Ah, Bitcoin-today pirouetting delicately at approximately $112,256, enshrining its market cap at a staggering $2.23 trillion. Such a figure elicits a cocktail of awe and the faintest hint of existential dread. The past 24 hours have witnessed a $44.38 billion frenzy of trade-a veritable financial mosh pit-while prices sashayed between $109,257 and $112,327. Taut as a violin string, yet with enough pizzazz to jolt traders into caffeinated mayhem. 🎢

Bitcoin

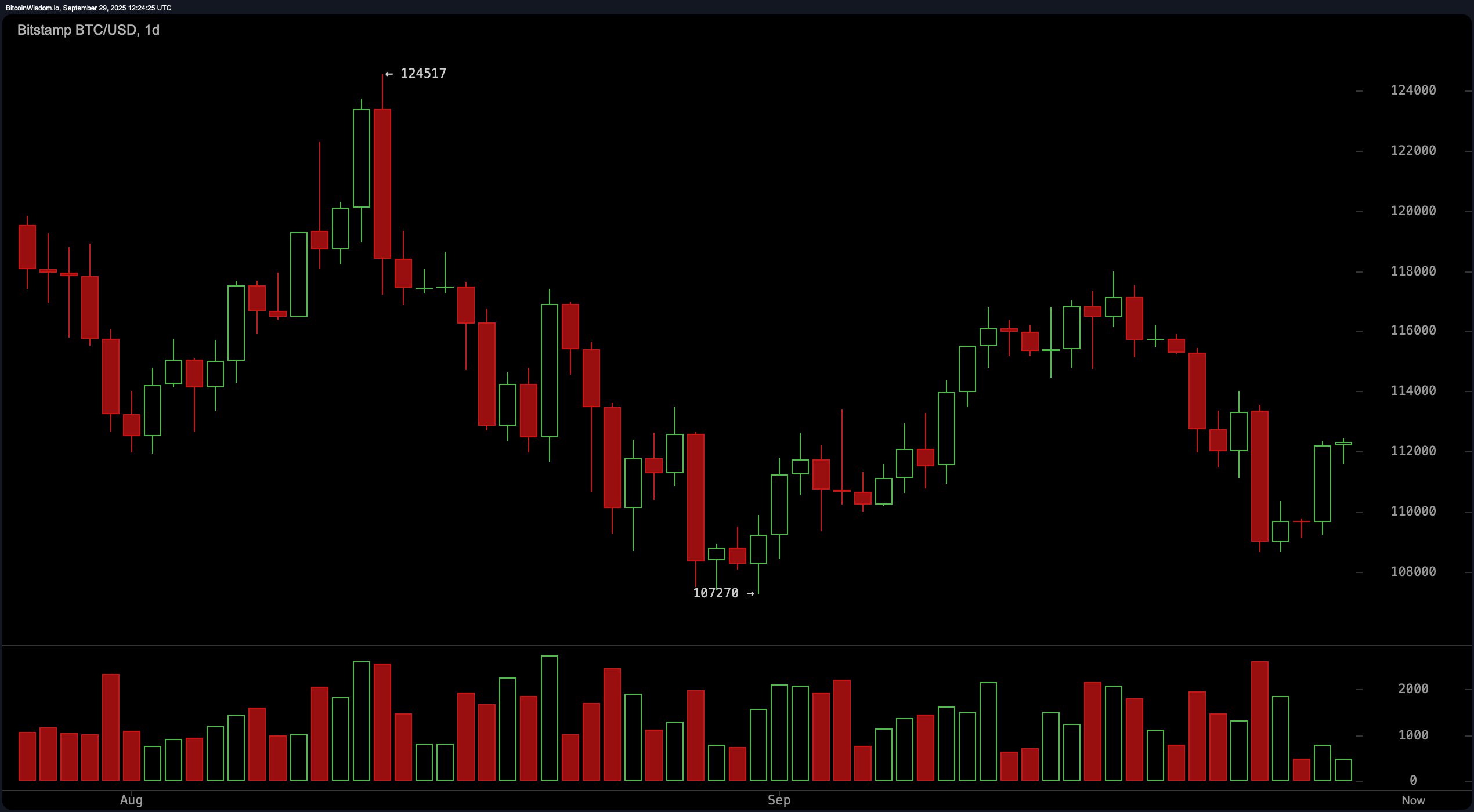

Peer now at the daily chart-our dear protagonist, bitcoin, played the Shakespearean fool in early September, tumbling into the $107,000 abyss with all the grace of a drunken ballet dancer. But lo! A double-bottom formation emerged, as cunning as a fox in a hat shop, signaling a surge worthy of a Hollywood comeback. Green candlesticks, chiseled with brawn and heft, parade bullish swagger, whispering sweet reassurances to the panting crowd of traders.

