In the vast expanse of the financial world, where fortunes are made and lost with the swiftness of a blink, Bitcoin (BTC) finds itself in a state of quiet contemplation, its price hovering near the lofty sum of $89,000, as if pondering the very nature of its existence. 🧠

Bloomberg ETF analyst Eric Balchunas, a man of discerning intellect, posited that Bitcoin’s recent decline is but a minor setback, a mere cooling of the embers that once burned brightly after its remarkable +122% ascent. “Assets, even the most volatile, are permitted to rest from time to time,” he mused, “and thus, the overanalysis of such fluctuations is, in my humble opinion, a most tiresome endeavor.” 📉

Yet, Balchunas, ever the scholar, dismissed the notion that Bitcoin mirrors the tragic fate of the tulip bulb. “The tulips, those fragile blooms, succumbed after a three-year frenzy, whereas Bitcoin has withstood six major storms, each more tempestuous than the last, from regulatory gales to the tempest of global crises.” 🌪️

He further argued that Bitcoin’s endurance, though seemingly unyielding, is not born of euphoria alone but of a quiet, enduring value akin to gold or a Picasso painting. “Would you compare a rare stamp to a tulip? No, for not all assets require productivity to hold worth-only the foolish do.” 🎨

Yes, bitcoin and tulips are both non-productive assets. But so is gold, so is a picasso painting, rare stamps- would you compare those to tulips? Not all assets have to “be productive” to be valuable. But even beyond that Tulips were marked by euphoria and crash. And that’s it.…

– Eric Balchunas (@EricBalchunas) December 6, 2025

US Activity Pressures Bitcoin in December

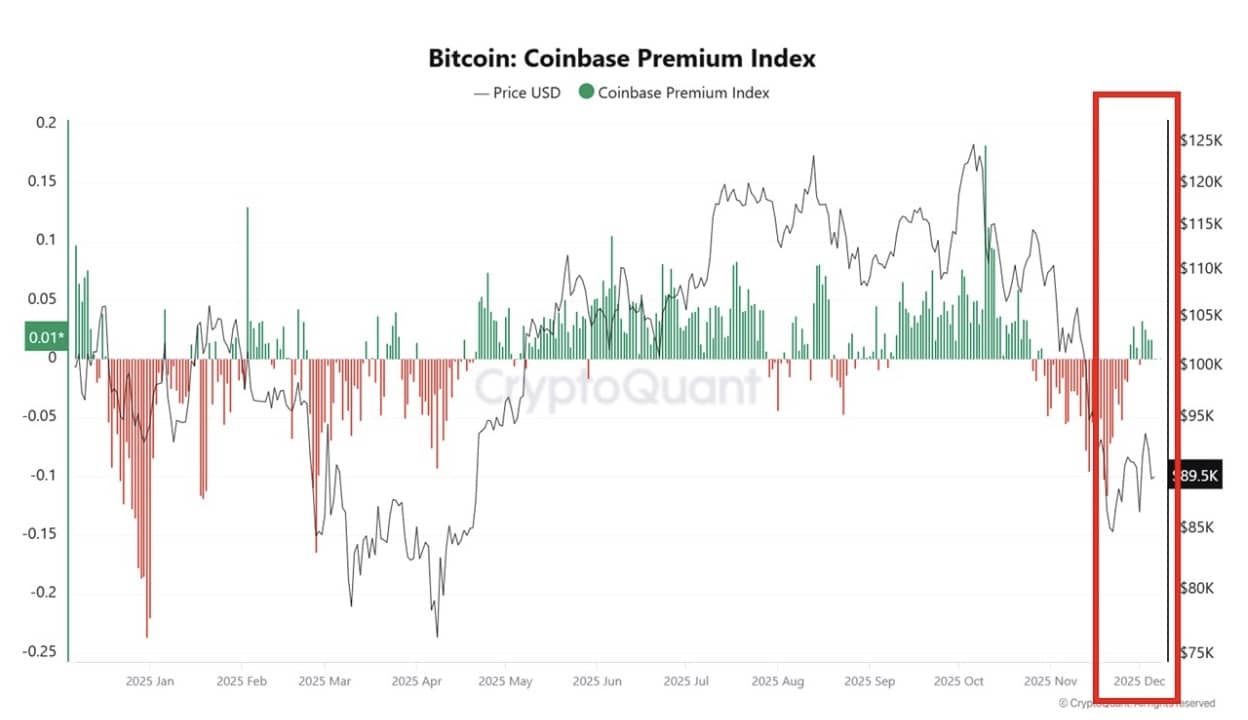

As December unfurls its cold fingers, the United States, that bastion of financial might, has cast its shadow over Bitcoin, prompting a retreat in its price. The Coinbase Premium Index, that barometer of market sentiment, reveals a descent into negative territory, a phenomenon historically linked to the seasonal ritual of portfolio realignment and tax-loss harvesting by American institutions. 📈📉

CryptoQuant, that ever-watchful sentinel, notes that this pattern, though familiar, has taken an unexpected turn. “The premium, once a harbinger of stress, has rebounded with surprising speed, suggesting that the US demand, like a phoenix, shall rise again.” 🦅

Coinbase Premium Index for Bitcoin | Source: CryptoQuant

Whether Bitcoin stabilizes or falls again now depends, as ever, on the whims of US liquidity, the caprices of derivatives, and the fickle nature of incoming flows. A dance of uncertainty, truly. 🕺

Futures Reset Signals Derivative Cooling

Meanwhile, the enigmatic Carmelo Alemán, with a gaze as piercing as it is analytical, noted the waning of Open Interest across the exchanges. “A dance of price and OI, both descending in tandem,” he observed, “not a sign of spot selling, but of futures’ quiet retirement, a cleansing of excess leverage, and a return to the fundamentals of the market.” 🧊

Bitcoin OI chart | Source: CryptoQuant

Alemán, ever the skeptic of fleeting trends, warned that price gains paired with rising OI often mask a fragile foundation, “a house built on sand, not stone.” 🏗️

Read More

- Gold Rate Forecast

- EUR USD PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- Brent Oil Forecast

- Silver Rate Forecast

- USD MYR PREDICTION

- Bitcoin’s Downfall: Two Scenarios That’ll Make You Scream 😱

- EUR RUB PREDICTION

- CNY JPY PREDICTION

- USD KZT PREDICTION

2025-12-07 15:03