So, Bitcoin is having one of its moments again. You know the ones. Where it wobbles about like a freshman after a long night out, trying desperately to remember where it left its dignity and several thousand dollars. It’s currently propping itself up just north of $110,000, a number so ludicrous you’d think it was a misprint just a few years ago. The ‘bulls’-those perpetually optimistic creatures-are trying to stop it from sliding further, bless their hopeful little hearts.

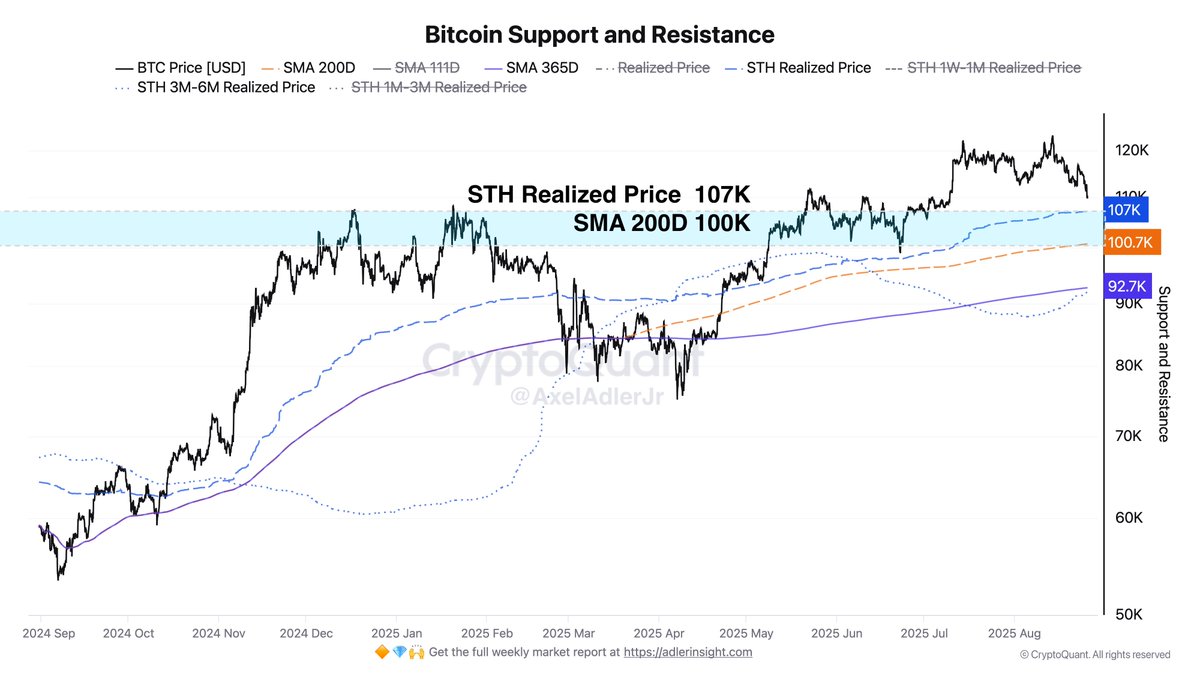

Naturally, we must consult the high priests of finance, the analysts, who speak in a language of cryptic acronyms and grim portents. One such sage, Axel Adler (a name that sounds like he should be fronting a prog-rock band, not predicting financial apocalypses), has pointed out that the digital darling’s next likely stop, should it fall, is a comfort zone between $100K and $107K. This isn’t just any old number; it’s where two of the market’s most beloved indicators, the STH Realized Price and the 200-day Simple Moving Average, decided to have a casual hook-up. Historically, this is where Bitcoin has gone to have a strong cup of coffee and reconsider its life choices before embarking on another heroic rally.

Lose this level, however, and we could be in for what the experts politely call a ‘broader retracement’ and what everyone else calls a ‘bloodbath.’

A Stunningly Detailed Look at Numbers That Might Not Matter Tomorrow

Let’s delve deeper into Adler’s crystal ball, which is probably just a very expensive Excel spreadsheet. The $100K-$107K band is apparently the financial equivalent of a medieval castle’s outer wall. If the marauding bears breach it, everyone flees to the inner keep, which is apparently somewhere around $92K. This is the ‘cost basis’ of the Short-Term Holders, a skittish bunch who bought in the last few months and will likely sell if someone sneezes too loudly, terrified of losing the value of a decent used Honda Civic.

The good analyst warns that a fall through this hallowed floor could cause ‘panic selling.’ This is a technical term for people frantically hitting the ‘SELL’ button while making a high-pitched whimpering noise. Yet, in a truly impressive display of having it both ways, he and his ilk remain convinced that in the long run, everything will be just fine. The fundamentals are strong! Institutions are adopting it! It’s basically the future of money, aside from these occasional, heart-stopping plunges into the abyss.

More Charts! Because Why Use Words When Lines Will Do?

At this very moment, Bitcoin is priced at a precise-sounding $110,213, which suggests a level of accuracy that is almost certainly fictional. It’s currently eyeing the 200-day moving average with the nervousness of a cat watching a vet unpack a thermometer.

The other lines on the chart-the 50-day and 100-day averages-have now flipped from friendly guides to grumpy bouncers, blocking the door to the club upstairs around $115K. The entire enterprise has failed to recapture its recent glory high of $123K, settling into a phase of consolidation, which is the market’s word for ‘sulking.’

The next move is apparently a binary choice between triumphant recovery or weeping into a spreadsheet. It’s all very dramatic. So, grab some popcorn. Or maybe a stress ball. You’re probably going to need it.

Read More

- GBP CHF PREDICTION

- ETH PREDICTION. ETH cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- CNY JPY PREDICTION

- XMR PREDICTION. XMR cryptocurrency

- EUR RUB PREDICTION

- USD VND PREDICTION

- USD KZT PREDICTION

- EUR ARS PREDICTION

2025-08-27 01:30