Once again, the machines of commerce grind on, swallowing millions in pursuit of an elusive digital ghost. Strategy, the so-called “treasury” giant, has done what it loves-buying Bitcoin as if it’s collecting stamps, only these stamps cost over forty million dollars and come with a lot of zeros. 🤑

Strategy Has Stolen Another 390 BTC-Just Like Clockwork

In a tweet that probably caused a few fingers to cramp from clicking “send,” Michael Saylor, the oracle of digital gold, announced another expansion of their digital hoard. This round involved snagging 390 BTC at roughly $111,000 each-because who doesn’t like paying a king’s ransom for a bunch of digital squiggles? Total spending: a neat $43.4 million, money that could buy a yacht-or maybe a small moon mission.

The timing? Perfect as ever. Just a day after Saylor’s Sunday ritual, where he grins like a kid in a candy store, Strategy declared “It’s Orange Dot Day,” because every good capitalist needs a dash of color symbolism, right? 🍊😎

Filing with the SEC reveals they funded this latest binge through the sale of their stocks-because it’s always fun to sell what’s hot to fund even hotter assets. The firm now claims ownership of 640,808 BTC, with a total cost basis of around $47.44 billion. At today’s leisurely exchange rates, that stash is worth nearly $74 billion, with a profit margin comfortably lounging at 55.8%. Talk about playing with house money!

Last week, they dipped into their treasure chest for only $18.8 million-so this week’s mega-buy signals a bit of enthusiasm. But compared to earlier splurges, it’s more clipboard than tsunami, more nibble than feast.

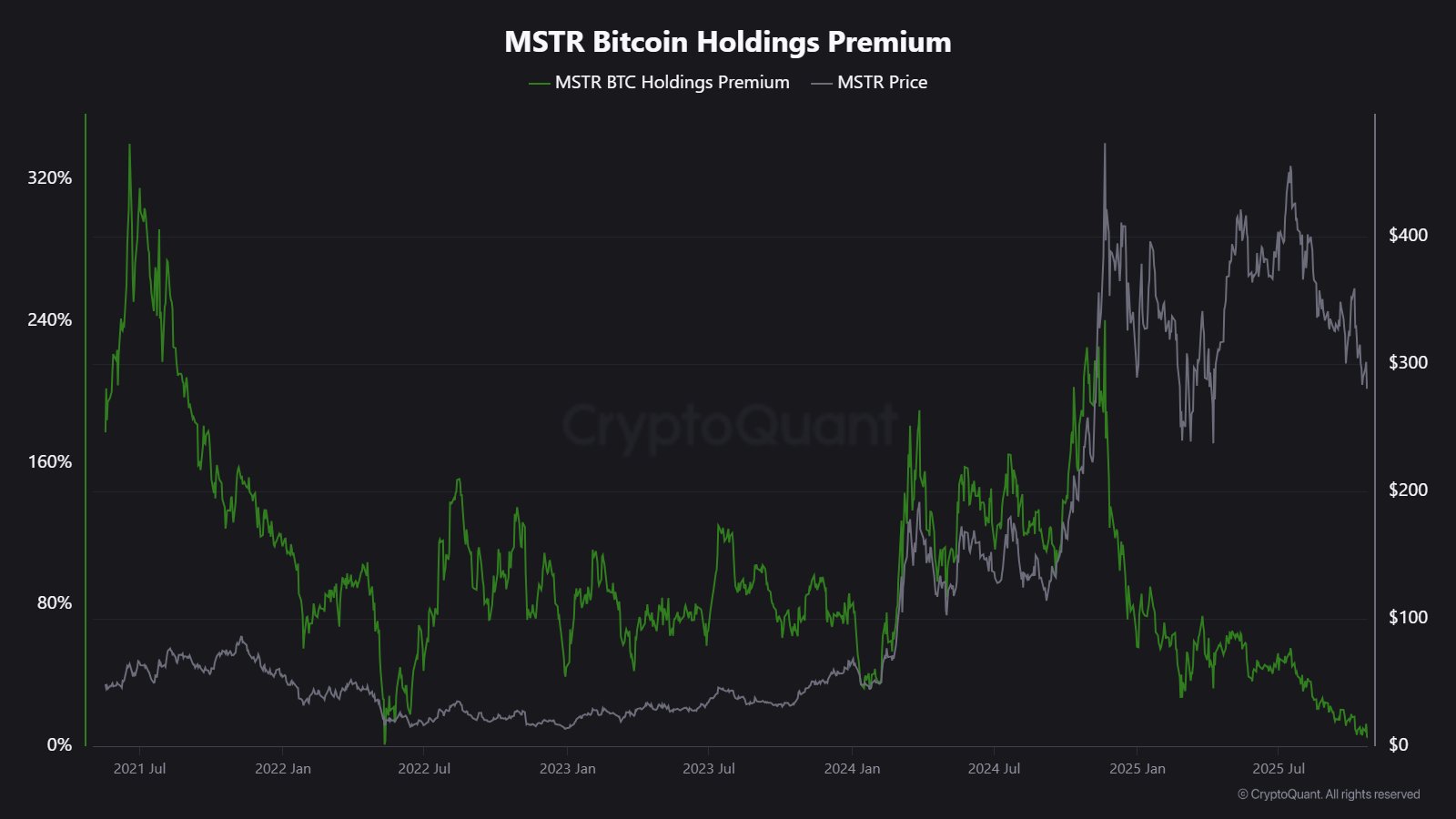

Crypto analyst Maartunn, always eager to remind us that the gravy train might be slowing, pointed out that capital-raising is becoming tougher. The premium on their equity offerings has plummeted from an eye-watering 208% to a mere 4%. Confidence wanes, but the diamonds keep glinting. 💎

