Oh no, not again! Bitcoin takes a tumble as inflation climbs 0.3% in June, leaving investors feeling blue.

Inflation Soars, Bitcoin Takes a Dive

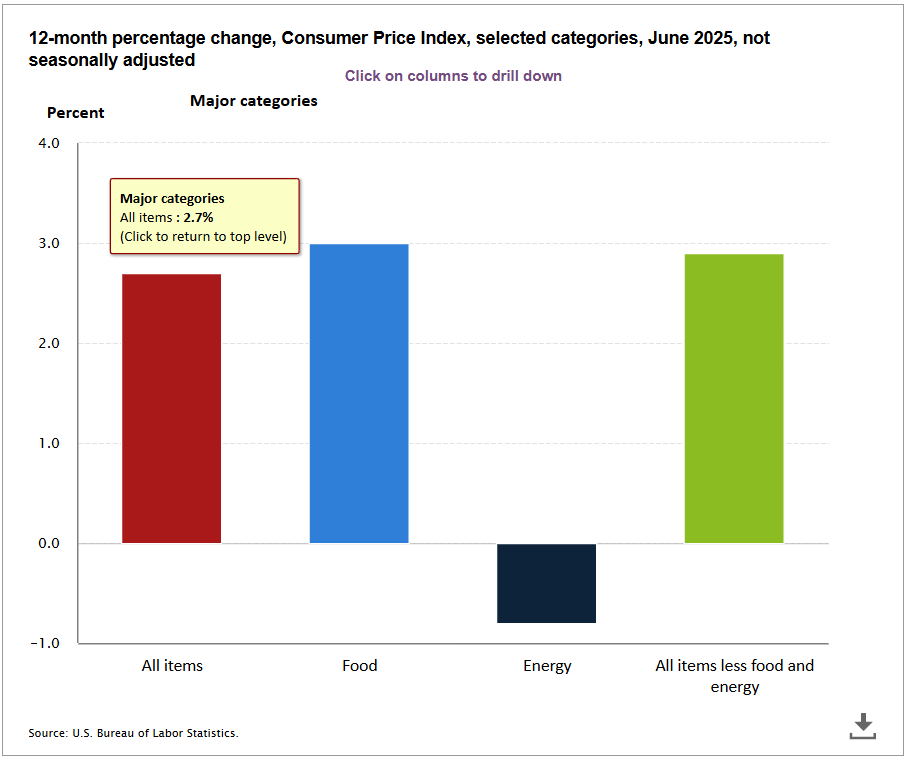

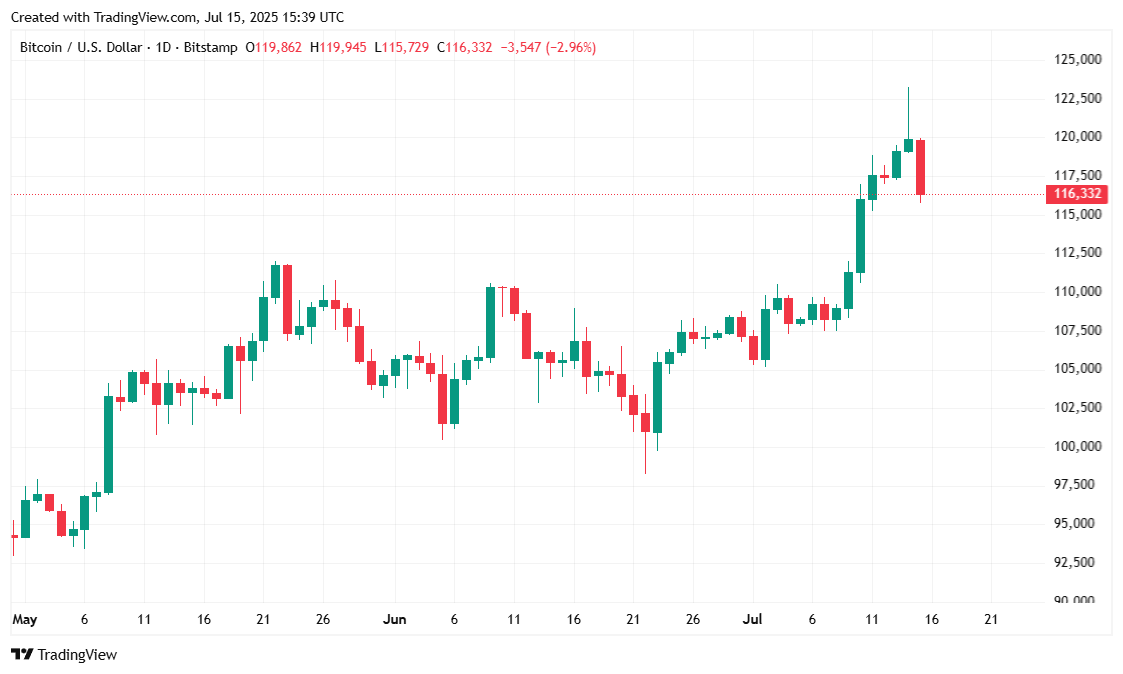

The U.S. economy may be feeling the heat from President Trump’s tariff policies as inflation spiked 0.3% in June, according to the U.S. Bureau of Labor Statistics. Bitcoin, the world’s most popular cryptocurrency, took a nosedive, falling below $117K after reaching a high of $123K on Monday.

