Ah, behold! The great Bitcoin hovers, like a wayward pigeon, at a remarkable $117,826 this fine Wednesday. Open interest in our futures and options markets soars to lofty heights, calling forth a conundrum of the most riveting speculation! 🐦💰

The Numbers Behind Bitcoin’s Quiet Yet Dramatic Power Shift on the Derivatives Stage

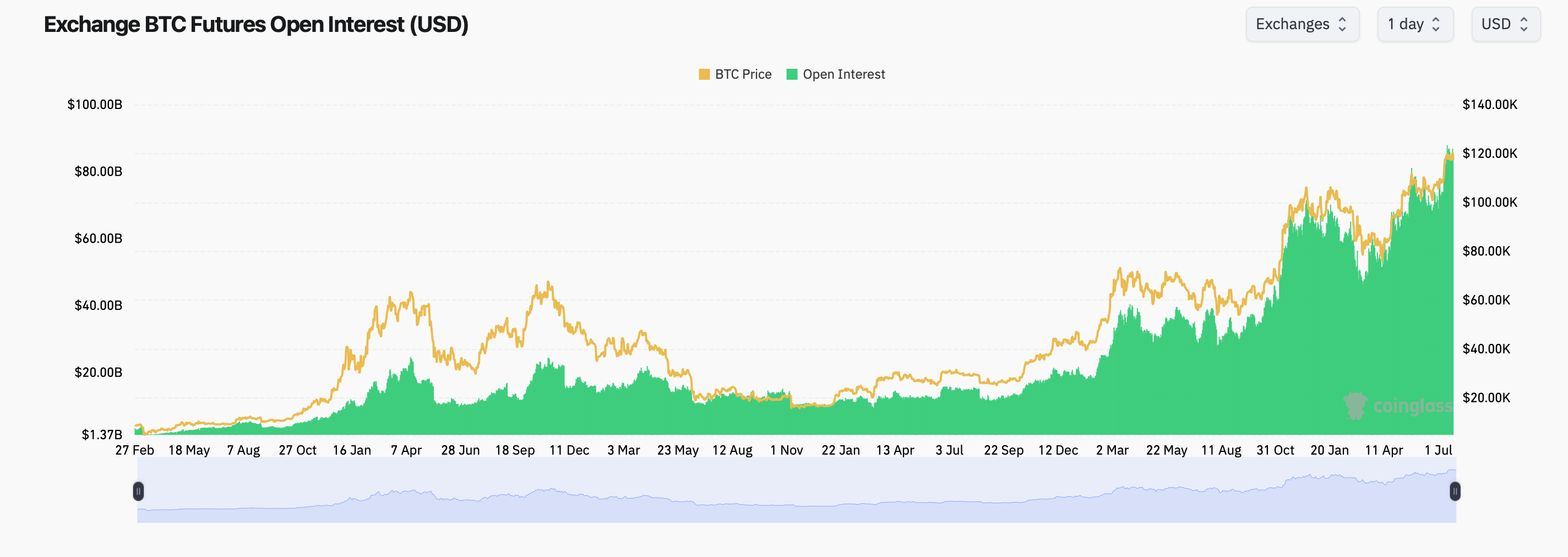

Open interest (OI) in our dear bitcoin derivatives continues its joyous ascent as traders cast their nets wide, throwing capital towards both futures and options amidst a tempest of market excitement. As the wise Coinglass reports, the total futures OI has erupted to a staggering $84.83 billion across platforms, with CME leading the parade at $18.49 billion, leaving Binance and Bybit scrambling in its wake. 🎉

Now, let us prance over to Bybit, where bullish spirits rise with a delightful 2.06% spike in OI over the past four hours. Meanwhile, BingX performs an astonishing leap of 3.87%! 🌟 But oh dear, what of MEXC? It falters, declining by 3.14%, sliding down the hill like a contestant on a slippery game show! 🥴 Yet, dear Kucoin exhibits spirited growth with a 3.4% rise, suggesting retail speculators engage in a lively dance around their platform.