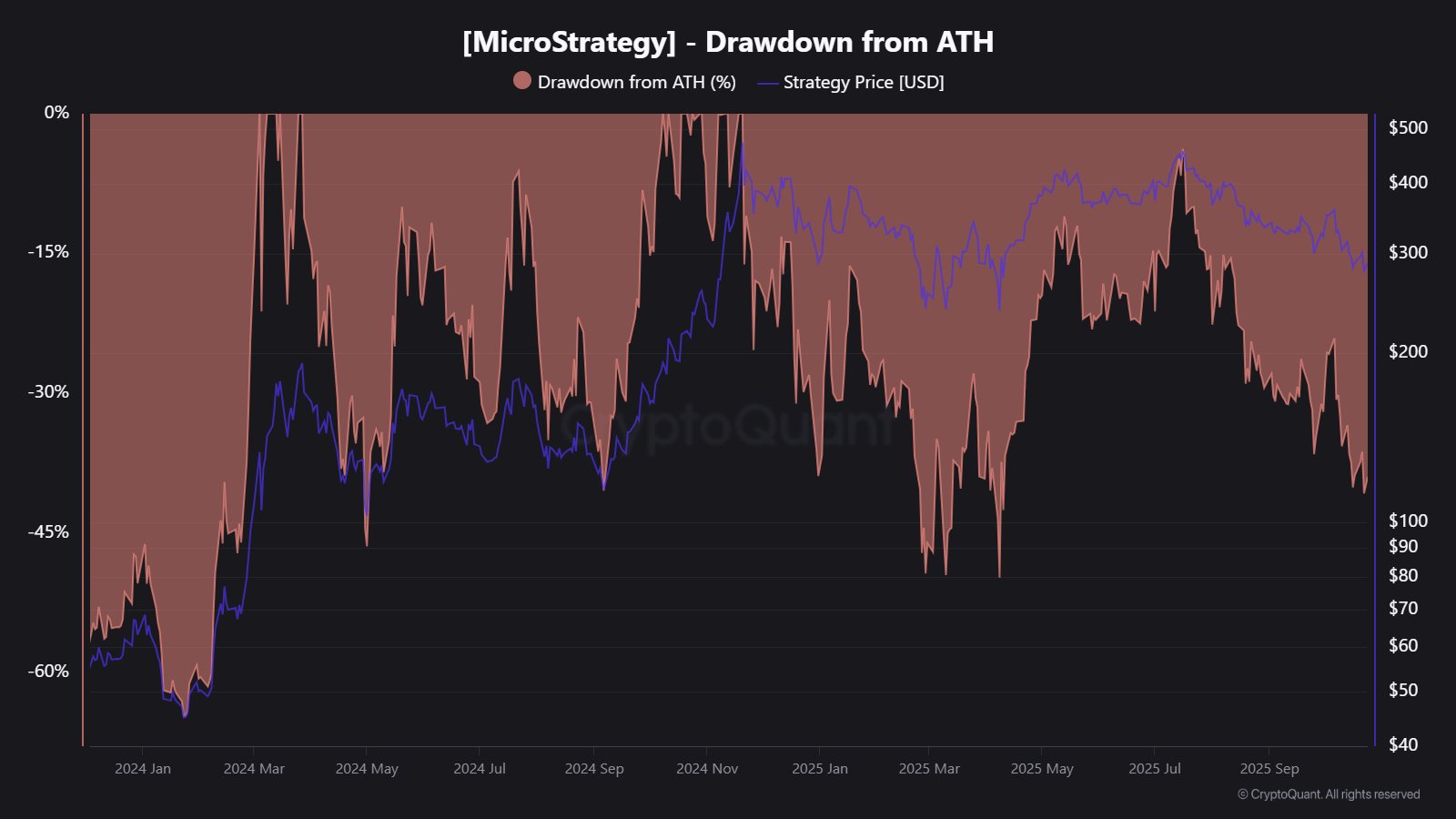

Meanwhile, Strategy’s stock-once a shining star-is now trading at half its peak glory. Bitcoin itself is down from its all-time high, but at least it’s not in the obituary zone, unlike that company’s stock. Still, the digital gold remains remarkably resilient, like a stubborn cockroach escaping nuclear blast after nuclear blast. 🪳

Despite the slowdown, Strategy persists, like a old pirate with a treasure map-steadily accumulating, cementing its reputation as the largest corporate Bitcoin whale on the planet. It’s a slow, relentless march, a digital monolith carving its empire one satoshi at a time.

