Let’s all give a round of applause for Bitcoin, the digital marvel that’s somehow managed to throw a party where everyone’s invited, but the snacks are gone, the lights are flickering, and someone’s using a leaf blower in the pool. The network’s mining rigs are devouring electricity like it’s going out of style—33 gigawatts and climbing—while the rest of us stare at transaction fees so low they’re basically begging for a coffee fund. It’s the ultimate paradox: a system built to thrive on chaos, now gasping under the weight of its own success. Or is it a midlife crisis? Let’s dig into this dumpster fire of a report.

- Bitcoin’s mining network has morphed into an energy-guzzling beast, slurping 33 gigawatts to keep the blocks flowing even as transactions slow to a crawl. It’s like buying a Tesla just to drive to the mailbox.

- The GoMining Institutional report paints a picture of a crypto Wild West where hashrate and hardware multiply like rabbits, but fees and activity are drier than a tax seminar. It’s Vegas without the neon—just a lot of blinking machines and sighing miners.

- Experts predict this imbalance could linger longer than a bad Tinder conversation, with miners clinging to the block subsidy like it’s a life raft made of expired gift cards. Halvings every four years? More like a slow march to financial dehydration.

The Bitcoin network’s current vibe? It’s like watching a reality show where the contestants are all dehydrated. Energy consumption has doubled since 2024, but miners are earning less than a barista at a cat café. The GoMining report reads like a horror story for the crypto crowd: “Hey, guess what? You’re using enough power to light up Liechtenstein, but your transaction fees are the equivalent of finding a penny in a couch cushion.”

According to the data, Bitcoin’s energy use rocketed from 15.6 GW in January 2024 to 33.1 GW by May 2025. That’s a 100% spike! If you’re counting, that’s faster than your grandma learning TikTok dances. The report blames the post-halving “energy-dense mining infrastructure” boom, which sounds like a euphemism for “we built a data center next to a power plant and hoped for the best.”

Analysts shrug: “Sure, mining rigs are more efficient now, but we’ve got so many of them it’s like swapping a hangnail for an ingrown toenail.” The focus has shifted from ASIC design to “Where’s the cheapest power?”—a quest that’s probably leading someone to drill for oil in their grandma’s basement as we speak.

Difficulty: Hard Mode, Served Cold

Mining difficulty in 2025 has been about as exciting as watching paint dry. The metric limped up just 6.54% in six months, a snooze-fest compared to 2024’s breakneck pace. But don’t worry—there were brief moments of drama! A 6.81% spike in April and a 4.38% jump in May sent difficulty to a record high… only for it to crash 7.48% in June. Why? Heatwaves turned North America into a sauna, forcing miners to power down. Classic Bitcoin: always one heatwave away from a nervous breakdown.

Meanwhile, the transaction layer is drowsier than a narcoleptic sloth. Activity fell to 2023 levels, with fees stuck at 1 satoshi per byte. You could send a transaction faster than ordering a latte, but where’s the fun in that? Miners, meanwhile, are left whispering, “Is this all there is?”

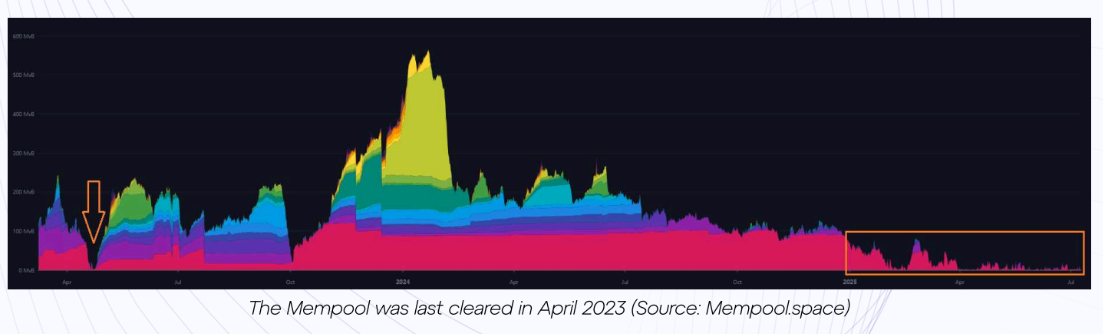

The Great Mempool Vanishing Act

Here’s a trick: Bitcoin’s mempool—where transactions wait like anxious penguins—emptied twice in 2025. The first time since 2023! Miners briefly earned zilch in fees, surviving on block subsidies alone. It’s the crypto equivalent of a ghost town with tumbleweeds. And while users love free lunch, miners are stuck in a “Hunger Games” reboot where the prize is a participation trophy and a power bill.

So what’s next? Miners are sweating bullets (and electricity) as they juggle rising costs and dwindling rewards. By 2140, when the last bitcoin is mined, today’s struggles will look like a picnic. Until then, Bitcoin’s economic model is a sinking ship with a “BYOB” sign—Bring Your Own Band-Aid.

In the words of a weary miner: “We’re here for the block rewards, the heatwaves, and the existential dread. It’s a living… or will be, until the lights go out.” 🚨💸

Read More

- GBP CHF PREDICTION

- ETH PREDICTION. ETH cryptocurrency

- EUR RUB PREDICTION

- USD VND PREDICTION

- XMR PREDICTION. XMR cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- USD MYR PREDICTION

- SHIB PREDICTION. SHIB cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- USD KZT PREDICTION

2025-08-01 12:36