The latest inflation data has caused quite the stir amongst those monetary bigwigs-Fed fellows now seem to be clutching their rate cut pearls, preparing for a dainty trim, while Trump, in the distance, waves his 1% banner with all the bravado of a man trying to sell umbrellas in the Sahara. The dream of a cut worthy of a circus ringmaster’s applause looks about as likely as Aunt Agatha skipping the annual snooze-fest in Bognor Regis.

- U.S. services inflation is doing its best impersonation of a stubborn dachshund, refusing to budge and dashing hopes for a radical rate snip.

- The Fed is still eyeing a trim-a modest 25 basis points-like a barber offering a gentle snip rather than a full-blown mullet transformation.

- Bitcoin’s fortunes have taken a dip, after hearing higher interest rates might be sticking around like unwanted guests at a country house.

So, inflation data pranced onto the scene and promptly threw a banana peel at the notion of generous Fed cuts. On that fateful Thursday, September 4 (a date which will now live in infamy among Bitcoin hodlers), the mighty BTC slumped 2.4%. One might say it was sulking at $109,444-a figure so specific, even Jeeves would raise an eyebrow. The altcoin brigade fared no better; the top 20 tokens, and presumably their respective holders, slipped 2.7%, proving once again that misery loves crypto company. 😂

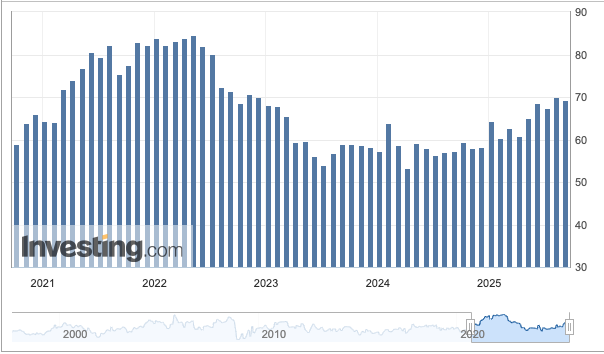

The markets, ever jumpy, twitched at the latest ISM Services Prices Index reading: 69.2 in August. A tad lower than the expected 69.5, and even lower than July’s racy 69.9. But before you rush off to celebrate, bear in mind that anything above 50 means prices are still climbing, much like Bertie Wooster’s tab at the Drones Club.

These lofty inflation figures have made the Federal Reserve about as adventurous as a vicar at a champagne tasting. The upcoming September 17 rate session is likely to produce a prim 25 basis point trim, with 86% of Polymarket’s chaps betting that this is as daring as it gets. To call it thrilling would be to insult thrill-seeking everywhere. 🥱

Trump’s Grand Rate Cut Spectacle Fizzles

The new inflation data has thrown a spanner in Trump’s gleaming machinery of monetary ambition. Ever since taking up residence at 1600 Pennsylvania Avenue, Trump has been cheerleading for lower rates with the enthusiasm of a man who’s just discovered compounding interest. But since July, he’s set his sights on a whisker-thin 1%-a goal so optimistic, even Psmith would require a strong drink before taking it seriously.

Nevertheless, Trump isn’t the sort to be deterred by a mere central bank, and rumor has it the Treasury Department-firmly in his mitts-is buying up Treasuries with gusto, dropping $2 billion on September 3. An analyst at Investing.com called this “QE without the Fed,” which is rather like attempting a ballet solo without knowing the difference between plié and a pie. The operation’s singular aim: chop down the government’s borrowing costs, ideally before the next news cycle grows old and tired. 🎩💼

Read More

- BTC PREDICTION. BTC cryptocurrency

- Ethereum Whale’s Bold $280M Short: Is the Market on a Cliff or Just a Cliffhanger? 🤔

- Bitcoin’s Cosmic Cringe: Why the Crypto World Is Now a Black Hole 🌌💸

- You Won’t Believe What Secretly Predicts Bitcoin’s Next Crash! 😱

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- Upbit’s Wild Goose Chase: $1.77M Frozen, Hackers on the Run 🕵️♂️💰

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- Litecoin’s Wild Ride: $131 or Bust? 🚀💰

- 🐳 XRP Whales Splash Cash: Is the Tide Turning? 🌊

2025-09-04 20:56