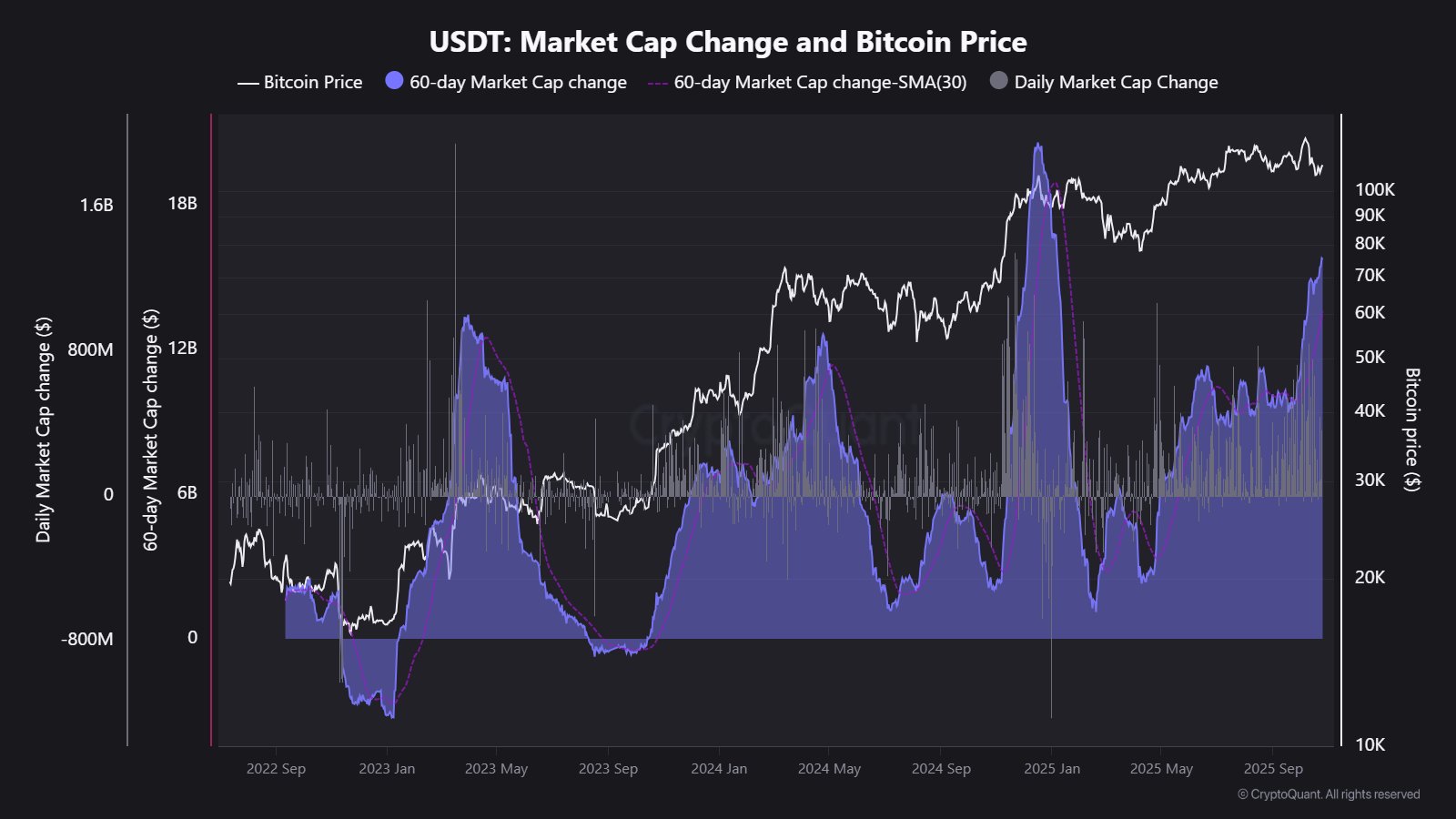

Meanwhile, in a plot twist worthy of a financial soap opera, USDT-the stablecoin that’s supposed to be, well, stable-has been growing like weeds in a neglected garden. Maartunn points out that USDT’s market cap has surged over the past 60 days, signaling a typically bullish hint for Bitcoin enthusiasts. Or a sign that everyone’s just holding onto their cash because the circus is still in town. 🎪

According to the chart, the flow of capital into USDT has been faster than a caffeinated squirrel, which-happens to be a pretty reliable indicator of short-term Bitcoin upside. Or so the prophets say. Either way, the game’s afoot, and the players are betting big on this digital roulette wheel.

Bitcoin’s Latest Thrill Ride

After a rollercoaster week, Bitcoin has bounced back to flirt with $115,500-because nothing says “confidence” like a good rally after a nosedive. The digital gold continues to tease its fans and skeptics alike, bouncing on the charts like a caffeinated kangaroo.

Read More

- EUR USD PREDICTION

- GBP CNY PREDICTION

- NEXO PREDICTION. NEXO cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- STX PREDICTION. STX cryptocurrency

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- CNY JPY PREDICTION

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- USD MYR PREDICTION

- Is XRP About to Soar or Crash? The $3.27 Dilemma Explained!

2025-10-28 12:50