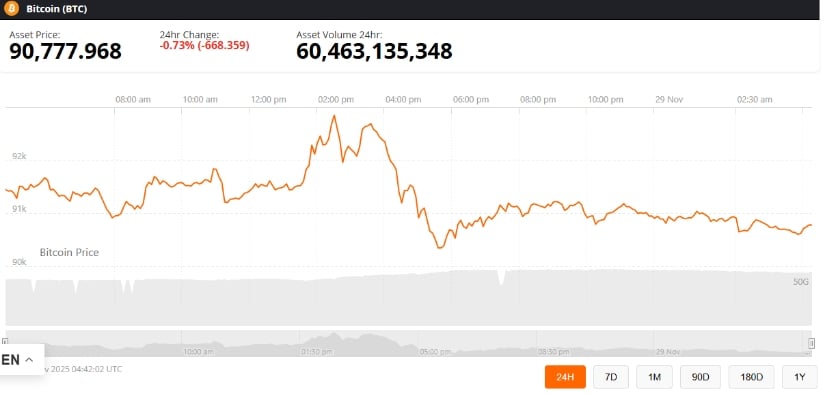

Ah, Bitcoin, that ever-elusive phoenix, has once again soared past the $90,000 mark, drawing the attention of traders and analysts alike-though one might wonder if they’re more interested in the spectacle than the substance. 🤔💸 Some prudent souls caution that low liquidity and overbought conditions may temper the rally’s vigor, but let’s not be dull, shall we? 🕵️♂️📉

Bitcoin Price Today Holds Above Key Levels

Bitcoin’s price today hovers around $90,850, clinging to the $90,200-$90,800 support like a moth to a flame. 🦋🔥 Technical analysts, ever the optimists, claim buyers are defending this range with the fervor of a romantic duel. 💼⚔️ The upper resistance zone of $92,500-$92,900 represents a strong liquidity area where buy-side interest could emerge-though one might question if it’s a trap for the unwary. 🕵️♀️📉

As Ava Nakamura, a crypto market journalist with a focus on BTC technical analysis, explains, “While Bitcoin breaking $90,000 indicates bullish momentum, low spot market demand and thin liquidity suggest the rally may not have a fully stable foundation.” Spot market data confirms modest trading volumes, highlighting limited fresh capital entering the market-like a party with only one guest. 🎉💸

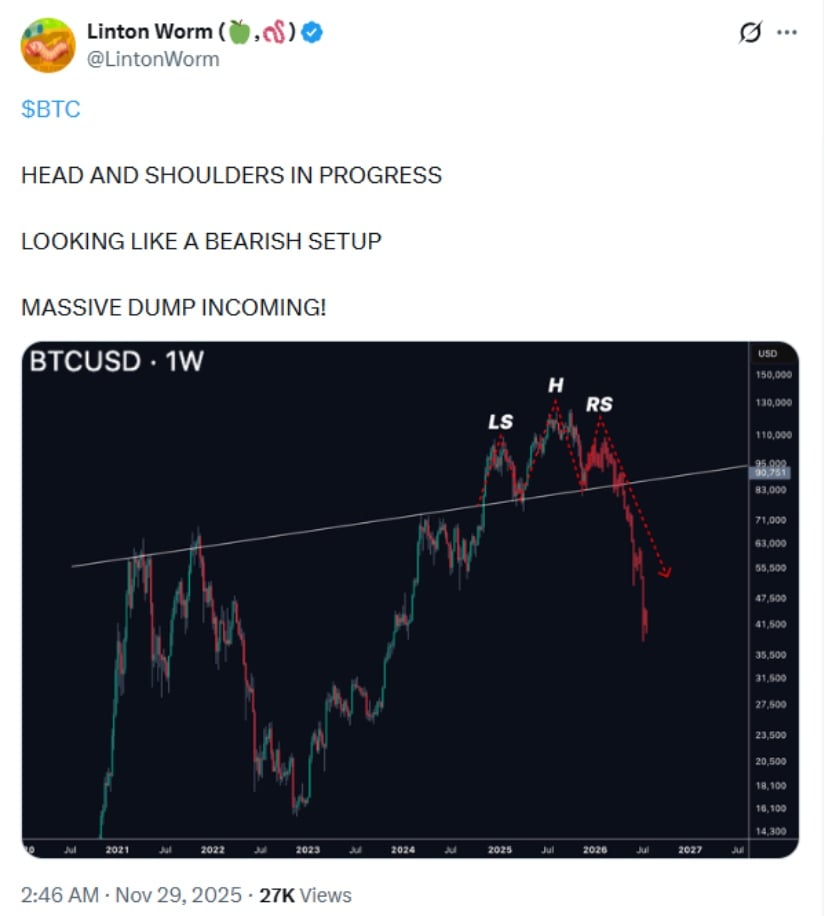

Head-and-Shoulders Pattern Signals Conditional Downside

On Bitcoin’s weekly chart, technical analyst Linton Worm, who focuses on BTC trend-pattern analysis, identified a head-and-shoulders formation-a classic pattern often interpreted as a potential trend reversal. The right shoulder is near $90,000, with the neckline around $83,000. 🕵️♂️📉 If the neckline support fails, Bitcoin could experience a correction toward $80,000-$55,500-though one can’t help but wonder if the market is more interested in drama than actual numbers. 🎭

