Markets

What to know:

- Bitcoin, that stubborn idol of our era, shows the heralds of a bear’s winter: participation dwindling, demand thinning to a whisper, liquidity constricting, and prices lingering in the dull mid-$70,000s as if the horizon itself were narrowing.

- U.S. spot bitcoin ETFs have shifted from net buyers to net sellers, and the Coinbase premium remains negative, a sardonic bell toll reminding us that the fervor that once propelled markets has taken leave.

- Broader macro weather-anticipations of a steady Federal Reserve and political pressures upon rate decisions-keeps liquidity chained and weighs upon crypto and tech-linked ventures across Asia as if they were but guests in a grand, empty hall.

Good Morning, Asia. Here’s what’s making news in the markets:

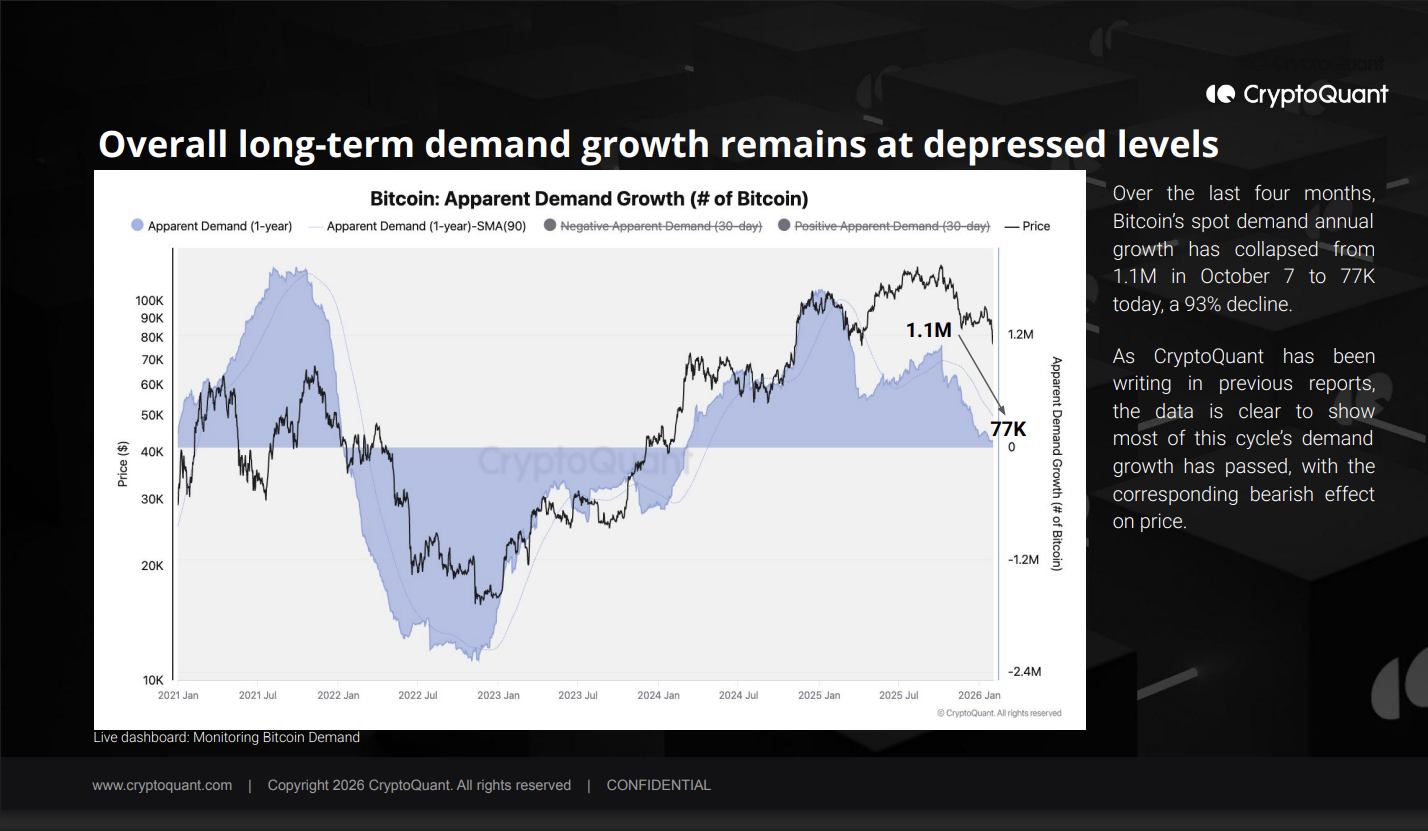

CryptoQuant’s latest weekly dispatch casts the weakness as structural rather than seasonal, its Bull Score Index lying on the zero line while bitcoin treads far below its October crown. The missive argues the market no longer digests gains but operates with a thinner cadre of buyers and a liquidity that slips away like a thawing river.

Glassnode’s chronicle reinforces this portrait: weak spot volumes and a demand vacuum where selling pressure is not met with patient absorption. The trouble, one might say with a shrug and a sigh, is not panic but participation.

