🦁👑

CME’s OI began the year at a robust 175,000 BTC, but like a poorly written novel, it has steadily declined. The basis trade, once a profitable charade-buying spot bitcoin while selling futures to capture the price premium-has lost its allure. The profitability? Vanished like a butterfly in a Nabokov novel. 🦋✨

Binance, however, remains the playground of retail punters, those daring souls who bet on price movements with the fervor of a chess grandmaster. Their open interest has held steady, unmoved by the institutional doldrums. After all, why fret over basis rates when you can ride the waves of speculation? 🌊🎢

Ah, memories! Just over a year ago, CME’s OI soared to 200,000 BTC as prices flirted with $100,000, buoyed by the euphoria of President Trump’s electoral triumph. The basis rate? A giddy 15%. Today, that rate has shriveled to 5%, a testament to the diminishing returns of institutional folly. 📉😢

As spot and futures prices converge, arbitrage opportunities shrink like a timid shadow. CME, once the darling of institutional positioning ahead of the spot bitcoin ETF launch in January 2024, now finds its advantage as fleeting as a dream. For now, Binance reigns, and the retail rebels have their day. 🌟🎉

Read More

- USD JPY PREDICTION

- EUR PHP PREDICTION

- EUR USD PREDICTION

- Brent Oil Forecast

- Gold Rate Forecast

- USD MYR PREDICTION

- EUR THB PREDICTION

- Silver Rate Forecast

- USD INR PREDICTION

- BTC PREDICTION. BTC cryptocurrency

2025-12-22 19:21