Oh, Bitcoin, you dramatic queen! 👸✨ On Jan. 12, 2026, you’re pulling a classic “I’m just gonna hover here and make everyone nervous” move, chilling between $90,090 and $92,392. Traders are sweating, algorithms are twitching, and the charts? They’re whispering secrets like a gossip circle at a high school reunion. 🗣️💸

Bitcoin Chart Outlook

The 1-hour chart is basically Bitcoin’s mood swings on full display. 📈💃 It spiked from $90,090 to $92,392 like it had one too many energy drinks, then crashed back to $90,500. Classic rise-and-recoil, followed by low- volume pullbacks-aka profit-taking, not panic selling. Calm down, Bitcoin, we know you’re just flexing. 💪😏

Now it’s tiptoeing like a ballerina in a tight range between $90,000 and $92,000. Traders are watching like hawks, because if it breaks above $92,400, it’s party time! 🎉 But if it dips below $89,800 with strong volume, it’s ghosting us all. 👻💔

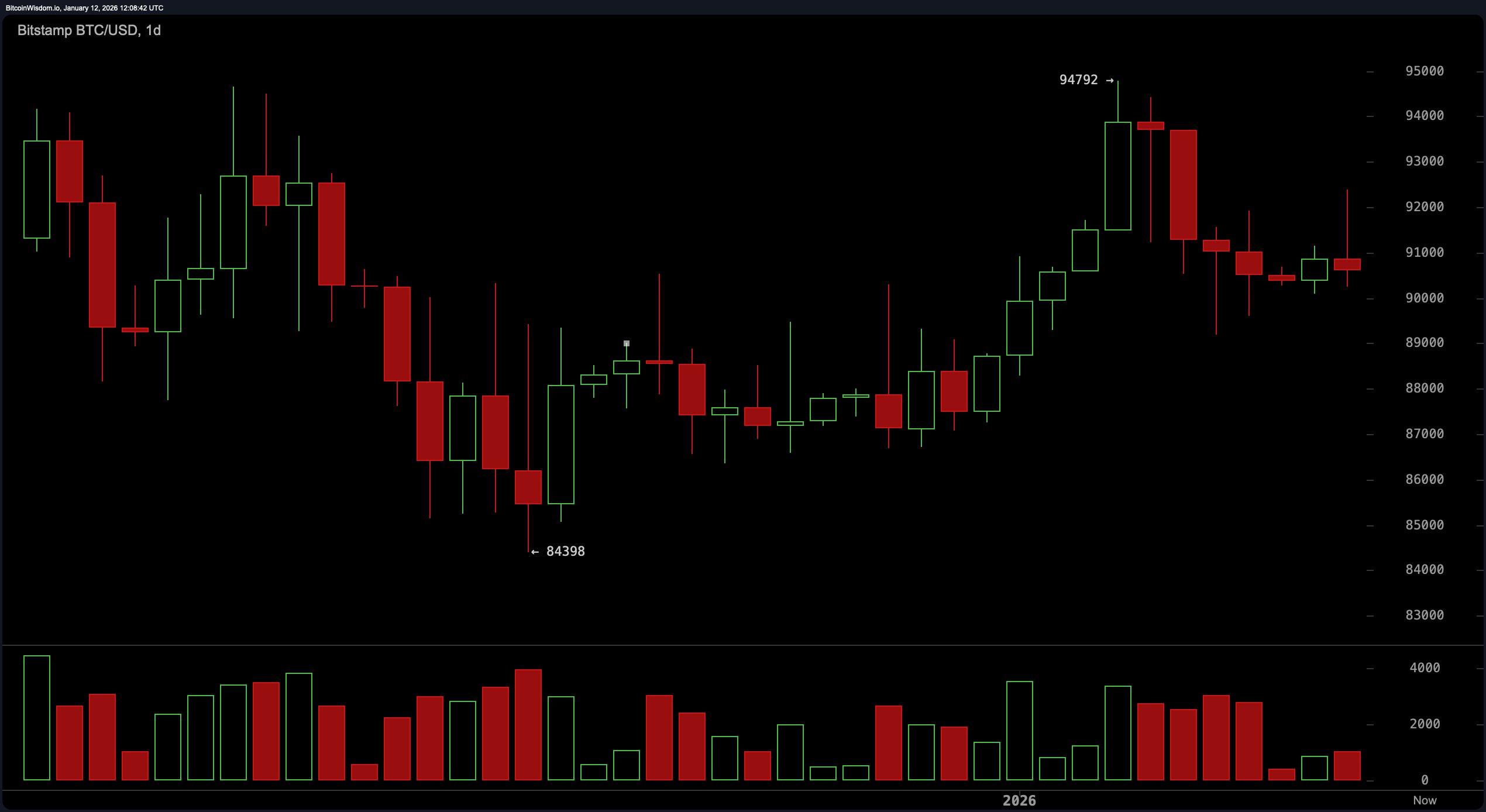

The 4-hour chart? Total mid-life crisis. 😵💫 After a dramatic fall from $94,792 to $89,199, Bitcoin’s now stuck in a consolidation phase that’s either a bearish flag or a descending triangle-depending on whether you’re Team Pessimist or Team Optimist. Lower highs, but that $90,000 support line? Still holding on like a loyal ex. 💔 If it breaks above $92,000 with conviction, we might see $94,000 again. But if $89,000 gives way, it’s time to call the therapist. 🛋️

On the daily chart, Bitcoin’s like, “I’m fine, I’m just going through a phase.” 😢 Rebounded from $84,398, hit a wall at $94,792, and now it’s sulking between $88,500 and $89,500. Bulls, this is your moment to shine! But beware the $94,500 to $95,000 resistance-Bitcoin’s emotional baggage is heavy there. If it closes below $88,000, it’s officially a breakup. 💔

