So, Bitcoin is just chilling at around $66,000 on February 18, like it’s trying to decide whether to order takeout or actually cook something. Despite some dramatic swings that could make a rollercoaster jealous, it’s showing about as much momentum as a sloth on a Sunday.

Bitcoin Stagnates in Narrow Range

On this fine Wednesday, Bitcoin was more range-bound than your average cat on a windowsill, oscillating between $65,840 and $68,000. It’s like the crypto community decided to throw a party, but only half the guests showed up-those who did were busy arguing over whether pineapple belongs on pizza.

As of 3 p.m. EST, Bitcoin was doing its best impression of a flat tire, logging a 2.6% drop for the day. The total market cap was drifting lower, mirroring the “please, let me just finish my coffee before we trade” attitude of institutional traders.

The drama of the day was led by Cryptoquant CEO Ki Young Ju, who apparently decided to stir the pot by asking if we should freeze dormant coins-yes, even Satoshi Nakamoto’s legendary stash of 1.1 million BTC. You know, casual conversation at the water cooler.

“Would you support freezing dormant coins to save BTC from quantum attacks? Or does that go against Bitcoin’s core vibe?” Ju asked. If that doesn’t scream “let’s create a Twitter war,” I don’t know what does.

Ju claims there are 6.89 million BTC hiding out in legacy P2PK addresses, which are as exposed as a celebrity in a no-pants challenge. These addresses could be vulnerable to future quantum computing attacks, which sounds like the plot of a bad sci-fi movie.

Of course, critics are waving their pitchforks and claiming that this “freeze” idea is like putting a sock in the mouth of Bitcoin’s immutability. Freezing coins would mean a major protocol upgrade, which is basically the equivalent of saying, “Hey, let’s change the rules of Monopoly because I’m losing!”

Geopolitical Winds: The ‘Risk-off’ Pivot

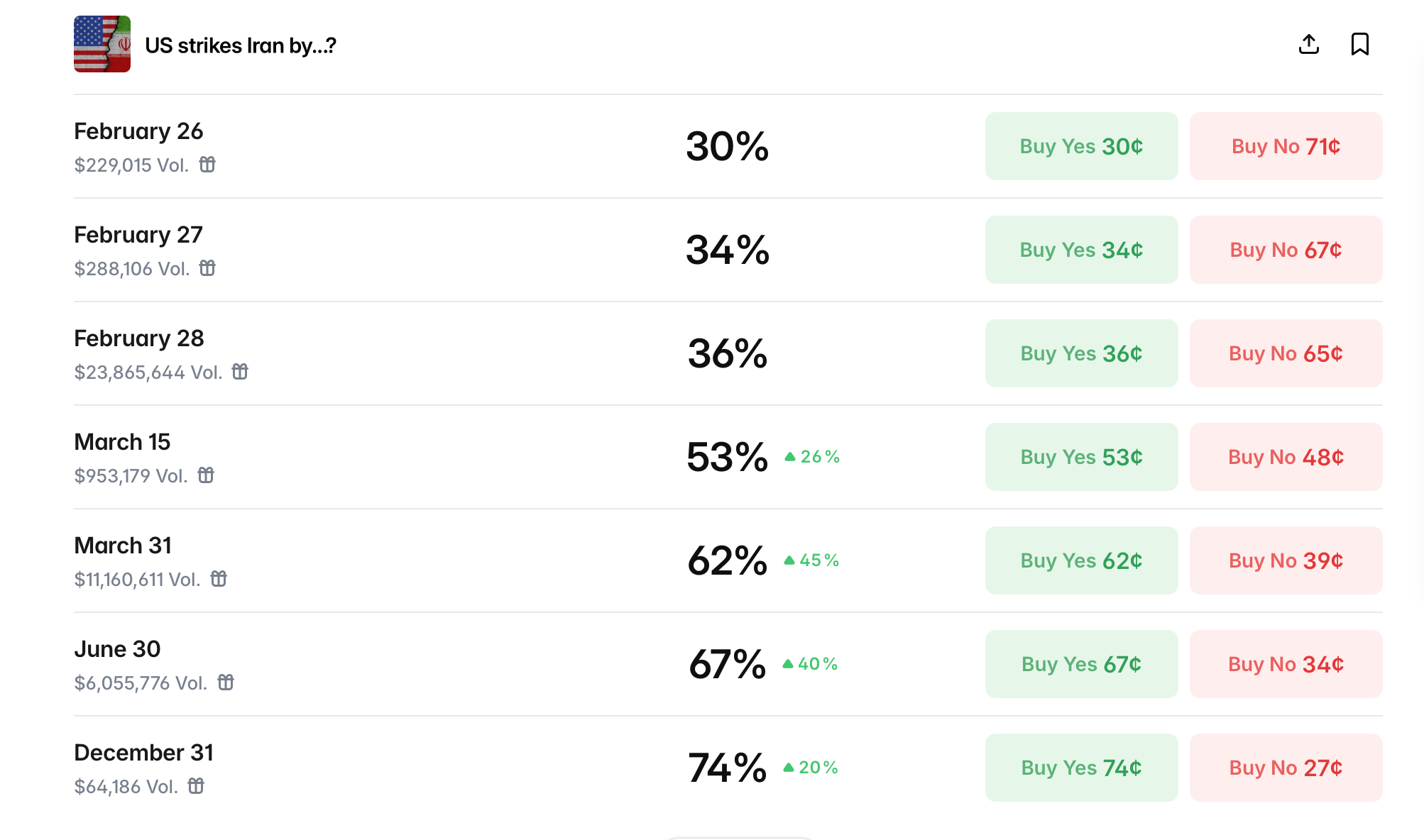

While we’re debating Satoshi’s frozen treasure, Bitcoin seems blissfully unaware of the geopolitical drama unfolding. Reports say U.S. and Israeli military strikes on Iran are on the horizon, making everyone wonder if we’re heading straight into a blockbuster sequel of “Kinetic Conflict.”

A wider conflict would throw a wrench in critical trade routes and send oil prices skyrocketing higher than your uncle’s wild stories at family gatherings. For Bitcoin, the speculation around this remains as intense as a soap opera cliffhanger. Traditionally seen as digital gold, it’s now acting like a tech asset that just got rejected by its crush. So, when the fireworks start, investors might just be looking to snuggle up with good ol’ U.S. Treasuries and gold.

This could put even more pressure on Bitcoin as global liquidity tightens like your favorite pair of skinny jeans after the holidays.

FAQ ❓

- Where is Bitcoin trading now? It’s hanging out between $67K and $68K, just persisting like a stubborn stain.

- What sparked the community debate? Cryptoquant’s CEO proposed freezing dormant coins, including Satoshi’s hidden gems.

- Why is the proposal controversial? Critics say it’s like breaking the sacred rule of the Bitcoin club-no freezing allowed!

- How do geopolitics affect Bitcoin? With tensions rising in the Middle East, investors might run back to traditional safe havens, putting pressure on BTC.

Read More

- BTC PREDICTION. BTC cryptocurrency

- EUR JPY PREDICTION

- USD MYR PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- USD PEN PREDICTION

- ETH’s $3,400 Battle: Will It Rise or Fall? 💰🔥

- The XRP Conundrum: Will It Eclipse Bitcoin in Grandeur? 🤔

- Ethereum’s Descent: A Whale’s Wail and a Flicker of Hope 🐋💸

- XRP’s Wild Ride: Liquidity Vanishes Faster Than Brooks at a Drama Club Meeting!

2026-02-18 23:57