Ah, the world of finance—where numbers grow faster than mushrooms in a damp cellar, and everyone pretends they understand what’s going on. Well, buckle up, because gold and bitcoin ETFs have just crossed the $500 billion mark together. Yes, you read that right. Half a trillion dollars. It’s like someone combined a shiny rock 🪨 and a digital coin 💻 into an unholy alliance of investment wizardry.

What to know (because ignorance is only bliss until it isn’t):

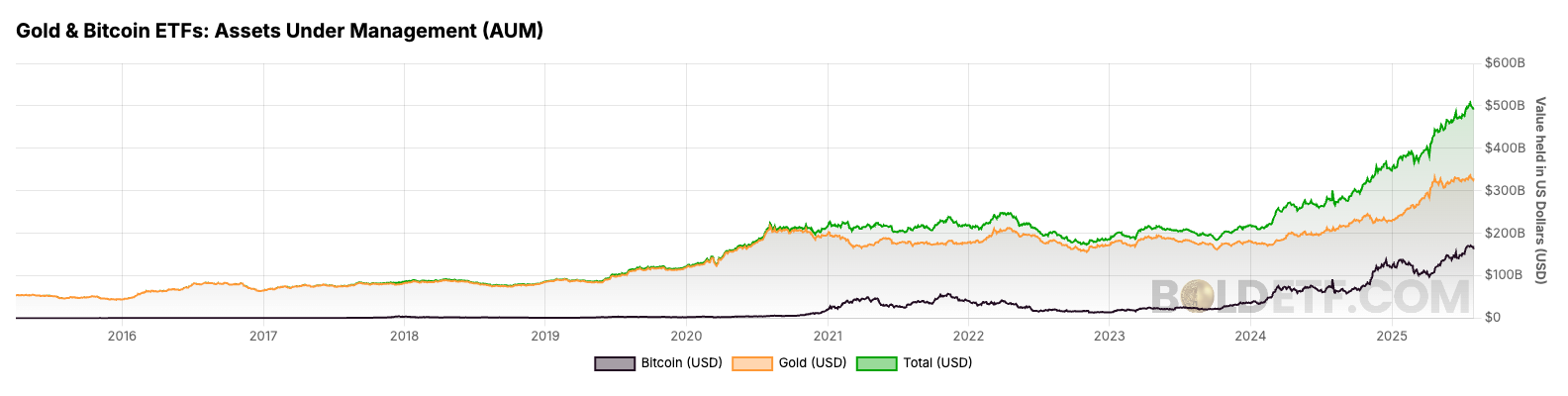

- Bitcoin ETF assets have gone from “meh” at $20 billion to “whoa!” at $162 billion, thanks to the US deciding that spot bitcoin ETFs were finally worth approving. Apparently, all it took was a few decades of begging.

- Meanwhile, gold ETFs, those dependable old-timers of the investment world, have nearly doubled their assets under management (AUM) to $325 billion. But let’s be honest—bitcoin is the flashy new kid on the block, with its price skyrocketing 175% compared to gold’s modest 66%. Poor gold. Still stuck being… well, gold. 😅

BTCBTC$114,491.82◢0.72%

So here we are, folks. The combined AUM of gold and bitcoin ETFs has officially hit the big leagues, crossing $500 billion for the first time. According to the Bold Report (which sounds suspiciously like a superhero comic), gold ETFs account for about $325 billion, while bitcoin ETFs have surged to $162 billion as of early August 2025.

Gold, bless its metallic heart, has been the steady Eddie of ETF markets, growing year after year like a well-behaved plant 🌱. Bitcoin, on the other hand, is more like that one weed in your garden that suddenly takes over everything. Before the US spot bitcoin ETFs arrived, global bitcoin ETF AUM was a measly $20 billion. Now? Eight times bigger. That’s not growth; that’s a financial explosion. 🧨

If you look at the chart tracking AUM growth over the past five years, gold ETFs are like a slow-moving glacier—majestic but predictable. Bitcoin ETFs? More like a caffeinated squirrel on a sugar rush. 🐿️ The divergence in price movements tells a similar story. Since the US bitcoin ETF launch, bitcoin’s price has shot up 175%, leaving gold’s 66% gain looking positively pedestrian. Some might call it volatility; others might call it chaos. Either way, it’s making people money—or losing it, depending on how lucky you’re feeling today. 🍀

And there you have it. Gold and bitcoin, two very different beasts, now sharing the same pasture of prosperity. Whether you’re team shiny rock or team digital wizardry, one thing’s for sure: this $500 billion milestone is either the start of something great or the calm before the storm. Place your bets wisely—or don’t, because who really knows what’s going to happen next? 🎲

Read More

- Gold Rate Forecast

- EUR USD PREDICTION

- Brent Oil Forecast

- BTC PREDICTION. BTC cryptocurrency

- EUR AUD PREDICTION

- Silver Rate Forecast

- POL PREDICTION. POL cryptocurrency

- Bitcoin’s Downfall: Two Scenarios That’ll Make You Scream 😱

- CNY JPY PREDICTION

- EUR RUB PREDICTION

2025-08-04 12:51