Oscillators are like that friend who’s “fine” but clearly not fine. 😬 RSI at 52? Neutral, sure. Stochastic at 48? Also neutral. CCI at 57? Mild strength, but no commitment issues here. ADX at 26? No dominant trend, just vibes. And the MACD at 446? A tiny bullish wink. 😉

Moving averages are the blunt friends we all need. Short-term EMAs and SMAs are like, “Uh-oh, overhead pressure at $90,730 and $91,438.” But the 20- and 30-period averages? They’ve got Bitcoin’s back. Meanwhile, the 100- and 200-period averages are side-eyeing any bullish dreams above $95,000. Bitcoin, you’ve got work to do! 💼

Bull Verdict: 🐂

If Bitcoin stays above $90,000 and breaks $92,400 with gusto, bulls might just throw a parade to $94,000-$95,000. 🎊 But keep an eye on volume and macro sentiment-this isn’t a rom-com, it’s crypto. 🍿

Bear Verdict: 🐻

If Bitcoin loses $89,000 with strong downside volume, it’s time to hibernate. Higher moving averages and a moody oscillator aren’t helping. Until it breaks $92,400, it’s just a consolidation with a side of risk. 🍂

FAQ ❓

- What’s Bitcoin’s price today, Jan. 12, 2026?

Trading at $90,524. 💰 - What’s Bitcoin’s 24-hour range?

Between $90,090 and $92,392. 📏 - Is Bitcoin bullish or bearish right now?

Consolidating with mixed signals-basically, it’s indecisive. 🤷♀️ - Where’s Bitcoin headed next?

Above $92,400? Upside. Below $89,800? Downside. Choose your adventure! 🎢

Read More

- Brent Oil Forecast

- Gold Rate Forecast

- Silver Rate Forecast

- EUR USD PREDICTION

- USD JPY PREDICTION

- EUR THB PREDICTION

- USD INR PREDICTION

- USD PLN PREDICTION

- The SEC Just Gave DTCC the Green Light! Which Altcoins Will Flourish? 🚀

- GBP CNY PREDICTION

2026-01-12 16:58