Ah, the fickle dance of Bitcoin, that digital siren luring the greedy and the gullible alike! Today, it teeters near $92,800, a fleeting rebound that does little to soothe the jangled nerves of the market. Fear, that old companion of traders, creeps in like a shadow, whispering doubts: is this but a fleeting bounce, or the prelude to a cataclysmic fall? 🌋

Peter Brandt, the Cassandra of Crypto, Sounds the Alarm 🚨

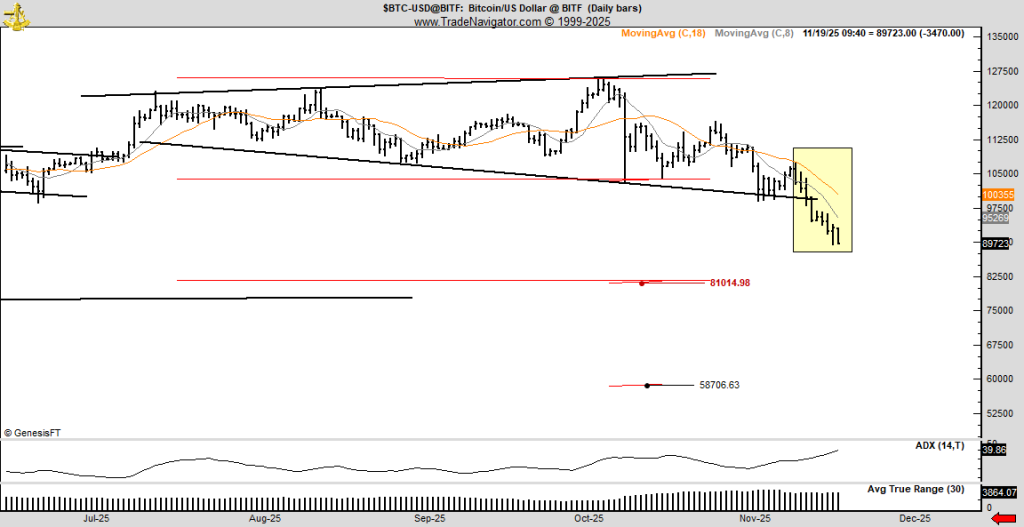

Behold, the sage Peter Brandt, a man whose charts are as ominous as a storm cloud on the horizon, warns of a broadening top pattern-a harbinger of doom, if ever there was one. “The reversal began on November 11,” he proclaims, his voice dripping with the gravitas of a prophet. Lower highs, fading momentum-the signs are clear, though the masses remain blind to their fate. 🧙♂️

First, $81,000 shall crumble, and if the gods of greed so decree, $58,000 awaits. Such is the prophecy, uttered at a time when altcoins strut like peacocks, and Peter Schiff, that eternal naysayer, returns to the stage, his schadenfreude palpable. Is this the dawn of a bear market, or merely a pause in the relentless march of greed? 🤡

The Market, a Beast in Distress 🐻❄️

The recent crash, a spectacle of carnage, wiped out over a billion dollars in leveraged positions-Bitcoin, Ethereum, XRP, all sacrificed at the altar of volatility. Kalshi’s soothsayers predict a 44% chance of Bitcoin dipping below $80,000 this year. A local accumulation pattern emerges, as if market makers, those shadowy puppeteers, have stepped in to catch the falling knife. But the lower time frame structure, ever fickle, flips back to bearish, leaving traders clutching their charts like lifelines. 📉

Correlation patterns, those enigmatic riddles, add to the chaos. Bitcoin, ever the contrarian, dances with the DXY in the long term but shuns it in the short. Should the DXY rise from its slumber, Bitcoin might follow-or perhaps not. Turning points, they say, align with trend shifts, but who can truly decipher the whims of the market? 🕵️♂️

Some whisper of a hidden bullish divergence, a glimmer of hope in the gloom. A fair value gap, a structure reminiscent of past cycles-could a relief rally be nigh? Unless, of course, the divergence fails, and the bear tightens its grip. 🐂⚰️

Downtrend resistance, that stubborn foe, looms large. “Hold above $90,000,” the traders plead, “or face the abyss!” Lose that level, and $84,000 to $86,000 beckons-a descent into the maelstrom. A temporary bottom this week? Perhaps. But the larger trend, they say, is down. October 6th, a peak? A 40 to 50% drop by next year? History, that cruel teacher, reminds us of bear markets past, where drops of 45 to 60% were but the beginning. Even a bounce, they warn, might be a mere countertrend rally before the next plunge. 🌊⬇️

The Road Ahead: $60,000, the Final Frontier? 🚀🤯

Amidst this cacophony of signals, the question lingers: will Bitcoin indeed plummet to Brandt’s $58,000? The key, they say, lies at $90,000. Hold, and a relief rally might yet materialize. Fall, and the bears shall feast, dragging the price to depths unknown. The market, ever the dramatist, holds its breath. What fate awaits the digital gold? Only time, that relentless judge, will tell. ⏳

Read More

- Gold Rate Forecast

- EUR USD PREDICTION

- Brent Oil Forecast

- Silver Rate Forecast

- CNY JPY PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- GBP CNY PREDICTION

- POL PREDICTION. POL cryptocurrency

- GBP RUB PREDICTION

- PI PREDICTION. PI cryptocurrency

2025-11-20 12:04