Ah, the fickle dance of Bitcoin’s four-year cycle-once a reliable partner, now seemingly lost in the shadows of 2025’s capricious waltz. For the first time, the year closed with a whimper rather than a bang, leaving the crypto ballrooms in disarray. 🕺💸

The Red Post-Halving Candle: A Scandal in the Salon

The four-year cycle, that cherished rhythm tied to Bitcoin’s halving events, has long been the darling of market prognosticators. Yet, 2025 dared to defy tradition, ending with a 6% decline-a scandalous red candle in a year that once promised grandeur. Bitcoin, my dear reader, has stumbled in its own quadrille. 🕯️🔴

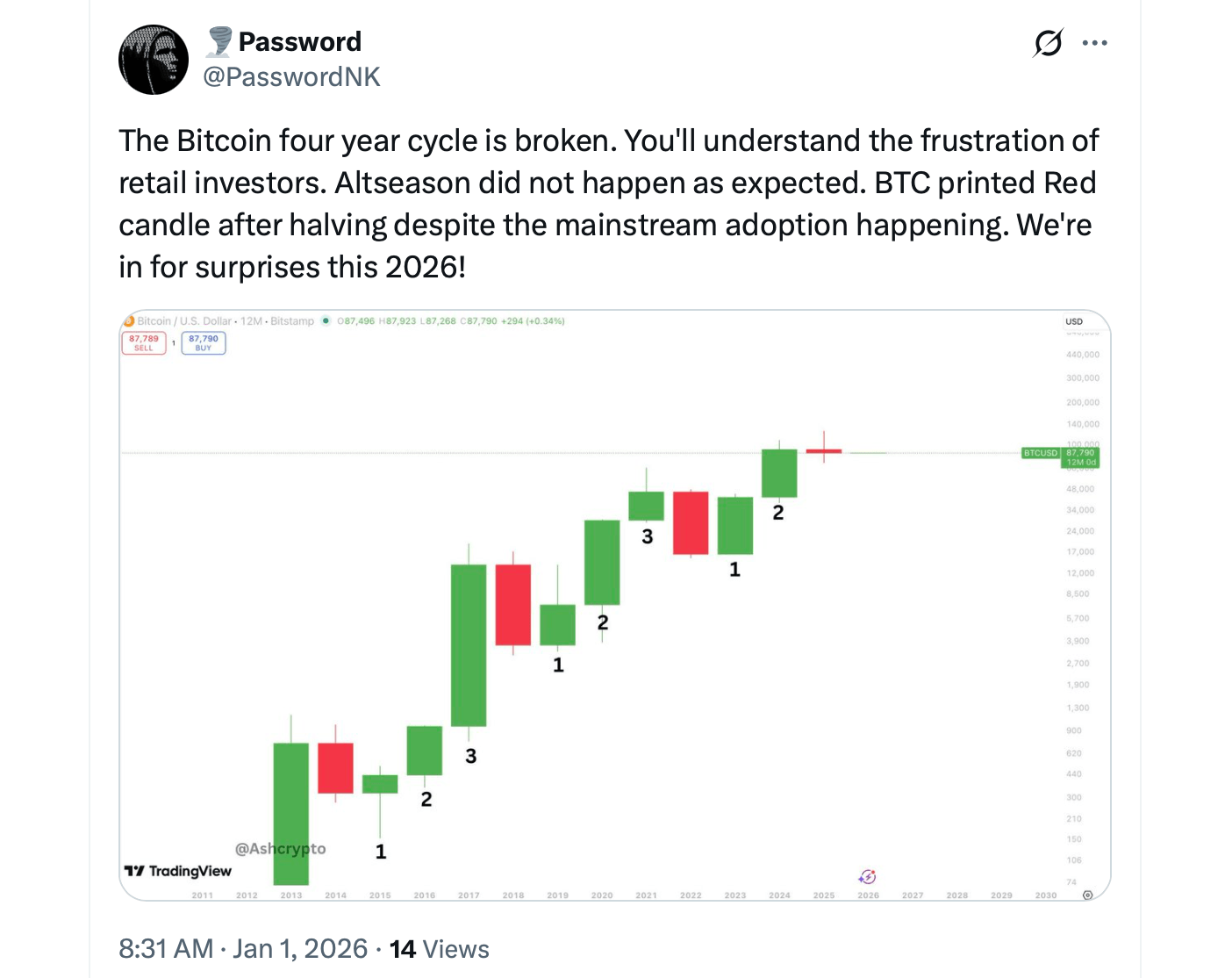

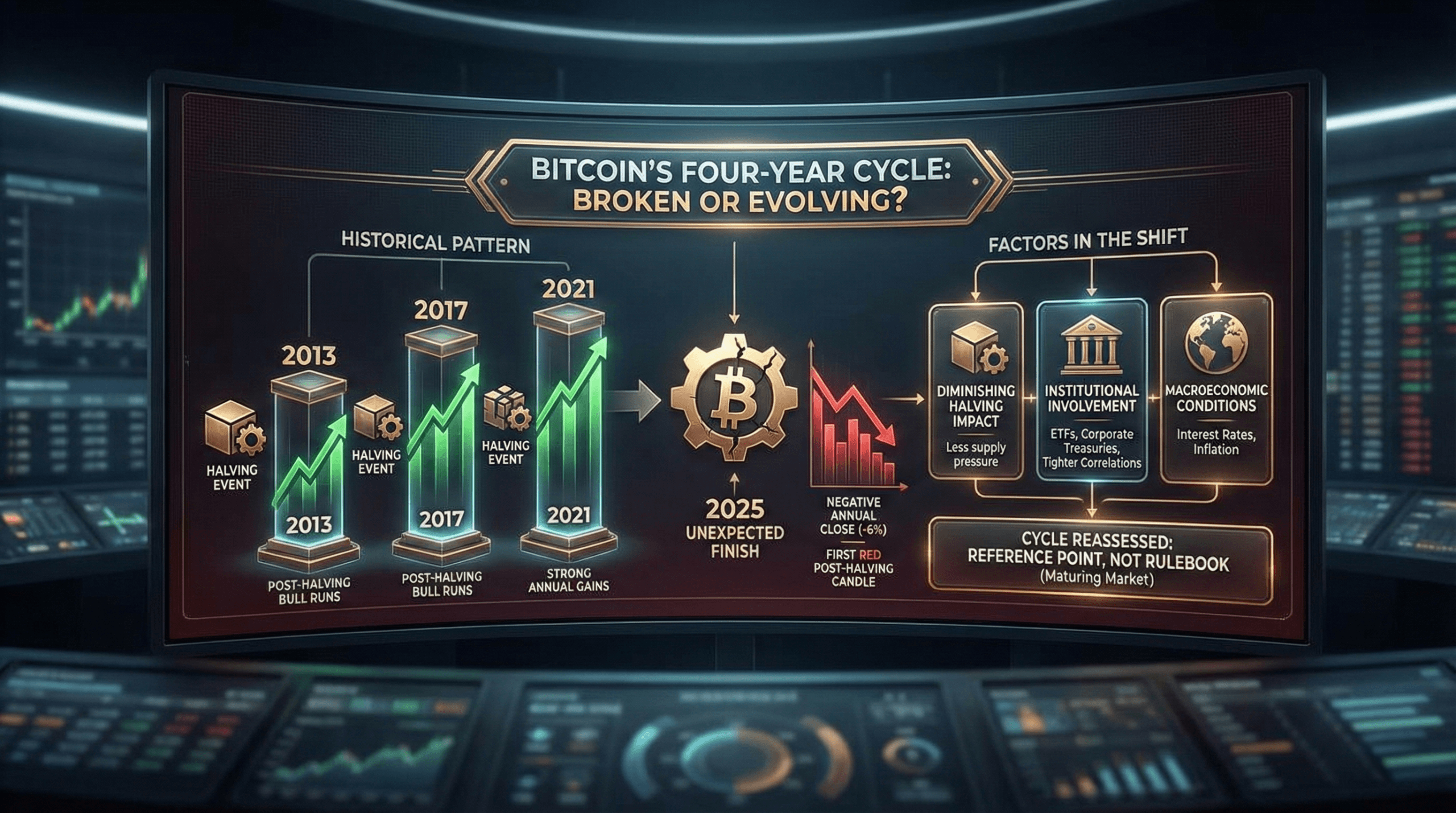

In years past-2013, 2017, 2021-the halving brought forth rallies as predictable as a Turgenev novel’s melancholy. But 2025? A rogue chapter, a plot twist no one saw coming. Even the intraday highs, fleeting as a summer breeze, could not save the year from its ignominious end. 🌪️📉

Across the crypto salons, whispers abound: “The cycle is dead!” cry the pundits, their proclamations as dramatic as a duel at dawn. Charts, those cold arbiters of truth, show 2025 as the outlier-a misstep in an otherwise graceful dance. Lark Davis, that modern-day bard of crypto, declared on X, “Can we finally agree the 4-year cycle is dead?” Alas, Lark, the market is no respecter of agreements. 🗣️📊

