Behold, Bitcoin’s recent stumble hath summoned the institutional gentry, who now whisper of Fidelity’s “key price zone”-a mere trifle shaped by Federal Reserve theatrics and the eternal quarrel betwixt digital coin and golden bauble.

Fidelity’s $65K Gambit: A Bitcoin Overture Before the Next Act

On the 6th of February, 2026, Fidelity’s director of global macro, that most learned scribe Jurrien Timmer, didst scribble upon the digital parchment of X, proclaiming $65,000 an “attractive entry point” for Bitcoin, as though the almighty coin were but a humble goose to be plucked at such a sum. With charts aglow and graphs a-twirl, he linked this figure to the tempests of macro volatility and the eternal duel betwixt Bitcoin and gold-a rivalry as old as King Louis XIV’s pocket watch.

He didth quip:

“Lo! The markets didth roar last week at the naming of the next Fed Chair. Yet for Bitcoin, I hold $65K as a noble endeavor.”

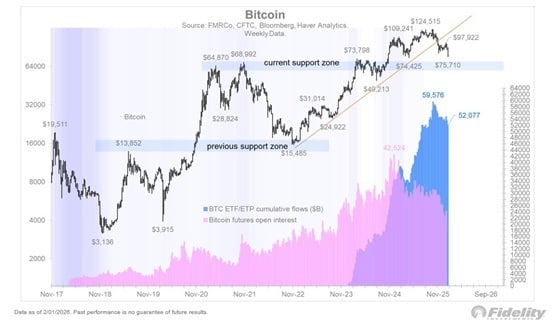

The chart, a veritable scroll of destiny, didth reveal Bitcoin’s “current support zone” nestled near $60,000, a figure once a stubborn wall of resistance. Such theatrics followed the tumult after President Trump’s nomination of Kevin Warsh to the Fed-a choice as consequential as a court jester declaring himself king, sending ripples through bonds, currencies, and the fragile hearts of investors.

The visual, a tapestry of numbers, didth show Bitcoin consolidating above its long-term trend, a phoenix rising from the ashes of its $120,000 peak in late 2025. Below, the cumulative flows of BTC ETFs and ETPs neared $59.6 billion, while futures open interest remained lofty, as if the institutions were but drunken revelers clinging to a waltz that had long since ended.

Later, the Fidelity sage didth expound:

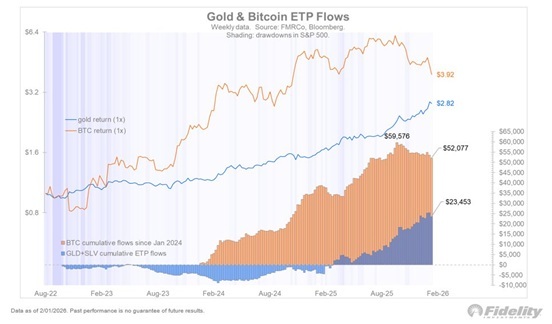

“Given the chasm betwixt gold and Bitcoin in their support levels, I suspect gold shall outpace Bitcoin until their flows embrace like long-lost lovers.”

A second chart, a duet of gold and Bitcoin ETP flows, didth lay bare the imbalance. Gold, that ancient relic, drew $52.1 billion in inflows via GLD and SLV, while Bitcoin’s $23.5 billion paled in comparison. Though Bitcoin didth outshine gold in normalized returns, gold’s steadiness during equity drawdowns proved as comforting as a velvet garter to a cautious dowager.

Markets, ever the fickle court, interpreted Warsh’s nomination as a herald of tighter policy and faster balance sheet reductions, bolstering the dollar and casting scorn upon anti-debasement trades. Within this maelstrom, Timmer framed Bitcoin’s weakness as a mere hiccup in the grand opera of 2026-a year of consolidation, not collapse-and dubbed $65,000 a “strategic accumulation zone” for the patient investor, as if one might plant a rosebush and expect diamonds by dawn.

FAQ ⏰

- Why doth Fidelity fancy $65,000 a noble Bitcoin endeavor?

Timmer claims it aligns with prior highs, the whims of psychology, and valuation models that smell of alchemy. - How did Warsh’s Fed nomination bewilder Bitcoin and gold?

Markets didth price in a hawkish Fed, scolding Bitcoin while gold basked in the glow of defensive flows. - Doth Fidelity prophesy a Bitcoin bull run in 2026?

Nay, it deems 2026 a year of consolidation, as if the market were but a cat napping after a feast. - Why doth gold outshine Bitcoin now, per Timmer’s jest?

He ascribes it to timing and policy’s capricious dance, not the coin’s inherent virtue.

Read More

- BTC PREDICTION. BTC cryptocurrency

- Ethereum Whale’s Bold $280M Short: Is the Market on a Cliff or Just a Cliffhanger? 🤔

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- Bitcoin’s Cosmic Cringe: Why the Crypto World Is Now a Black Hole 🌌💸

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

- 🐳 XRP Whales Splash Cash: Is the Tide Turning? 🌊

- Litecoin’s Wild Ride: $131 or Bust? 🚀💰

- You Won’t Believe What Secretly Predicts Bitcoin’s Next Crash! 😱

2026-02-08 06:19