It’s time to grab your favorite snack, sit back, and try to make sense of the mystical world of Bitcoin. On-chain data is showing that the Bitcoin RHODL Ratio has done a bit of a flip, which could be a sign that the market is transitioning into a new cycle. But don’t worry, I’ll try to break it down in a way that won’t make your head spin. 🤯

The RHODL Ratio: A Magic Number?

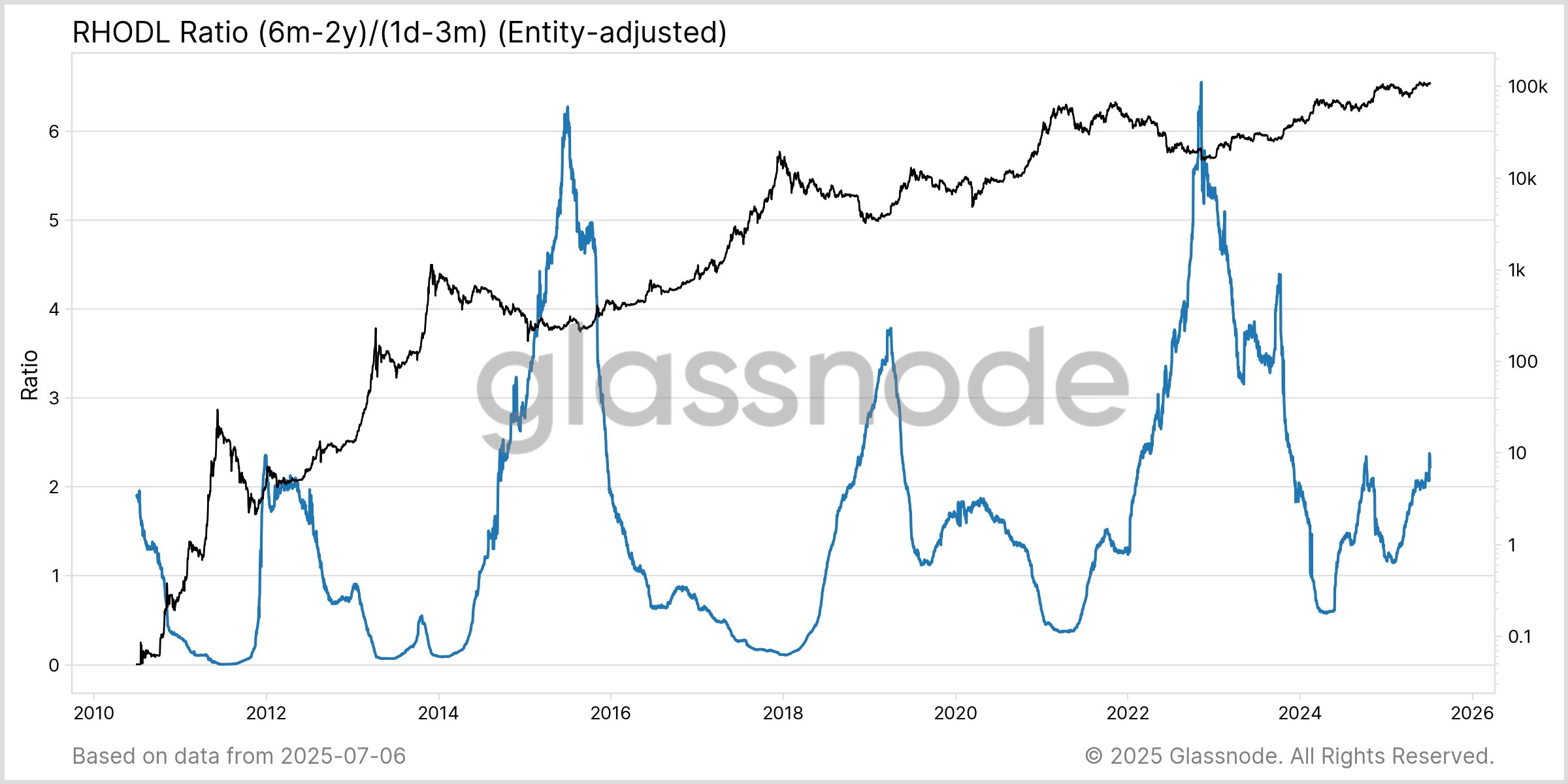

Glassnode, a firm that analyzes on-chain data, has been looking at the RHODL Ratio, which is a fancy way of measuring the ratio between the Realized Cap of two groups of Bitcoin holders. The Realized Cap is like a price tag on each Bitcoin, based on the last time it was bought or sold on the blockchain.

Think of it like a game of musical chairs, where the chairs are Bitcoins and the players are investors. The RHODL Ratio looks at two groups of players: those who just bought in (the newbies) and those who have been holding on for dear life (the veterans). The ratio shows how much capital is being held by each group.

As you can see from the chart, the RHODL Ratio has been going up, up, up! This means that more capital is being held by the veterans, while the newbies are taking a backseat. Glassnode notes that this is a sign of a shift in the market, where more wealth is being held by long-term holders.

But here’s the thing: this pattern has been seen before, during past cycles when the market was transitioning away from bull markets. So, is this the start of a long-term shift, or just a temporary blip on the radar? 🤔

BTC Price: The Elephant in the Room

At the time of writing, Bitcoin is trading around $109,300, up more than 1.5% in the last week. Not bad, but not exactly a moonshot either. 🚀

So, what does it all mean? Is Bitcoin entering a bear market? 🐻 Only time will tell, but one thing’s for sure: the world of cryptocurrency is never dull. Stay tuned, folks! 📺

Read More

- EUR USD PREDICTION

- GBP CNY PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- STX PREDICTION. STX cryptocurrency

- CNY JPY PREDICTION

- NEXO PREDICTION. NEXO cryptocurrency

- USD MYR PREDICTION

- HBAR’s Price Tango: A Bumpy Ride with a Bearish Twist!

- INJ PREDICTION. INJ cryptocurrency

- Get Ready for Rate Cuts: Morgan Stanley’s Shocking Forecast Will Leave You Speechless!

2025-07-10 07:23