Why the Cycle May Have Lost Its Step

The critics, ever eager to dissect the corpse of tradition, offer their diagnoses. Some blame the halving’s diminishing returns-a supply reduction from 6.25 BTC to 3.125 BTC in 2024, a mere shadow of its former self. Others point to the intrusion of institutions, those staid gentlemen in top hats, with their ETFs and corporate treasuries. Bitcoin, once a rebel, now dances to the tune of traditional markets. 🎩💼

And let us not forget the macroeconomic tempest-interest rates, inflation, and economic doldrums that weighed on risk assets like a leaden sky. Even President Trump’s digital fortitude could not stem the tide. 🌧️💨

Yet, some argue Bitcoin’s growth has merely stretched its cycles, like a novel too grand for a single volume. With a market cap of $1.7 trillion, perhaps its rhythms now unfold over decades, not years. A comforting thought, but one that leaves us in suspense. 📚⏳

Not all despair, however. Some recall past obituaries for Bitcoin, only to see it rise again, phoenix-like, from the ashes. Others note that halving effects, like fine wine, may take time to mature-especially in the shadow of macroeconomic giants. 🦅🍷

So, is the four-year cycle truly dead, or merely resting? The data declares 2025 an anomaly, but the future remains as opaque as a Russian winter. What is certain is that Bitcoin’s dance is now influenced by a chorus of new partners-institutions, macro forces, and the relentless march of maturity. 🌨️💃

As the debate rages, the cycle may yet prove less a rigid rulebook than a flexible guide-a reference point in a world where Bitcoin’s steps are ever more complex. 🩰📖

FAQ ❓

- What is the Bitcoin four-year cycle?

A historical pattern linking Bitcoin’s price to halving events, occurring every four years-or so we thought. 🕰️🔗 - Why is 2025 significant for Bitcoin?

It marked the first post-halving year to close in the red, a scandalous departure from tradition. 🔴📆 - Did Bitcoin reach new highs in 2025?

It flirted with greatness but could not sustain the romance, ending the year in decline. 💔📈 - Is the four-year cycle officially over?

No consensus-some see a structural shift, others a mere anomaly. The jury is still out. 🤷♂️⚖️

Read More

- EUR PHP PREDICTION

- Brent Oil Forecast

- EUR USD PREDICTION

- USD INR PREDICTION

- USD MYR PREDICTION

- EUR THB PREDICTION

- USD PLN PREDICTION

- USD JPY PREDICTION

- Silver Rate Forecast

- Gold Rate Forecast

2026-01-01 20:57