Institutional flows sharpen the picture. U.S. spot bitcoin ETFs, once net accumulators at this hour of last year, have flipped into net sellers, leaving a yawning year-over-year demand gap measured in tens of thousands of bitcoins.

Concurrently, the Coinbase premium has remained negative since October, signaling that U.S. investors are not stepping in meaningfully despite cheaper prices. In the annals of market history, enduring bull phases have marched in step with robust U.S. spot demand. That engine, at present, sits idle.

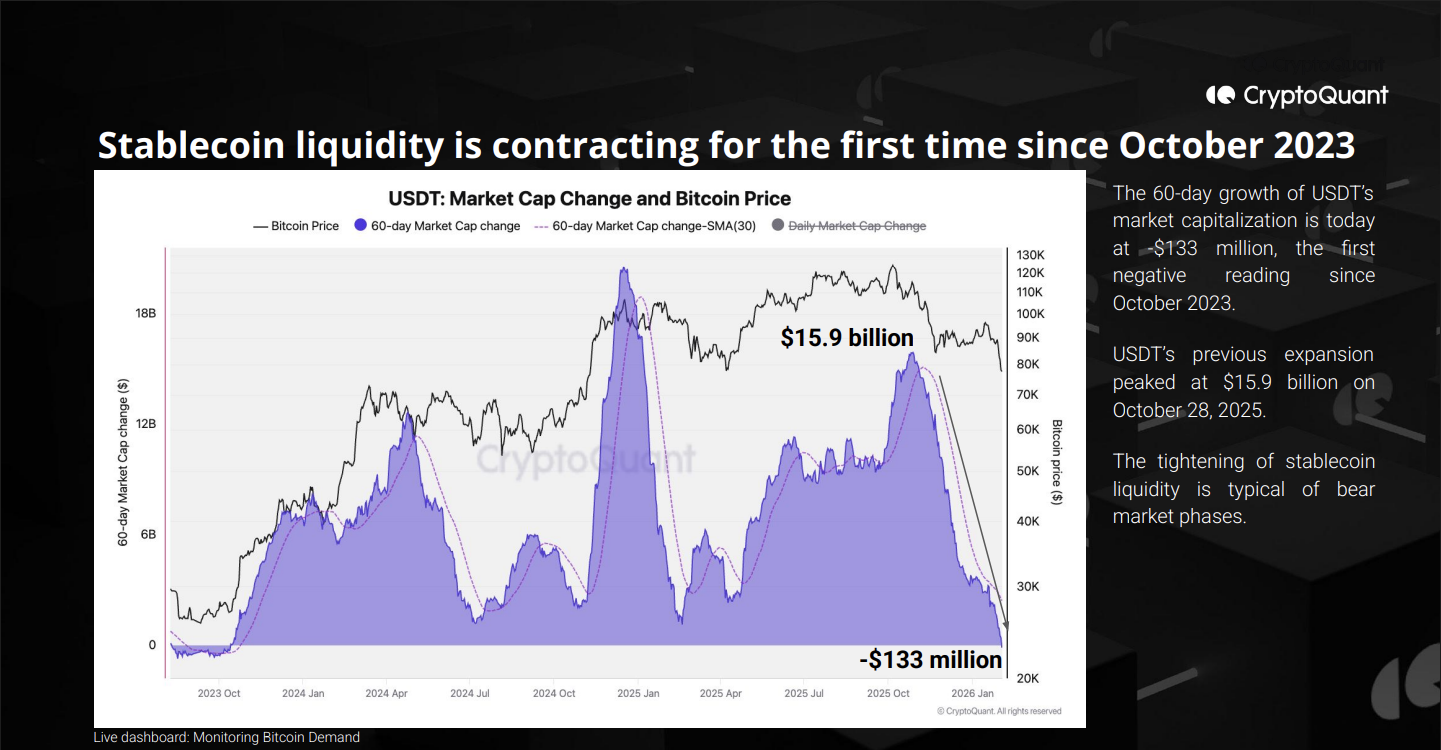

Liquidity conditions hide beneath the surface and tighten still. Stablecoin expansion, which usually fuels risk appetite and trading activity, has stalled, with USDT market-cap growth turning negative for the first time since 2023.