However, this scenario depends on sustained selling pressure and low buying interest. Some analysts suggest milder declines toward $65,000, noting that whale activity and broader market interventions could mitigate the move-like a magician’s trick with a safety net. 🎩🎩

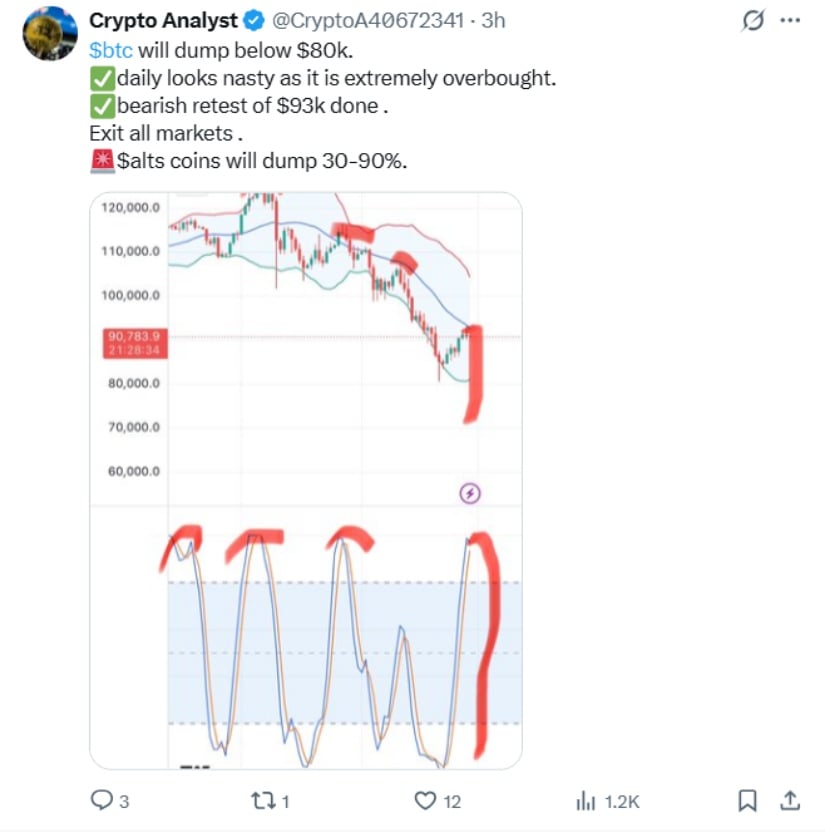

Overbought Conditions and EMA Insights

Bitcoin shows overbought conditions on the Relative Strength Index (RSI) above 70, indicating potential short-term pressure. A bearish retest of $93,000 has already occurred, prompting social media analyst @CryptoA40672341 to suggest cautious position management. 🧠📊

Additionally, BTC is testing the 50-week Exponential Moving Average (EMA), historically a key dynamic support level. EMA retests often precede strong rebounds, but current momentum shows sellers exerting influence. If BTC closes below $100,900, a short-term correction toward $95,000 or $90,000 could be more likely-though one might question if the market is just playing games. 🎲

Quick Explanation: The EMA smooths past price data to highlight long-term trend support or resistance. Traders often use it to assess whether buying or selling momentum dominates-though in crypto, even the most reliable indicators can be as fickle as a cat. 🐱

Short-Term Bullish Outlook

Despite these cautionary indicators, Bitcoin demonstrates short-term bullish potential. The recent impulsive rally on November 27th and support at the FVG zone (Fair Value Gap-a price area where trading was previously thin, often attracting buyers or sellers in retests) indicate possible upward movement. 🚀

If the $90,200-$90,800 range holds, BTC could retest $92,500-$92,900. Analysts note that liquidity accumulation in this zone could support a temporary price rebound-though one might question if it’s a mirage. 🌫️

Market Liquidity and Data Transparency

Liquidity remains a critical factor. Low liquidity increases sensitivity to smaller trades, potentially exaggerating price swings. Spot volume data over the past 24 hours shows thinner-than-average order books, reinforcing the importance of careful risk management. 🚧

Nakamura emphasizes, “Even modest trades can move the price significantly. Traders should interpret the rally’s sustainability in the context of actual market depth, not just headline prices.” A reminder that in crypto, the devil is in the details-or the lack thereof. 🐉

Looking Ahead: BTC Price Predictions and Key Levels

-

Support: $90,200-$90,800 (FVG zone), 50-week EMA near $100,900

-

Resistance/Target: $92,500-$92,900

-

Conditional Bearish Scenarios: $83,000 neckline, $80,000, possible extension toward $55,500 (if selling pressure persists)

-

Short-Term Outlook: Consolidation with potential bounce if support holds

Bitcoin’s short-term forecast reflects a balance between bullish momentum and market caution-a bit like trying to dance the waltz while wearing roller skates. 🕺🌀 Traders are advised to monitor liquidity conditions, technical indicators, and support/resistance levels. After all, in the world of crypto, nothing is certain except the uncertainty. 🤷♂️🔮

Read More

- Gold Rate Forecast

- EUR USD PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- GBP CNY PREDICTION

- Brent Oil Forecast

- STX PREDICTION. STX cryptocurrency

- Silver Rate Forecast

- CNY JPY PREDICTION

- EUR AUD PREDICTION

- USD JPY PREDICTION

2025-11-29 23:51