Ah, the Bitcoin short-term holders-those fickle souls-are taking fewer profits at $115K. Analysts, in their infinite wisdom, declare the market “balanced,” despite ETF outflows and dwindling leverage. Balanced, you say? Or is it merely teetering on the edge of chaos? 😅

Behold! The Bitcoin short-term holders have curbed their insatiable appetite for profit-taking as prices hover near $115,000. Glassnode, that oracle of blockchain metrics, whispers sweet nothings about a “relatively balanced position,” even as the market flirts with pullbacks from its giddy all-time highs. Balanced? Perhaps. But one wonders if this is the calm before the storm-or just another episode of crypto’s perpetual drama. 🌩️

This newfound restraint among short-term holders suggests caution, though analysts assure us such behavior is par for the course during mid-cycle corrections. Par for the course? How delightfully mundane! One might almost forget we’re talking about Bitcoin, the financial equivalent of a Shakespearean tragedy wrapped in memes. 🎭

Short-Term Holders: The Puppeteers of Volatility

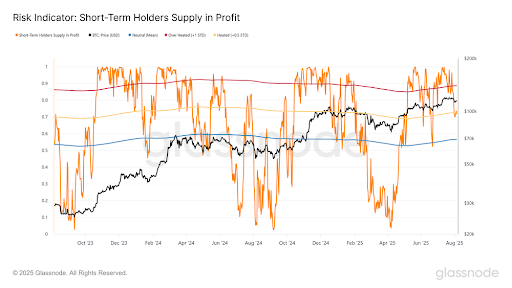

Who are these enigmatic short-term holders (STHs)? They are traders or investors who clutch their Bitcoin for less than 155 days, reacting to every price wiggle like cats chasing laser pointers. According to Glassnode, only 45% of Bitcoin spent by these jittery souls recently turned a profit-a far cry from earlier highs and below the neutral mark of 50%.

Glassnode, ever the optimist, declares the market “relatively balanced,” noting that 70% of STH-held supply remains profitable. Relatively balanced? What a marvelously ambiguous phrase! It’s as if they’re saying, “Yes, the Titanic has hit an iceberg, but look how gracefully it tilts!” 🚢❄️

This data paints a picture of stability-where fear hasn’t quite overtaken greed-but traders tread cautiously, like guests at a party unsure whether the host will serve cake or demand rent. Meanwhile, 30% of short-term holders nursing losses remind us that not everyone timed their entry perfectly. Poor dears-they bought near July’s peaks and now face the cruel irony of being underwater. 🏊♂️📉

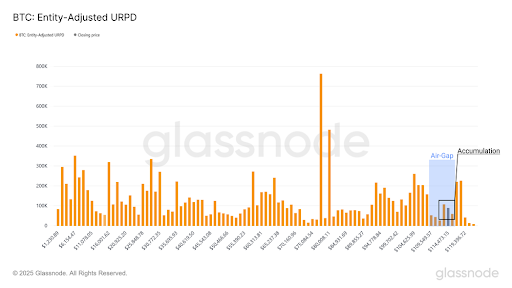

Market Faces “Air-Gap” Resistance Below $116K

Oh, the horror! Bitcoin’s price dipped to $112,000 at the end of July after flirting dangerously close to $123,000 earlier that month. This plunge pushed it into a so-called “air-gap” zone beneath $116,000-a barren wasteland of thin trading activity. A zone of resistance, you ask? More like a cosmic void where hope goes to die. 🌌

Here, short-term holders with an average cost basis of $116,900 squirm uncomfortably, many selling near break-even. “Get me out!” cries analyst Checkonchain on social media, echoing the collective wail of weaker hands. If the market lingers below $116,000 too long, losses could deepen, eroding confidence faster than a politician’s promise. 📉💔

a drop toward $110,000 remains possible if this resistance holds firm. Ah, the cruelty of numbers! 💸

Leverage Drops as Traders Wait for Direction

And then there’s leverage-the double-edged sword of crypto trading. Funding rates on perpetual futures have plummeted below 0.10%, signaling traders’ reluctance to bet big using borrowed money. Is this prudence or paralysis? Either way, Glassnode assures us it’s “normal for a bull-market correction.” Normal? In Bitcoin? Surely you jest! 😂

Yet, danger lurks. Should weakness deepen, the tide may turn decidedly bearish. Meanwhile, Bitcoin spot ETFs experienced their largest outflow since April, shaking confidence momentarily until inflows rebounded the next day. Such is the bipolar nature of markets-now despair, now elation. 🎢

Amidst this uncertainty, some cling to hope. Tom Lee, co-founder of Fundstrat and chairman of BitMine, boldly predicts Bitcoin could soar to $200,000 or even $250,000 by year’s end. “Bitcoin should really build upon this $120K level,” he proclaims. Build upon it? Or collapse under its own weight? Only time will tell. ⏳

Read More

- USD BGN PREDICTION

- ETC PREDICTION. ETC cryptocurrency

- GBP CHF PREDICTION

- SOL PREDICTION. SOL cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- EUR ARS PREDICTION

- USD COP PREDICTION

- Is XRP About to Soar or Crash? The $3.27 Dilemma Explained!

- ETH PREDICTION. ETH cryptocurrency

- USD VND PREDICTION

2025-08-08 13:59