Ah, Bitcoin, that fickle mistress of the digital realm, has begun her week with a dramatic plunge, descending beneath the $112K threshold, as if to mock the fleeting hopes of last week’s one-month high. Since then, she has languished in a suffocating embrace between $112K and $113K, leaving traders in a state of existential despair. 🥀

The air is thick with anticipation, as the masses await her next move, their hearts heavy with the weight of investor caution. For lo, three titanic U.S. economic reports loom on the horizon, ready to dictate Bitcoin’s fate with the cruelty of a capricious god. 🌩️

The Charts Whisper Their Dark Secrets

CryptoQuant, that oracle of the crypto sphere, reveals three harbingers of doom-or perhaps salvation: CME futures, CME options, and Binance funding rates. Each speaks in unison, painting a portrait of investors trembling on the precipice of volatility, yet paralyzed by indecision. 🕳️

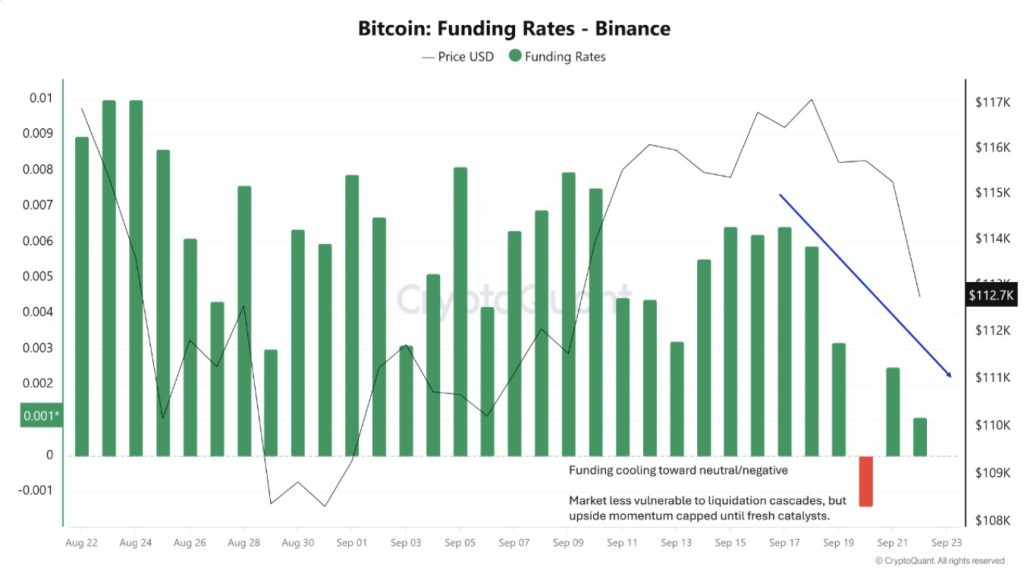

On Binance, funding rates have retreated to neutrality, even flirting with the negative, as bullish traders abandon their reckless dreams. The silver lining? The market is less likely to suffer the agony of sudden liquidation crashes. 🛡️ But alas, without the fervor of long bets, Bitcoin struggles to ascend, shackled by the absence of new catalysts. ⛓️

CME: The Theater of Institutional Angst

Turn your gaze to CME, the playground of institutional titans, where futures open interest lingers in the October-November expiry window. Here, professional traders hedge their bets, their spirits broken by the uncertainty that clouds the horizon. They wait, like condemned men, for clarity before daring to dream of rallies. ⚰️

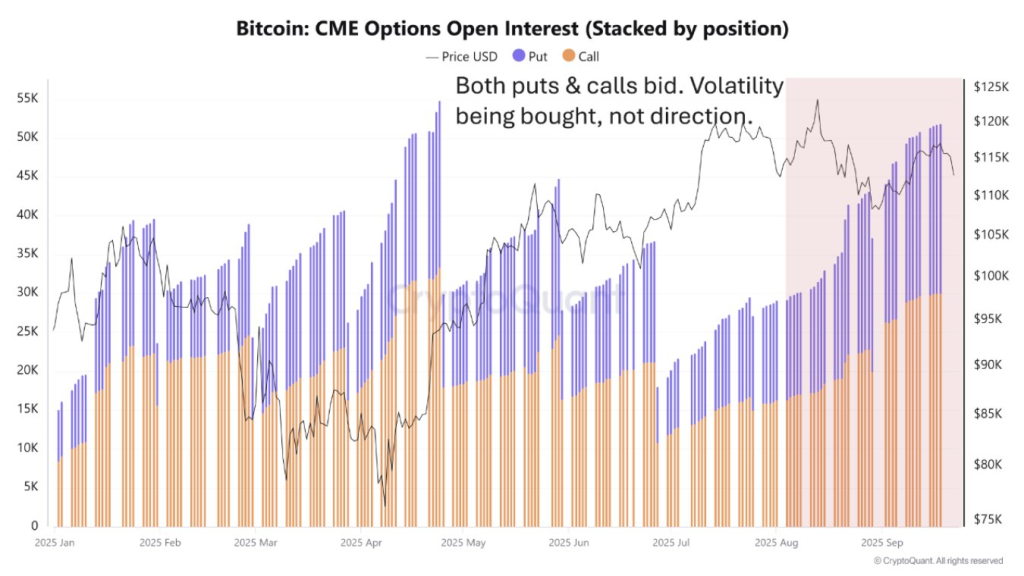

Yet, the CME options open interest tells a different tale. CryptoQuant Research observes a surge in both calls and puts, as traders, in their despair, embrace volatility itself, forsaking the illusion of control. 🌀

Thus, Bitcoin remains trapped in her narrow cage, a prisoner of equilibrium, awaiting the cataclysmic event that will shatter her chains. 🔗

The U.S. Economic Tempest Approaches

What lends this drama its tragic irony is the timing. The coming days are fraught with the weight of U.S. economic data, a deluge that will reveal whether the American economy burns with fever or cools to ashes. 🌡️

On Thursday, Jobless Claims, GDP, and Durable Goods Orders shall descend upon the markets, offering a glimpse into the soul of the economy. Will it be a inferno of inflation, dragging Bitcoin to the depths of $107K? Or shall it be a gentle breeze of easing inflation, whispering promises of Fed rate cuts and propelling Bitcoin to the heights of $118K or beyond? 🌪️

And on Friday, the Fed’s beloved Core PCE and consumer sentiment data shall complete this macabre dance, sealing Bitcoin’s fate with the finality of a Dostoevskian climax. 🎭

Oh, the agony and the ecstasy of it all! Will Bitcoin rise like a phoenix, or shall she be consumed by the flames of uncertainty? Only time-and the cruel hand of economic data-will tell. ⏳

Read More

- BTC PREDICTION. BTC cryptocurrency

- ETH PREDICTION. ETH cryptocurrency

- USD JPY PREDICTION

- SOL PREDICTION. SOL cryptocurrency

- GBP EUR PREDICTION

- GBP CNY PREDICTION

- USD TRY PREDICTION

- USD KZT PREDICTION

- DOGE GBP PREDICTION. DOGE cryptocurrency

- TIA PREDICTION. TIA cryptocurrency

2025-09-23 10:54