Economists had warned that Trump’s trade policies would lead to runaway inflation, but the president remained undeterred. Instead, inflation came in lower than expected and employment data was consistently positive. The president, feeling increasingly confident in his trade strategy, called for Jerome Powell, Chairman of the U.S. Federal Reserve, to cut rates or resign. Powell has been hesitant to cut rates until inflation falls below the Fed’s 2% target.

Now that inflation is on the rise again, some are warning that the 0.3% increase in the consumer price index (CPI) is a lagging indicator of the consequences of Trump’s tariffs. To be fair, today’s CPI numbers didn’t surprise anyone, as they were mostly in line with economists’ predictions, and the president has even chimed in on Truth Social characterizing June’s inflation figures as “very low.”

“Consumer Prices LOW. Bring down the Fed Rate, NOW!!!

Fed should cut Rates by 3 Points. Very Low Inflation. One Trillion Dollars a year would be saved!!!

Overview of Market Metrics

Bitcoin was trading at $116,233.73 as the time of reporting, down 3.35% since yesterday, according to Coinmarketcap. The cryptocurrency has been trading between $115,765.69 and $120,488.41 over the past 24 hours and has appreciated 7.3% since last week.

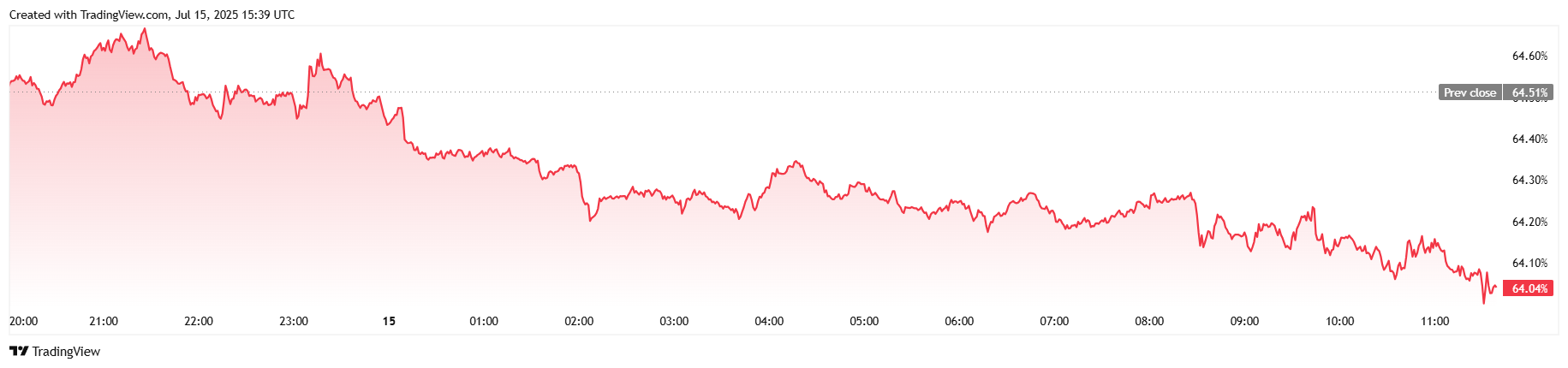

Trading volume fell by roughly 46% over 24 hours after yesterday’s frenzy and currently stands at $93.04 billion. Bitcoin’s market capitalization also eased 3.3% since yesterday and is now at approximately $2.31 trillion. BTC dominance dropped to 64.05% and is down 0.72% from 24 hours earlier.

Total open interest for BTC futures fell 2.12% today and is currently around $86.03 billion. Bitcoin liquidations fell dramatically after multiple days of heavy losses for short sellers. Total liquidations stood at $36.01 million with short sellers accounting for $6.39 million of that figure while bulls had $29.62 million wiped out on their long positions.

Read More

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- 🔥Vienna’s Crypto Carnage: Ukrainians Burn Wallets & Souls! 💰💀

- BTC PREDICTION. BTC cryptocurrency

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- EUR USD PREDICTION

- Cardano’s Melancholy Ballet: Death Cross Dances as Markets Pause for Dramatic Effect

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

- Bitcoin’s Cosmic Cringe: Why the Crypto World Is Now a Black Hole 🌌💸

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

2025-07-15 19:57