Bitcoin ETFs experienced $103.57 million in net outflows on January 23rd, meaning more money left these funds than entered, for the fifth day in a row.

Summary

- Bitcoin ETFs lost $103.57M on Jan 23, marking five straight days of outflows.

- The sell-off has pulled $1.72B from Bitcoin ETFs since Jan 16.

- Ethereum ETFs also slid, extending their outflow streak to four sessions.

The BlackRock IBIT fund saw $101.62 million withdrawn, while the Fidelity FBTC fund experienced $1.95 million in redemptions.

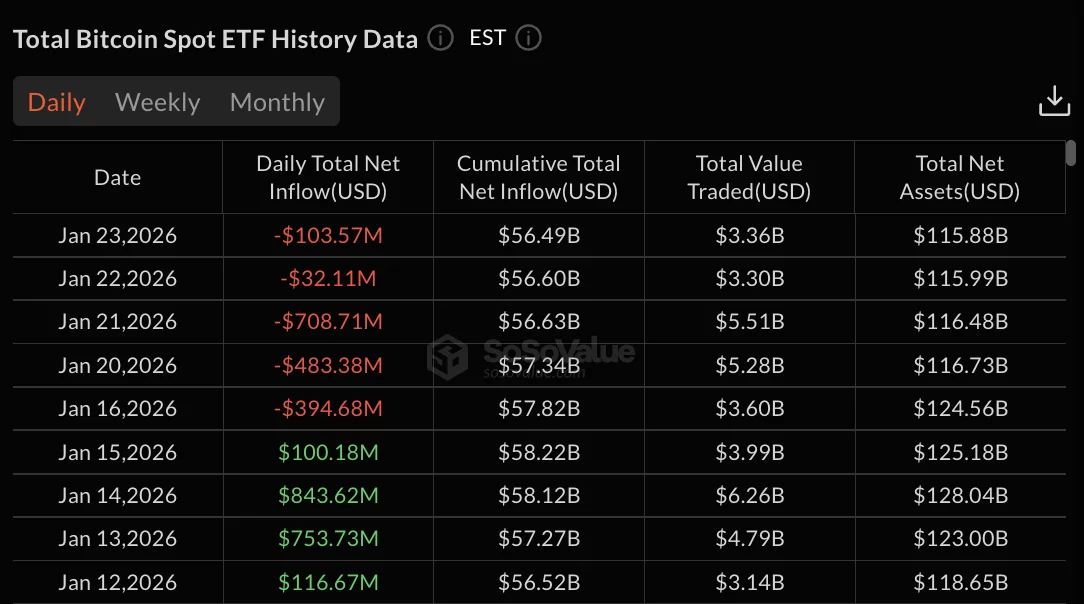

As an analyst, I’m seeing a significant outflow from Bitcoin products. Over the past five days, we’ve observed roughly $1.72 billion leave the market. This has brought the total assets under management down to $115.88 billion, a drop from $124.56 billion recorded on January 16th.

Overall investment into these funds decreased slightly from $57.82 billion to $56.49 billion. On January 23rd, most Bitcoin ETFs didn’t see any investment activity, with only the iShares Bitcoin Trust (IBIT) and Fidelity Bitcoin Trust (FBTC) experiencing inflows.

$708M Bitcoin ETFs exit

On January 16th, investors started selling Bitcoin ETFs, resulting in $394.68 million leaving the market. This ended a four-day period where these funds had seen a total of $1.81 billion in investments.

After being closed for the weekend, markets reopened on January 20th and saw $483.38 million withdrawn.

On January 21st, investors pulled out a record $708.71 million. The next day, January 22nd, saw further outflows of $32.11 million. This continued a trend, with January 23rd marking the fifth day in a row that more money left funds than entered, totaling $103.57 million in outflows that day.

Trading volume dropped to $3.36 billion on January 23rd, down from $5.51 billion on January 21st. Recent, continuous selling has wiped out the gains seen in mid-January when Bitcoin ETFs initially drew significant interest from institutional investors.

On January 23rd, several Bitcoin exchange-traded funds (ETFs) – including Grayscale’s GBTC and mini BTC trust, Bitwise’s BITB, Ark & 21Shares’ ARKB, VanEck’s HODL, Invesco’s BTCO, Valkyrie’s BRRR, Franklin’s EZBC, WisdomTree’s BTCW, and Hashdex’s DEFI – experienced no investment inflows or outflows.

The BlackRock IBIT fund has seen a total of $62.90 billion flow into it, while Fidelity’s FBTC has received $11.46 billion. In contrast, Grayscale’s GBTC has experienced $25.58 billion in outflows since it changed how it was structured.

Ethereum posts fourth consecutive outflow session

Ethereum spot ETFs experienced $41.74 million in net outflows on January 23rd, marking the fourth day in a row that more money has left these funds than has been invested.

ETHA, managed by BlackRock, saw the largest outflows with $44.49 million, followed by Grayscale’s ETHE with $10.80 million in withdrawals.

Grayscale’s small ETH trust gained $9.16 million, while Fidelity’s FETH saw inflows of $4.40 million. Other similar trusts from Bitwise, VanEck, Franklin, 21Shares, and Invesco didn’t experience any investment activity.

Ethereum saw roughly $611 million in outflows over four days, from January 20th to January 23rd. This caused the total value of assets to decrease from $20.42 billion on January 16th to $17.70 billion.

Net inflows decreased to $12.30 billion, a drop from $12.91 billion. Trading volume also fell, reaching $1.31 billion on January 23rd, compared to $2.20 billion on January 21st.

Read More

- EUR USD PREDICTION

- GBP CNY PREDICTION

- STX PREDICTION. STX cryptocurrency

- USD MYR PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- EUR ARS PREDICTION

- CNY JPY PREDICTION

- NEXO PREDICTION. NEXO cryptocurrency

- Gold Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

2026-01-24 17:25