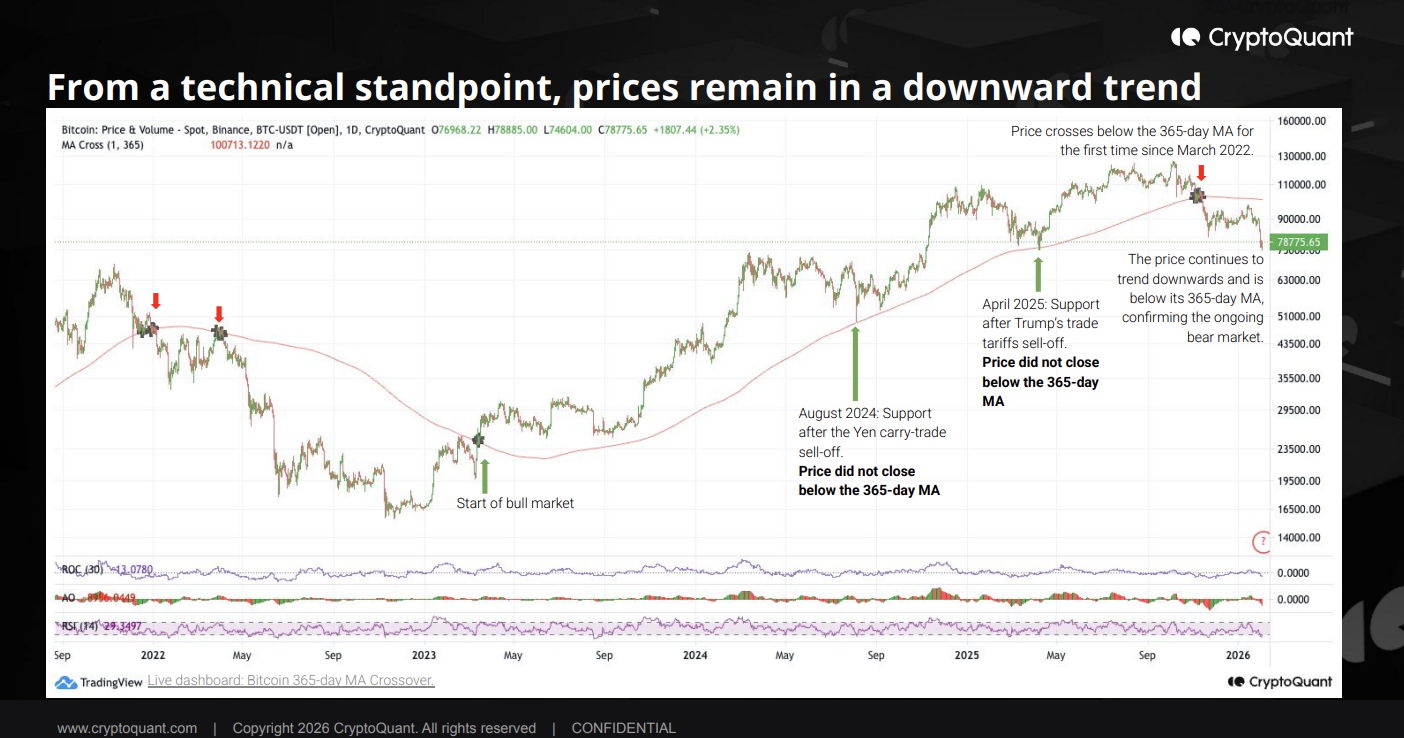

Longer-term apparent demand growth has likewise collapsed from last year’s pinnacles, suggesting this is not merely leverage being flushed but participation itself fading. Technically, bitcoin remains below its 365-day moving average, with on-chain valuation bands clustering major support in the $70,000 to $60,000 corridor.

Overlaying this is a macro backdrop in which bitcoin wears the garb of high-beta software rather than the calm ascribed to digital gold. Prediction markets show traders still leaning toward no change at the Federal Reserve’s April gathering, with only modest expectations for a June rate cut. That hesitancy keeps near-term liquidity relief out of reach like a distant mirage.

The policy narrative is further complicated by politics. President Donald Trump recently spoke to the press about his Fed nominee Kevin Warsh and remarked in an NBC News interview that a Fed chair who would have raised rates “would not have gotten the job,” a quip that tempers earlier optimism about central bank independence.

For Asia, the result is a market defined less by shock than by absence, where bounces remain possible, but conviction remains thin.

Market Movement

BTC: Bitcoin drifted lower into the mid $70,000s after briefly testing support, with rebounds fading quickly as spot demand remained thin and tech stocks stayed under pressure.

ETH: Ether hovered just above the low $2,000s, struggling to build momentum as broader risk sentiment softened and flows remained muted across major exchanges.

Gold: Gold rebounded toward the $5,000 to $5,100 range, extending a volatile recovery driven by safe-haven buying after U.S.-Iran tensions flared and softer private payroll data offset mixed economic signals while traders reassessed the Fed outlook under Trump’s new chair pick.

Nikkei 225: Japan’s Nikkei 225 edged lower by roughly 0.3% as chip and tech heavyweights tracked Wall Street’s sell-off, though broader Japanese equities remained relatively resilient compared with regional peers.

Read More

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- BTC PREDICTION. BTC cryptocurrency

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

- Ethereum Whale’s Bold $280M Short: Is the Market on a Cliff or Just a Cliffhanger? 🤔

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- Ethena’s $106M Token Unlock: Will Aave’s Liquidity Bust or Just a Bad Hair Day? 🤔

- 🔥Vienna’s Crypto Carnage: Ukrainians Burn Wallets & Souls! 💰💀

2026-02-05 06:24