Turns out, the OG whales who’ve held Bitcoin through apocalyptic bear markets and crypto bro hype cycles are now the cool, collected types. Meanwhile, the new money whales-those who bought in at ~$98k-are currently panicking like they bought a meme stock instead of a digital gold standard.

The New Guardians of Supply

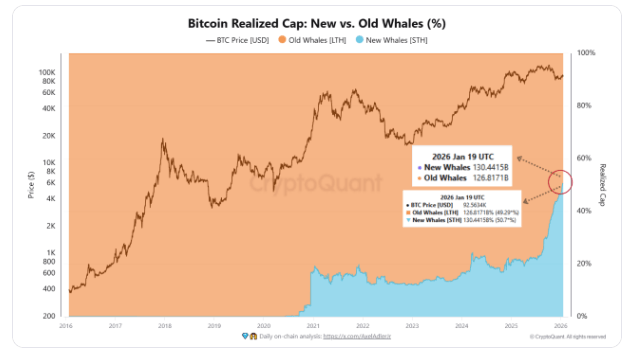

According to Cryptoquant, the new whales-the ones who probably watched a TikTok about “HODL” before throwing their cash at BTC-now control more of Bitcoin’s realized cap than the OGs who’ve been here since the days of dial-up mining. This isn’t just a shift; it’s a full-blown coup. The market’s no longer dictated by the OGs’ “diamond hands” (a term that now feels tragically ironic), but by the jittery, “should I sell now?” vibes of the new guard.

Realized cap, that fancy metric that basically says “this is how much everyone paid for their BTC last time they moved it,” shows that a ton of BTC has recently changed hands at premium prices. These new whales-entities holding >1,000 BTC with coins younger than 155 days-are now the market’s de facto overlords. Congrats to them, I guess?

But here’s the kicker: while the OGs bought their BTC at ~$40k and have the emotional fortitude of a war veteran, these newbies bought in at ~$98k. They’re sitting on a $6B loss that’s probably bigger than their self-esteem. As the report says, this isn’t just a bad day at the office-it’s a full-blown identity crisis for crypto’s newest elite.

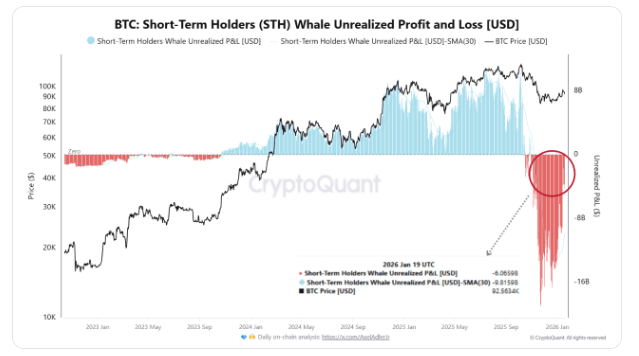

Market Under Pressure: The $6 Billion Gap

The report claims the current volatility? That’s just the new whales’ panic attack manifesting. With BTC trading below their cost basis, they’re collectively sweating bullets and probably questioning every life decision that led them here. Unlike the OGs, who’ve weathered bear markets and probably still have a VHS tape of the 2017 bull run, these newbies are already Googling “how to sell BTC without crying.”

Instead of HODLing through the dip, they’re using every 10% bounce as an excuse to “take profits” (read: cut their losses). This isn’t investing-it’s a game of hot potato with a bag of cash that’s suddenly caught fire. And because these whales hold the most realized capital and trade like they’re on a sugar high, the market’s stuck in a loop of “sell, panic, repeat.”

The OGs? Still chilling, sipping their chamomile tea, and watching the chaos with the detached amusement of someone who’s seen it all. Meanwhile, the new whales are scrambling like they’re in a reality TV show where the prize is financial ruin. The report concludes that until these poor souls either admit defeat or the market absorbs their losses, BTC’s price action will be dictated by the emotional instability of people who thought buying $98k BTC was a “buy the dip.”

FAQ ❓

- What changed in Bitcoin’s whale landscape? New whales now hold more realized cap than OGs. Surprise surprise.

- Who are the new whales? Investors with 1,000+ BTC acquired in the last 155 days. Also known as “people who didn’t read the manual.”

- Why is the market under pressure? New whales face $6B in losses. Their panic is contagious.

- How does this affect Bitcoin’s price? Their sell-offs stall momentum. It’s like trying to run a marathon while someone keeps yanking the rug out from under you.

Read More

- EUR USD PREDICTION

- GBP CNY PREDICTION

- STX PREDICTION. STX cryptocurrency

- CNY JPY PREDICTION

- NEXO PREDICTION. NEXO cryptocurrency

- USD MYR PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- DOGE PREDICTION. DOGE cryptocurrency

- OP PREDICTION. OP cryptocurrency

- EUR ARS PREDICTION

2026-01-22 15:42