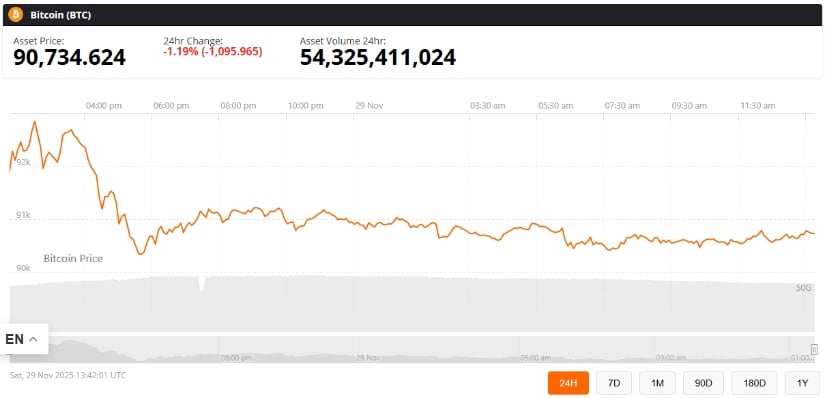

The digital sovereign, Bitcoin, hovers at $90,734, a mere whisper of its former glory, having shed 1.19% in the past day, while the market’s pulse, measured in daily trading volume, thunders at $54.3 billion. 📉

The charts, those silent witnesses, reveal a stark rejection at the $92,800-$93,000 threshold, a zone where sellers, like vigilant sentinels, have entrenched themselves. As the weekend’s liquidity wanes and the market’s depth falters, Bitcoin teeters on the precipice of a deeper correction or a fleeting rebound. 🚧📈

The $93K Resistance: A Defiant Fortress

The market’s analyst, Ted, with his pillow-like composure, declares that Bitcoin has “tapped the $92,000-$93,000 resistance and got rejected,” a recurring motif since early November, as if the price were a reluctant guest at a party it wishes to leave. 🧸🚫

This resistance, a ghost of November’s past, echoes through the exchanges, where the specters of derivatives traders, ever eager to short, loom large. 🕯️🧛♂️

According to my chart review, the next structural support, a distant mirage, lies at $88,000, a line drawn in the sand by prior demand zones, the mid-range of the August-October accumulation channel, and the high-volume nodes of the Visible Range Profile. 📌🧭

Ted, ever the optimist, posits that if $88,000 remains unyielding, Bitcoin may embark on its next leg, a journey fraught with uncertainty but laced with hope. 🧭🌟

On-Chain Metrics: A Dance of Shadows

Ali, with his charts as his compass, discerns encouraging on-chain signals, the Sharpe Ratio drifting toward the elusive “low-risk” zone, a realm where dip buyers, like moths to a flame, gather. 📊🕊️

CryptoQuant’s chart reveals the Sharpe Ratio descending into the hallowed grounds of favorable long-term entry points, a territory where the wise investor, ever cautious, may find solace. 📈🧠

Bitwise Research’s analysis suggests that Bitcoin’s current pricing mirrors the most bearish global growth expectations since the dark days of the COVID-FTX era, a time when hope was a rare commodity. 🧟♂️🌍

Weekend Woes: A Market in Disarray

The analyst tradecitypro, with a weary eye, notes a noticeable decline in market participation, the long-trigger setup morphing into a fake breakout, as sellers, ever opportunistic, strike before the price can reach its zenith. 🚨🕵️♂️

The main resistance, a phantom at 93,555, remains unscathed, the price failing to breach it, as sellers, like shadows, emerge from the woodwork. 🚫🧳

As Bitcoin hovers near $90,724, the market’s depth, once robust, now dwindles, leading to muted reactions and a price that dances to the tune of low volume. 🕳️🎭

Final Thoughts: A Gamble of Hope

The rejection at $93,000 has redirected the market’s gaze to the critical $88,000 support line, a line that may herald either uncertainty or opportunity, depending on the investor’s perspective. 🧭🌌

As the market moves through the weekend, traders will be watching for clarity in price structure and confirmation of whether Bitcoin will attempt another push toward resistance or consolidate near key support zones in preparation for its next major move. 🧭🔍

Read More

- Gold Rate Forecast

- EUR USD PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- Brent Oil Forecast

- GBP CNY PREDICTION

- STX PREDICTION. STX cryptocurrency

- Silver Rate Forecast

- EUR AUD PREDICTION

- USD JPY PREDICTION

- POL PREDICTION. POL cryptocurrency

2025-11-30 01:42