Well, well, well. Look who’s back in the game! Bitcoin is prancing around the $115,000 mark, with bulls puffing their chests, determined not to let it dip below $120,000. You could almost hear them chanting “bullish forever” (or maybe that’s just the sound of cryptocurrency optimism). The trend? You guessed it-bullish, baby! It’s being carried along by the ever-reliable combo of steady buying interest and a technical setup that’s all “hey, this is looking good.”

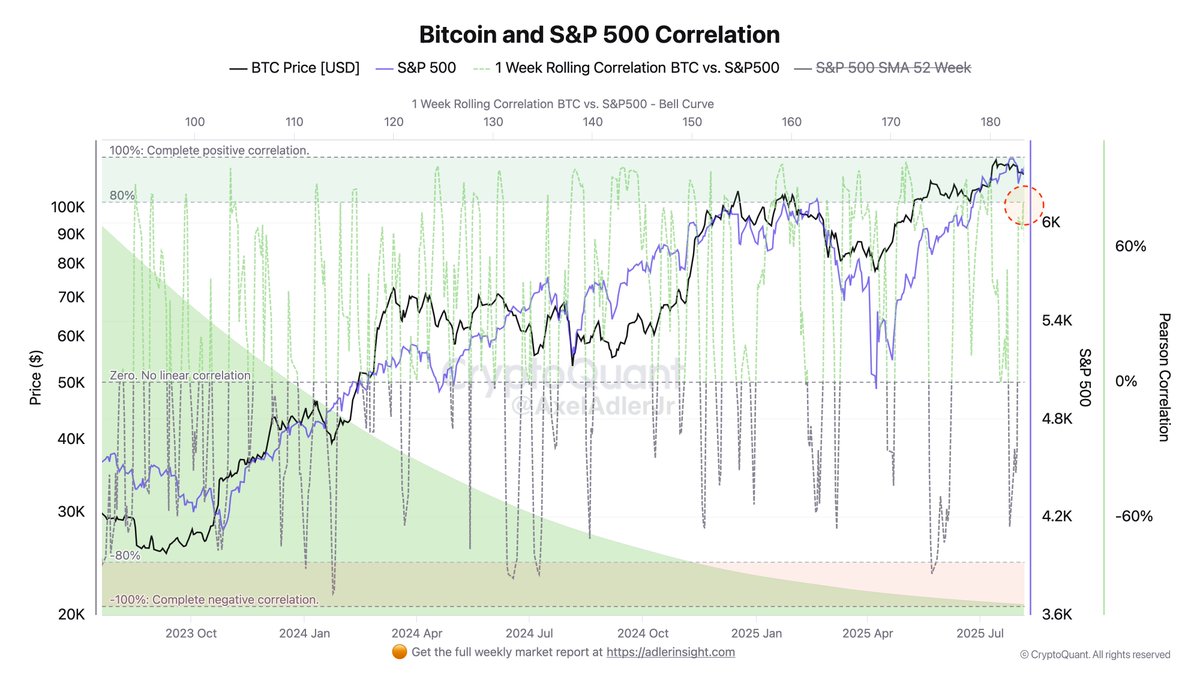

Now, for the juicy bit: Bitcoin and the S&P 500 are practically *joined at the hip* with an 80% correlation. Yep, you read that right-80%. That’s not a coincidence, folks! In the world of high correlation, if the S&P 500 continues its shiny rally, Bitcoin might just hop on the bandwagon, waving its digital pom-poms. On the flip side, if stocks take a dive, Bitcoin will probably have a little tantrum too. It’s all very interconnected, like an awkward dance at a family reunion.

Right now, the S&P 500 is cruising along in a bullish phase, and surprise, surprise-Bitcoin is tagging along. But hold your horses! Market experts (yes, those wise sages) are quick to point out that when correlations are this high, things can change faster than you can say “blockchain.” So, while everything looks rosy now, one wrong turn in the market could have Bitcoin flipping out faster than a cat in a room full of laser pointers.

S&P 500: Strengthening Bitcoin’s Macro Bond Like a Best Friend Forever

According to Axel Adler, an analyst who probably has more charts on his wall than friends, this 80% correlation isn’t just a fun number to throw around. Oh no, it’s a sign that macroeconomic forces are yanking the crypto market like a puppet on a string. We’re talking interest rates, liquidity conditions, and the “is it risk-on or risk-off today?” mood. It’s all feeding into Bitcoin’s wild ride.

If US equities keep flexing their muscles, Bitcoin might just get a boost, like the little sibling riding along on a bigger kid’s bike. But if stocks trip and fall, well, the crypto market might feel that stumble, too. It’s like when you drop your ice cream and then suddenly you’re questioning everything in life.

But don’t get too comfy, folks. Adler points out that this whole “high correlation” thing could be short-lived. It’s like a summer fling-fun while it lasts, but don’t expect it to last forever. The 80% correlation is based on a 1-week rolling metric, which can change faster than you can say “bear market.”

Still, for all the short-term shenanigans, the long-term outlook for Bitcoin is looking as bright as a disco ball, thanks to things like ETFs and corporate treasuries getting in on the action. But of course, you’ve gotta watch out for the usual suspects: economic downturns, tightening liquidity, or a surprise move from the Federal Reserve. Those could spoil the party real quick.

Bitcoin Price: Bulls Stand Guard Like a Bouncer at the Door

As of now, Bitcoin is hanging out at $116,565, looking mighty comfortable after reclaiming its $115,724 support level. It’s like finding that perfect spot on the couch where you don’t want to move, ever. On the 4-hour chart, BTC broke above the 50-day, 100-day, and 200-day SMAs-basically, it’s like getting three thumbs up from the market. So, if it gets tested again, that sweet support zone might just keep the bulls in charge.

The next target? Oh, just a little thing called $122,077. It was last tested in mid-July, so it’s been around the block. But Bitcoin’s been feeling some selling pressure near $117,000, so expect a bit of back-and-forth before it decides to break free. Volume’s been dropping a tad, so the bulls might need a little extra juice to push forward.

If Bitcoin stays above $115,724 and that comfy moving average cluster, the bulls could be gearing up for a little sprint towards $118,000-$122,000. But, just like with any good party, if it gets shut down early, we might see a pullback to $115,724. It’s a waiting game, people.

Read More

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- Ethereum Whale’s Bold $280M Short: Is the Market on a Cliff or Just a Cliffhanger? 🤔

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

- Binance Now Fully Approved in Abu Dhabi-What This Means for Crypto!

- Bitcoin’s Cosmic Cringe: Why the Crypto World Is Now a Black Hole 🌌💸

- Upbit’s Wild Goose Chase: $1.77M Frozen, Hackers on the Run 🕵️♂️💰

2025-08-09 11:18