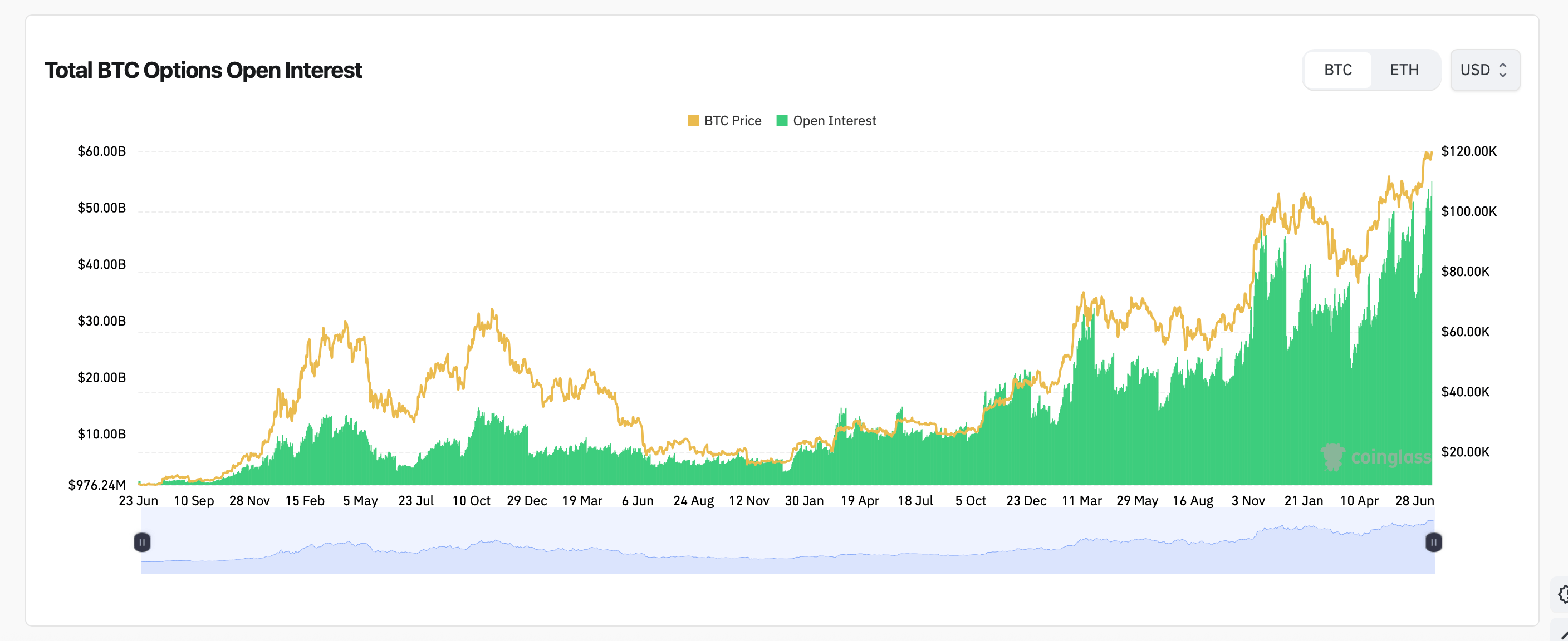

As we amble through the options market, Deribit reigns supreme! According to the OI rankings, traders find themselves overwhelmingly enamored with call contracts, especially those cheeky ones sporting strike prices of $120,000 to $140,000! The peak concentration of OI struts proudly with the Dec. 26, 2025, $140,000 call, flaunting 10,706 BTC, closely followed by a tantalizing $200,000 call winking at us with 8,586 BTC.

Volume from the past 24 hours reveals the glorious July 25, 2025, $120,000 call leading the charge with 4,446 BTC traded. Puts may join the merriment, but they are quite outclassed by the abundance of calls in both volume and OI. Presently, how delightful! 60.76% of OI sways toward calls, totaling 257,518 BTC, while the puts hang back with a modest 166,341 BTC.

This merry tableau reveals a distinctly bullish inclination, illuminated by the concentration hovering just above our current market levels. As we approach the July 25 expiry, a delightful crowd gathers around the $115K to $120K range, where implied volatility (IV) frolics between 31% and 38% like a jester in a royal court.

Thus, with both futures and options flourishing like an overabundant garden, Bitcoin’s derivatives saga unfolds with a growing appetite for grandiose bets and clever positioning at lofty valuations. Traders are certainly sharpening their quills for what promises to be a most noteworthy price performance in the final months of 2025. 🎭

Read More

- BTC PREDICTION. BTC cryptocurrency

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

- Cardano’s Melancholy Ballet: Death Cross Dances as Markets Pause for Dramatic Effect

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- 🔥Vienna’s Crypto Carnage: Ukrainians Burn Wallets & Souls! 💰💀

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- Shocking Rally Ahead for NIGHT Token: Analyst Predicts 4x Surge to $0.20!

- EUR USD PREDICTION

- Meet Vector: The Blockchain That Tosses Finality Speeds Out the Window! 🚀

2025-07-23 18:57