Ah, the illustrious Bitcoin! On this fine day of August 9, 2025, it finds itself perched at a lofty $117,304, with a market capitalization that would make even the most seasoned oligarch blush-$2.33 trillion! In the past 24 hours, this digital marvel has danced through a trading volume of $31.5 billion, oscillating between $115,979 and $117,786, a range so narrow it could make a tailor weep with envy. Such is the nature of its current consolidation phase, a veritable waltz of uncertainty.

Bitcoin

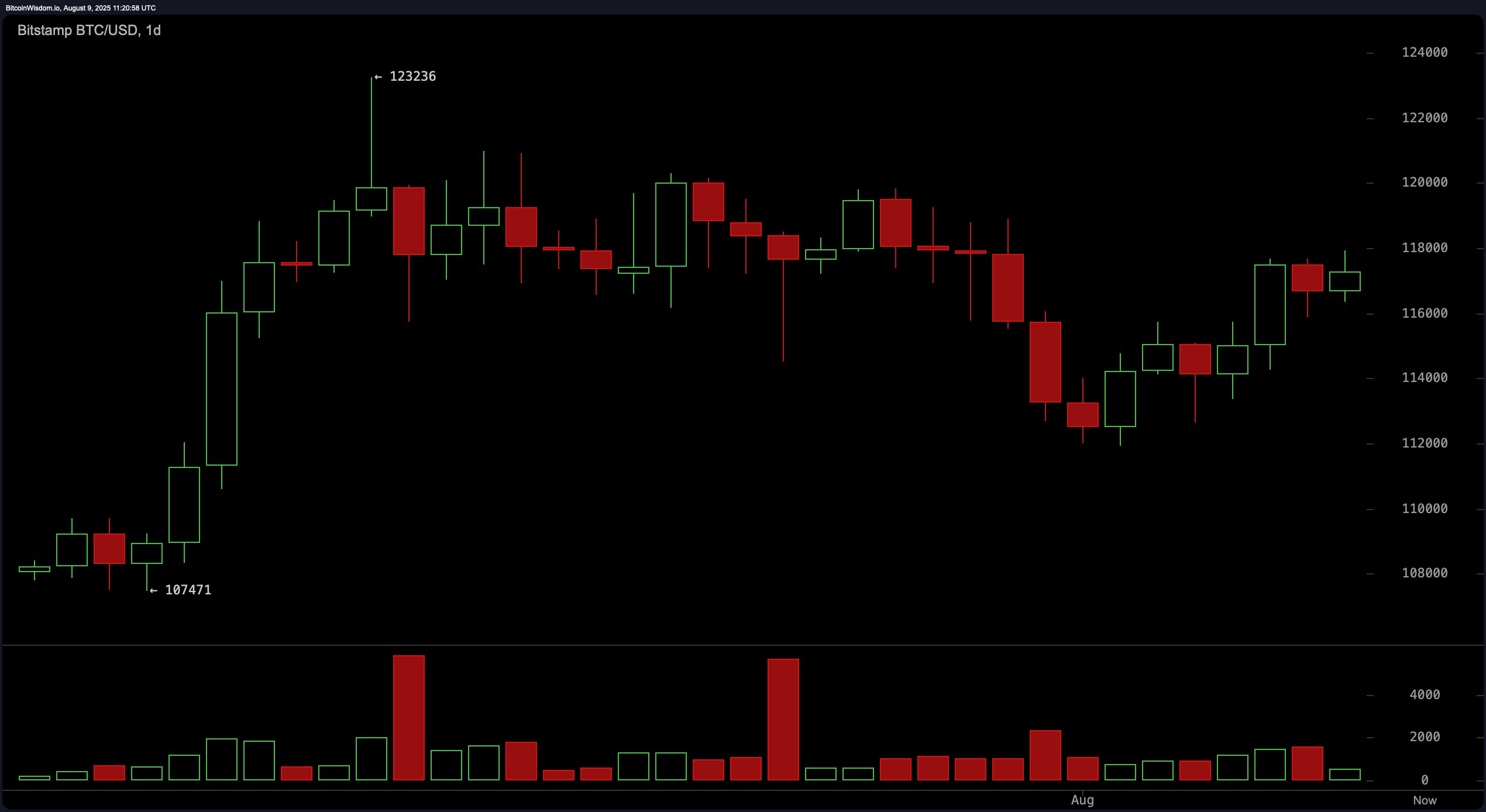

Upon gazing at the daily chart, one cannot help but notice that Bitcoin has rebounded from a recent dip, having flirted with the heights of $123,236 before finding solace in the $112,000 range. Resistance, however, lurks ominously between $118,000 and $118,500, where sellers have taken up residence like unwelcome guests at a dinner party. The trading volume spikes during these sell-offs suggest that buyers are lurking in the shadows, ready to pounce and provide a semblance of stability. Short-term momentum has donned its bullish attire after reclaiming the mid-$117,000 level, yet our dear Bitcoin remains ensnared in a broader consolidation pattern. Should it manage to close above $118,500, we might just witness a grand ascent; but alas, a rejection here could keep it shackled in its range-bound existence.

