Ah, the sweet smell of digital capitalism! Foundry USA, the Goliath of Bitcoin mining pools, just pulled off an improbable stunt-mining eight consecutive blocks like it’s some sort of blockchain Las Vegas slot machine. 🎲 While this streak turned heads and lit up crypto feeds faster than you can say “hashrate,” let’s not forget that luck favors the… well, the already rich and powerful. 😏

- Foundry USA mined eight blocks straight, from heights 910,500 to 910,507-a feat so flashy it practically begged for attention.

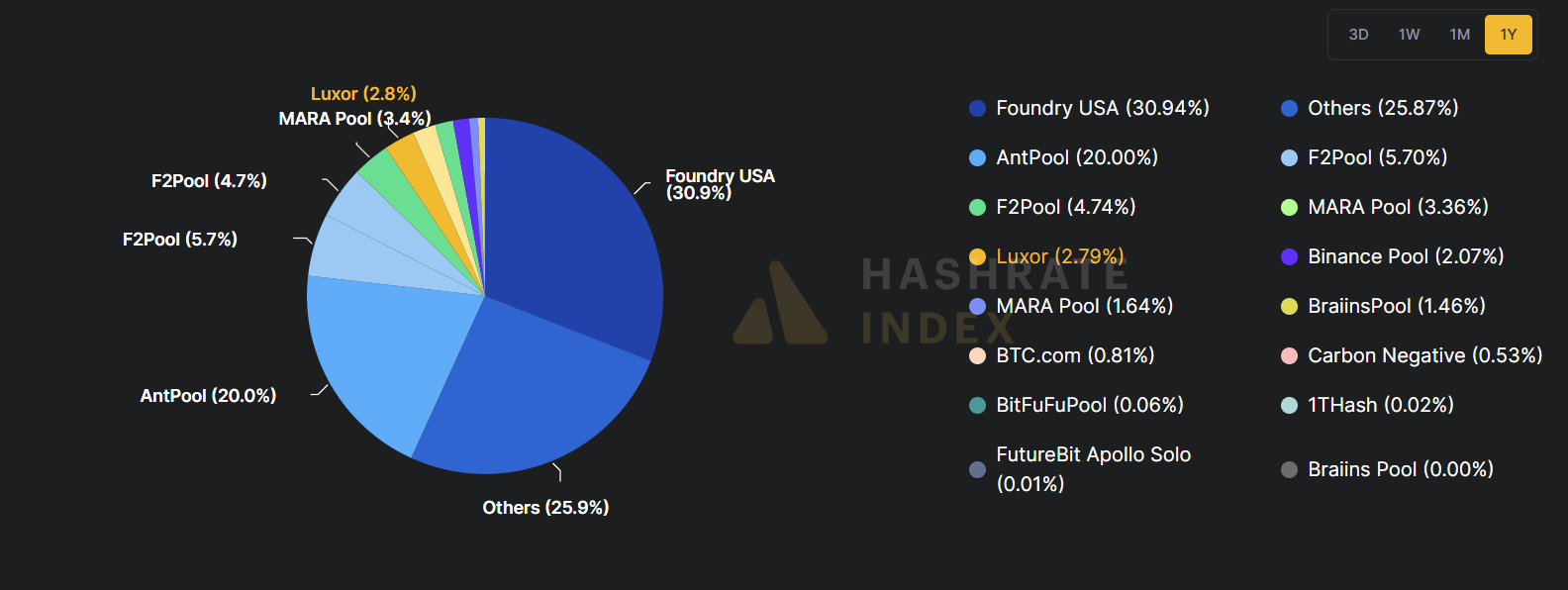

- With ~36% of the network’s hashrate (and about 30% of active pool activity), the odds were slim-about 1 in 12,000-but hey, someone’s gotta win the lottery, right? 🤑

- This little escapade highlights Bitcoin’s ongoing centralization drama: a few big players hogging the spotlight while smaller miners weep quietly in the corner. 🎭

Picture this: eight blocks, one miner, zero subtlety. It was as if Foundry USA decided to flex its computational muscles on the global stage. The pattern was glaring enough to make even casual observers do a double-take. Was it rigged? Nope. Just another day in the life of a massive mining pool flexing its dominance. 💪

Size Matters (Apparently)

By late 2024, Foundry USA had gobbled up around 36.5% of Bitcoin’s total hashrate-roughly 280 exahashes per second (EH/s). To put that into perspective, they’re bigger than Chinese Antpool and Luxor Pool combined. Yes, you read that correctly. Bigger. Than. Everyone. Else. 🌍

At press time, Foundry USA held a cozy 31% share of reported pool activity. That means, statistically speaking, they’re finding roughly three out of every ten blocks. So, mining eight in a row? Rare, sure-but not exactly alien-abduction levels of mysterious. Think of it as rolling lucky sevens at a casino where you own half the tables. 🃏

- Quick math alert: With a ~30% pool share, the odds of mining eight consecutive blocks are 0.008%, or 1 in 12,000. Not impossible, just unlikely. Like winning Monopoly against your financially savvy aunt. 🎲

In short, it wasn’t a hack, a bug, or a dystopian takeover-just a very lucky streak for the big fish in the pond. But don’t worry; the blockchain kept chugging along like nothing happened. Because, well, nothing *did* happen. 😅

Low-Fee Backdrop: Mining on a Shoestring 🪙

Here’s the kicker: this streak occurred during a period of unusually low transaction fees. Fees hovered in the low single digits of satoshis per virtual byte, and many blocks carried embarrassingly few transactions. In such conditions, miners relied almost entirely on the fixed block subsidy rather than juicy fee revenue. So, Foundry USA hit the jackpot without even breaking a sweat-or their budget. Cha-ching! 💰

Each of these eight blocks came with the usual suspects:

- a header;

- a coinbase reward;

- and whatever transactions happened to squeeze in.

The real shocker? Seeing Foundry USA’s name plastered across eight consecutive entries like a neon billboard. Sure, it looked impressive. But beneath the surface, it was business as usual-for them, anyway. 🕶️

Historical Parallels: Déjà Vu All Over Again 🔁

This isn’t the first time Bitcoin has seen a mining pool flex its muscles. History is littered with similar incidents when a single pool grabbed too much power and sparked public outrage. Remember those days? When everyone panicked because one entity controlled over 50% of the hashrate? Good times. 🚨

As Parker Merritt, a solutions engineer at CoinMetrics, pointed out, Bitcoin mining centralization remains a hot-button issue. Funneling most rewards to just two pools (Foundry & AntPool) raises eyebrows-and risks. Censorship? Network disruption? Sounds like the plot of a cyberpunk thriller. 📽️

“Foundry USA just mined eight blocks consecutively. This is extremely alarming! Even many Bitcoiners I know are starting to panic.

I’ve been warning people for years: Bitcoin is dangerously centralized. A tiny group of miners and insiders dominate both the network and its price…”

– Jacob King (@JacobKinge) August 18, 2025

And there you have it, folks. Another chapter in the never-ending saga of Bitcoin’s growing pains. Will decentralization ever truly reign supreme? Or will the big players continue to roll the dice and laugh all the way to the blockchain bank? Only time will tell. Until then, keep calm and HODL on. 🚀

Read More

- BTC PREDICTION. BTC cryptocurrency

- Gold Rate Forecast

- EUR USD PREDICTION

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

- USD TRY PREDICTION

- USD MYR PREDICTION

- EUR JPY PREDICTION

- Silver Rate Forecast

- Meet Vector: The Blockchain That Tosses Finality Speeds Out the Window! 🚀

- USD VND PREDICTION

2025-08-22 16:33