It was a weekend much like any other in the year 2025, where the price of Bitcoin (BTC) lingered around the $108,000 mark, as if it had forgotten the meaning of movement. The cryptocurrency market, a place where dreams are made and lost, continued its theme of indecision, much to the amusement of those who watch from the sidelines.

The question on everyone’s lips, or perhaps more accurately, their keyboards, was when Bitcoin would finally muster the courage to return to its all-time high. But, as fate would have it, the latest on-chain data suggested that investors were growing increasingly confident in the long-term promise of this digital enigma.

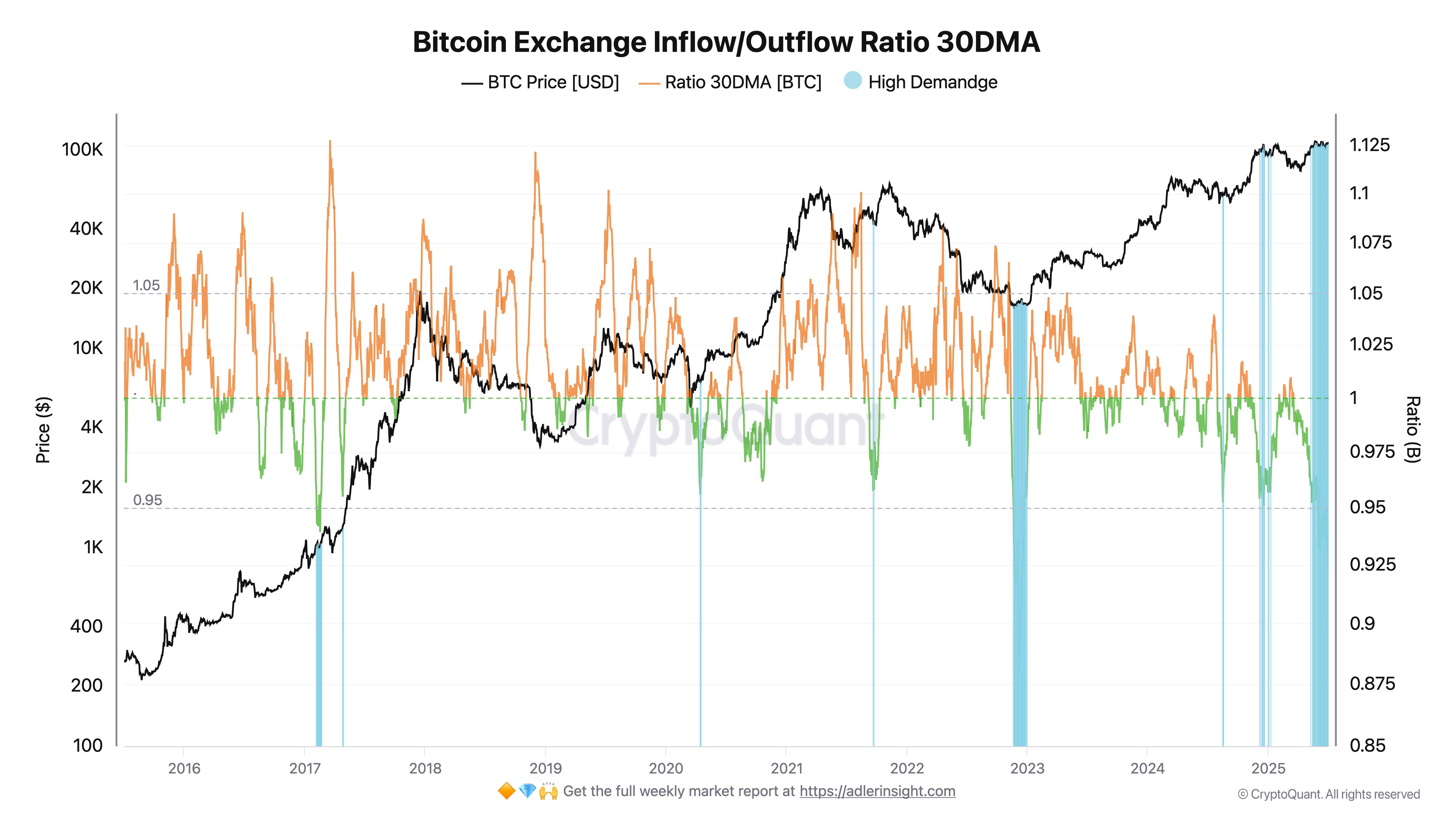

Bitcoin Exchange Inflow/Outflow Ratio Below 1: On-Chain Analyst

On July 5, an on-chain analyst known only by the pseudonym Darkfost, took to the X platform to share a curious observation. Bitcoin, it seemed, had been steadily flowing out of centralized exchanges over the past few months, a trend that, according to Darkfost, reflected a growing confidence among investors in the long term.

This insight was derived from the Bitcoin Exchange Inflow/Outflow Ratio 30DMA, a metric that measures the volume of BTC moving in and out of centralized exchanges over a 30-day period. A high ratio (>1) indicated more inflows than outflows, suggesting increased selling pressure. Conversely, a low ratio (<1) meant more coins were leaving exchanges, a sign that investors were holding onto their precious BTC for the long haul.

Darkfost noted that the Bitcoin monthly outflow/inflow ratio had recently dipped to around 0.9, its lowest point since the bear market of 2023. With the metric now below 1, it was clear that Bitcoin exchange outflows were the dominant force, a sign of strong and sustained demand on the spot market.

As of today, demand remains present as outflows continue to dominate, with a growing number of long-term holders stepping in.

Darkfost, ever the optimist, believed that this confidence in Bitcoin’s long-term promise was not unfounded. The growing adoption by major corporations and governments, particularly in the United States, was a testament to BTC’s evolving role as a store of value. “BTC is gradually becoming a cornerstone of treasury strategies,” the analyst mused.

Bitcoin Price At A Glance

At the time of writing, the price of BTC stood at around $108,103, a mere 0.3% increase over the past 24 hours. A testament to the market’s patience and, perhaps, its sense of humor.

Read More

- BTC PREDICTION. BTC cryptocurrency

- ETH PREDICTION. ETH cryptocurrency

- CNY JPY PREDICTION

- SOL PREDICTION. SOL cryptocurrency

- USD VND PREDICTION

- EUR USD PREDICTION

- XMR PREDICTION. XMR cryptocurrency

- EUR RUB PREDICTION

- GBP EUR PREDICTION

- GBP CHF PREDICTION

2025-07-06 20:17