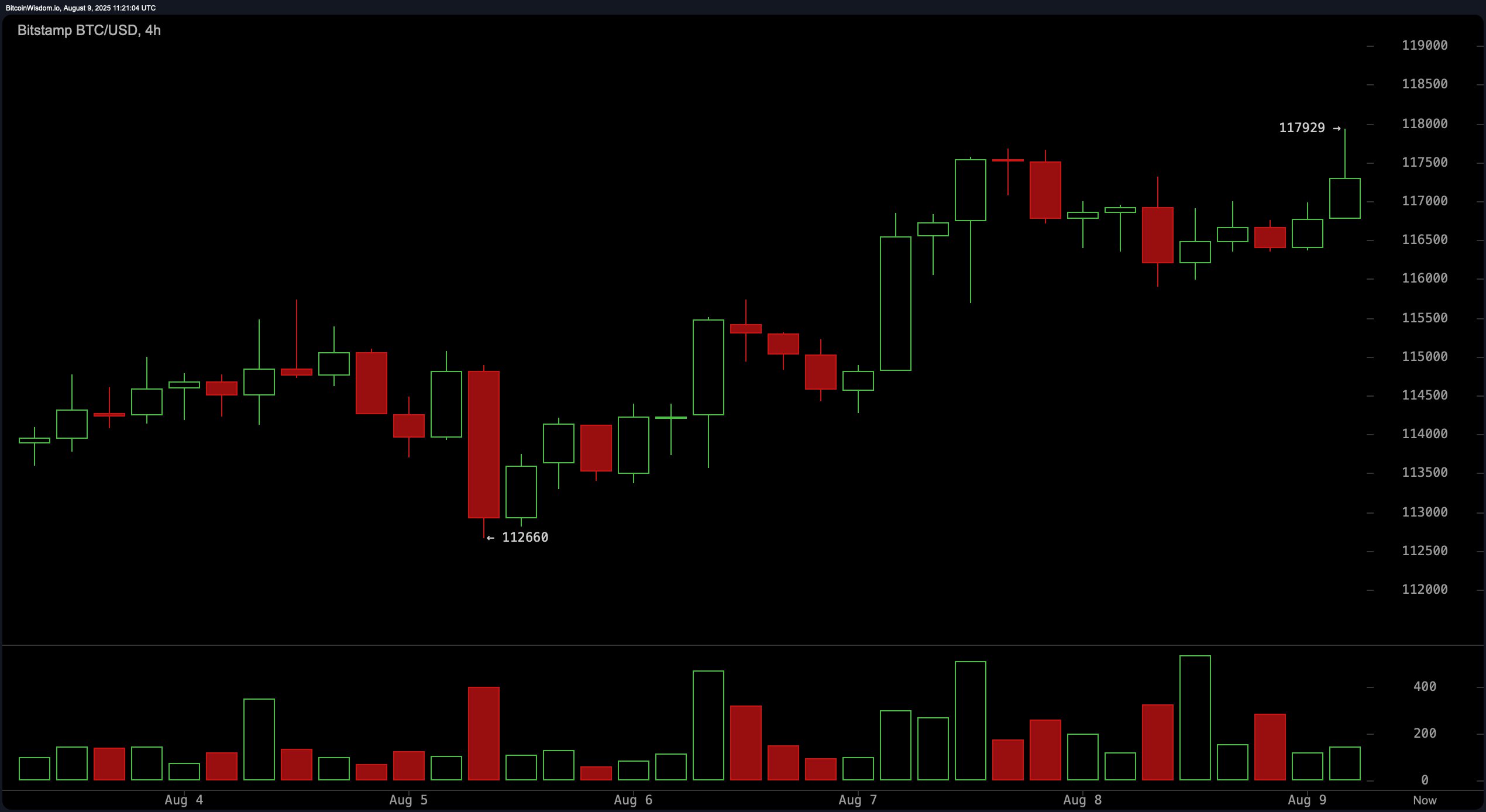

Turning our gaze to the 4-hour chart, we see that Bitcoin has been on a steady ascent since August 5, when it briefly touched the humble price of $112,660. The formation of higher highs and higher lows suggests a bullish structure, with $116,000 serving as a critical support level. Yet, rejections around $118,000 to $118,200 indicate that sellers are still very much in the game. The buying momentum during pullbacks has been as consistent as a well-timed joke at a family gathering. Trading volume during this timeframe supports the notion of accumulation, and the near-term sentiment remains as positive as a puppy in a room full of children-unless, of course, the price decides to close decisively below $116,000. Traders may find themselves eyeing strategic entry opportunities near this support zone, aiming for short-term targets just below the key resistance.

Now, let us not forget the hourly Bitcoin chart, which reflects a more subdued environment, with our dear BTC trading sideways, albeit with a slight upward tilt. A recent push to $117,929 faced a swift rejection, reinforcing the $118,000 ceiling like a stubborn lid on a jar of pickles. Micro support has formed between $116,800 and $117,000, with low volume suggesting a market indecision that could rival a cat contemplating a leap. Price action appears confined to a tight range, favoring short-term scalping strategies where entries are taken at support and exits at resistance. A confirmed breakout above $118,000 could provide the momentum needed for a push higher, while a breakdown may lead us to revisit lower 1-hour support zones.

As for the oscillators, they present a largely neutral stance, much like a diplomat at a contentious negotiation. The relative strength index (RSI) stands at 56, stochastic at 66, and commodity channel index (CCI) at 23-all neutral readings that could make one yawn. The average directional index (ADX) at 16 also points to a lack of strong trend momentum, while the awesome oscillator is slightly negative at −721 but neutral in bias, and momentum at −538 issues a bullish signal. Notably, the moving average convergence divergence (MACD) level at 411 issues a bearish signal, suggesting a delightful mix of confusion in shorter-term momentum versus trend continuation.

