In a universe where markets dance like deranged Vogons high on coffee, the crypto circus has teamed up with gold– that shiny relic folks hoard when the apocalypse feels imminent. Bitcoin, or BTC as it’s known in the galactic ledger, just punched through to a sparkling new all-time high, giggling all the way.

Ah, the US government shutdown: a splendid excuse for investors to bail on the dollar like it’s a malfunctioning hyperspace drive. Safe-haven assets like gold and Bitcoin became the cool kids on the block, as folks braced for the USD’s dramatic deflation into oblivion. How pedestrian!

Gold climbed to a dizzying $3,897 per ounce on Oct. 2, looking smug. Meanwhile, Bitcoin shrugged off physics and shot to $125,559 on Oct. 5, boasting a market cap fatter than a Trilian space whale-almost $2.5 trillion. Impressive, if slightly absurd.

Bitcoin lords over the crypto kingdom with a 58.5% dominance in a $4.26 trillion muddle, per CoinMarketCap’s infinite wisdom. And the CMC fear and greed index? Lounging in neutral, like a towel-clad hitchhiker waiting for the next improbability drive malfunction.

Are Timey-Wimey Holders Cashing Out on This Cosmic Rollercoaster?

Bitcoin’s upward trajectory owes more to short-term traders than a plot from a sci-fi novel. Take those US spot BTC ETFs: they slurped up $3.24 billion in fresh inflows last week, pushing the grand total over $60 billion. Because nothing says ‘investment’ like following the herd into the unknown. 🙄

Expectations of “Uptober”-the community’s cheeky nod to a bullish October festival-have sparked FOMO among the masses. Fear Of Missing Out? More like Fear Of Not Having Enough Yacht Fuel. ⛵

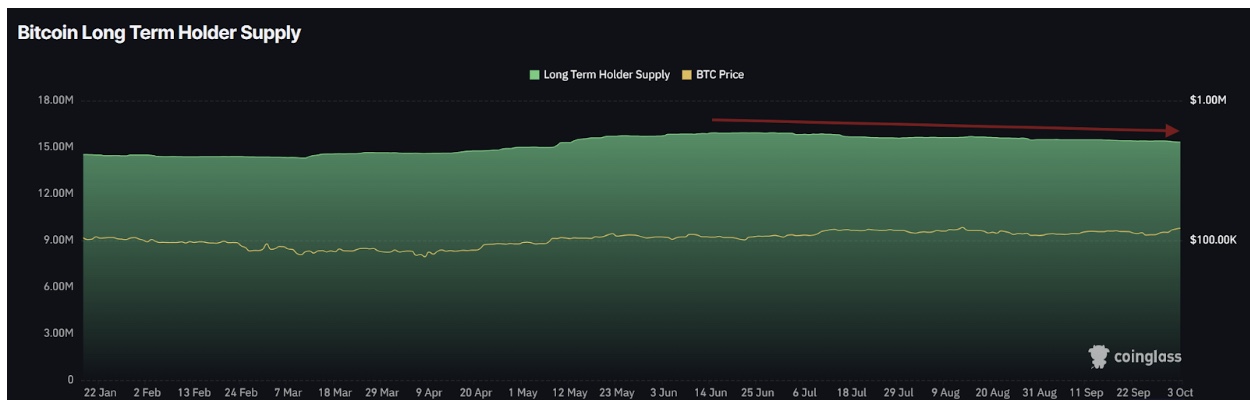

But hold onto your towels: the Bitcoin long-term holder supply has been trickling down since mid-June, from 15.92 million BTC to 15.32 million by Oct. 3, according to Coinglass. Selling out like a cheap knockoff of The Restaurant at the End of the Universe. Sad trombone. 😭

Long-term Bitcoin holders have been selling since mid-June | Source: Coinglass

This dwindling supply screams of fading faith in Bitcoin’s intergalactic future-perhaps a looming price correction bigger than the Big Bang. Investors might be bracing for the profit-taking tsunami that even Marvin the Paranoid Android would approve of.

And then there’s the Bitcoin Net Unrealized Profit/Loss indicator, bouncing from 0.51 to 0.56 last week. Still neutral-ish, but creeping toward 70 could unleash a greedy correction wave, leaving wallets lighter than a supernova’s afterglow. 😂💸

Read More

- BTC PREDICTION. BTC cryptocurrency

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- You Won’t Believe What Secretly Predicts Bitcoin’s Next Crash! 😱

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- 🔥Vienna’s Crypto Carnage: Ukrainians Burn Wallets & Souls! 💰💀

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- Binance Now Fully Approved in Abu Dhabi-What This Means for Crypto!

- ETH PREDICTION. ETH cryptocurrency

2025-10-05 12:49