That alluring long entry in the $110,000-$111,000 nook now dons the badge of legitimacy, though resistance lurks ominously between $117,000 and $118,000-a vip lounge barricaded against mere mortals. This breakout, buoyed by audacious volume, looks poised for a landing smoother than a cat on a windowsill, provided buyers don’t decide on an abrupt disappearing act. 🎩✨

The 4-hour bitcoin saga unfolds like a classic melodrama. After a savage sell-off that plunged the beast to $108,652, it bounced back with vengeance, reclaiming $112,000 as if spurred on by invisible rockets. Think of it: a V-shaped resurrection on steroids, stacking higher lows like a maître d’ stacking pancakes at brunch. An entrée served between $109,000 and $110,500 was gourmet territory; above, $113,500 to $114,000 stands as a buffet of resistance. Should the price get a slap there, expect a polite recess-consolidation in the parlance of our times-but so long as the floor at $108,500 holds, the bulls remain commandeering the chariot. 🐂🚀

Zoom in closer, the 1-hour bitcoin ticker narrates a tale of serene consolidation, nestled between $109,100 and $112,500 like a cat napping in the sun-undisturbed and mildly smug. Then emerged a breakout candle at 18:00 UTC on September 28: a firing starting gun for bulls alike. It blasted through $110,500-$111,000 with such conviction it didn’t even glance back. So long as Bitcoin struts confidently above $112,000, the short-term profit zone lounges in the $112,500-$113,000 suite. Beware, however, the sly glint of bearish divergence in the RSI-RSI being the sort of frenemy that betrays the naive. 🐱👤

Now for the grand theater of indicators-our oscillators staged a diplomatic meet-and-greet, neutral and noncommittal. The RSI languished at a modest 48, Stochastic hovered at 30, and CCI meandered around −58, like sheep at a financial pantomime. Even the usually dramatic ADX languished at a snoozy 17. The Awesome Oscillator yawned with a −1,986 and momentum flashed a cheeky, “Buy the dip!” Meanwhile, MACD, the sulky child in the corner, grumbled “Not yet, fam” at -658. So oscillators sat on the fence, momentum whispered sweet nothings to buyers, and MACD sulked in the shadows.

The moving averages chimed like a family reunion-some toasting the bulls, others clinging to their red flags. The 10-period EMA and SMA wrapped bullish scarves around $112,153 and $112,209 while the 20, 30, and 50-period EMAs and SMAs flashed a quartet of bearish “nahs.” The 100-period EMA offered a glimmer of hope at $111,792, while the venerable 200-period EMAs and SMAs stood robustly bullish at $106,343 and $104,609, like wise elders nodding sagely. In human terms: long-term bulls still wear the crown, but the short-term crowd looks like a party divided, some twirling with hope, others nursing their drinks in quiet suspicion.

In sum, bitcoin pirouettes triumphantly across multiple time frames, cradled by strong volume and dressed in bullish finery. Those hunting for an entry point should eye pullbacks to $110,000-$111,000 with the patience of a cat stalking a laser pointer. Should the floor at $108,500 remain steadfast, this breakout ballet has room to pirouette wildly toward $117,000-$118,000. But beware! The mixed signals from oscillators and moving averages suggest a script with a few well-timed plot twists-perhaps even a comic pratfall or two. 🎭

Bull Verdict:

The bulls have saddled up and are kicking dust, showing no signs of weary retreat. Breakouts glint like polished boots across all timeframes, support stands firm at $108,500, and high-volume rallies prance from recent lows. The momentum hums quietly backstage, while the 200-period moving averages beat the war drum in unison. If bitcoin avoids tripping below $110,000 on light volume, this rodeo might just gallop to the $117,000-$118,000 corral. Yeehaw! 🐂🔥

Bear Verdict:

Hold your horses, pardner. The recent bounce cries of bravado but key moving averages remain a bear chorus singing their cautionary sonnet, while the MACD’s sell signal rumbles like distant thunder. Oscillators prudently wear poker faces – hardly a cheer squad. Should bitcoin stumble beneath $113,500 and curl downward on thinning volume, beware the sneaky bull trap lurking in the shadows. A tumble below $108,500 would shatter this bullish reverie, reawakening the dark specter of sub-$107,000 lows. Cue ominous music. 🐻💤

Read More

- BTC PREDICTION. BTC cryptocurrency

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

- You Won’t Believe What Secretly Predicts Bitcoin’s Next Crash! 😱

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- 🔥Vienna’s Crypto Carnage: Ukrainians Burn Wallets & Souls! 💰💀

2025-09-29 16:58