When we turn our attention to moving averages (MAs), they overwhelmingly support a bullish bias, as if they were cheerleaders at a football game. The exponential moving average (EMA) 10 at $116,127 and simple moving average (SMA) 10 at $115,144 both signal positivity, as do the EMA 20 at $116,029, SMA 20 at $116,747, and EMA 30 at $115,436. Longer-term indicators are similarly positive, with the SMA 30 at $117,268, EMA 50 at $113,593, SMA 50 at $113,430, EMA 100 at $108,808, SMA 100 at $109,042, EMA 200 at $101,501, and SMA 200 at $99,669-all producing bullish signals. This alignment across multiple timeframes suggests that the broader trend remains upward, even as shorter-term conditions indicate consolidation.

Bull Verdict:

Bitcoin’s multi-timeframe moving averages, coupled with its consistent pattern of higher highs and higher lows on the 4-hour chart, suggest that the broader trend remains intact to the upside. If the $118,500 resistance is broken and confirmed as support, momentum could accelerate toward the $120,000 level and beyond, like a rocket fueled by dreams and ambition.

Bear Verdict:

Despite the underlying trend strength, persistent resistance at $118,000-$118,500 and neutral oscillator readings signal that upside progress is stalling, much like a car stuck in traffic. A break below $116,000 on higher timeframes could shift momentum toward $114,000 or lower, putting recent gains at risk, and leaving traders to ponder the fickle nature of fortune.

Read More

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- BTC PREDICTION. BTC cryptocurrency

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- 🔥Vienna’s Crypto Carnage: Ukrainians Burn Wallets & Souls! 💰💀

- Bitcoin’s Cosmic Cringe: Why the Crypto World Is Now a Black Hole 🌌💸

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- 🐳 XRP Whales Splash Cash: Is the Tide Turning? 🌊

- You Won’t Believe What Secretly Predicts Bitcoin’s Next Crash! 😱

2025-08-09 15:33