Ah, the grand theater of finance! Behold, the mighty Bitcoin, that digital phoenix, rises once more from the ashes of its own folly. Amidst the cacophony of collapsing leverages and the wails of ETF outflows, the American investor-ever the optimist, ever the fool-has rekindled their love affair with this volatile mistress. Yes, the Coinbase Premium, that fickle barometer of greed and despair, has turned positive, as if the gods of crypto have smiled upon the land since mid-January. But let us not forget the recent bloodbath, where Bitcoin, like a drunken tightrope walker, plummeted 30%, landing with a thud near $60,000. A free fall, they call it-a poetic term for financial vertigo.

Coinbase Premium: A Tale of Renewed Folly

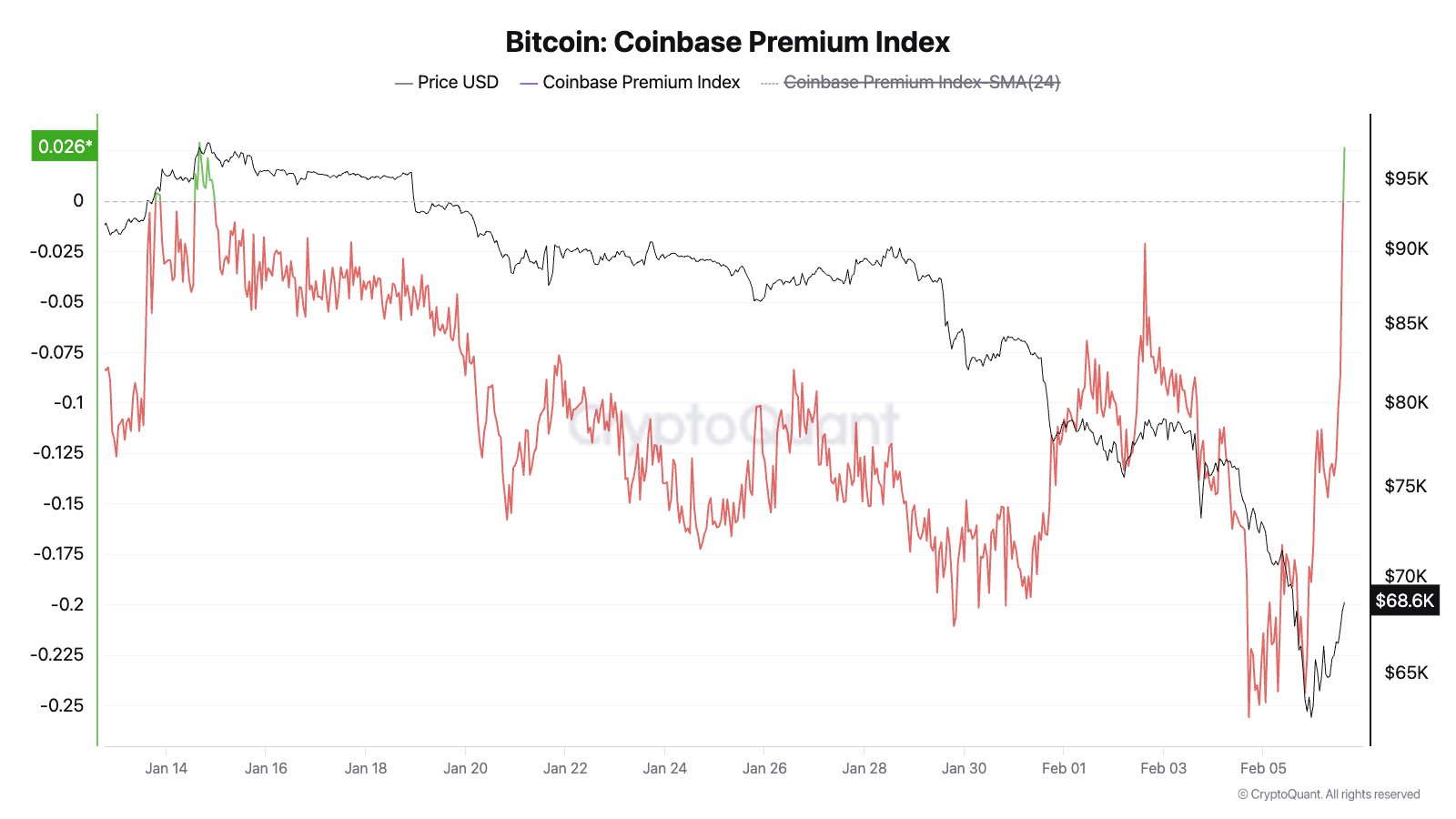

The Coinbase Premium, that sacred oracle of market sentiment, reveals the price disparity between Bitcoin on Coinbase and its brethren on other exchanges. It is, in essence, a mirror reflecting the soul of the American trader-how much more (or less) they are willing to pay for their digital gold compared to the rest of the world. Julio Moreno, the sage of CryptoQuant, declares that since mid-January, this premium has been negative, a testament to the lukewarm embrace of US traders. But lo! Since Bitcoin rebounded from its $60,000 abyss, the Yankees have rediscovered their bravado, and the premium has climbed into positive territory. How fleeting is their memory of pain!

Yet, let us not be swayed by this fleeting optimism. Bitcoin, that tempestuous lover, has climbed a modest 16%, now hovering around $70,000. But a positive Coinbase Premium is no guarantee of a full recovery. No, the gods of macroeconomics-the Federal Reserve with its interest rate dagger and liquidity-tightening noose-loom large. Global sentiment, geopolitical tremors-these are the true arbiters of fate.

Bitcoin’s Odyssey: A Market in Flux

At this hour, Bitcoin trades at $68,892, a 6.44% gain in the past day. Yet, the weekly and monthly charts tell a tale of woe: losses of 17.34% and 23.38%, respectively. The bear still roams these lands. CryptoQuant, that modern Cassandra, warns that Bitcoin remains 50% shy of its all-time high. Past bear markets, they remind us, have seen plunges of 70%-80%. Might this be but a prelude to a deeper abyss? The greater fear, they say, is not the depth of the fall, but the length of the winter. With a market cap of $1.4 trillion, Bitcoin reigns supreme, yet its crown sits uneasily.

Ah, the irony! The largest digital asset in the world, a titan of the crypto realm, yet so fragile, so prone to the whims of the market. Time, they say, is the true captor. How long will this winter last? Only the winds of finance know. Until then, let us watch, let us laugh, let us marvel at the spectacle of it all.

Read More

- BTC PREDICTION. BTC cryptocurrency

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- Bitcoin’s Cosmic Cringe: Why the Crypto World Is Now a Black Hole 🌌💸

- ETH PREDICTION. ETH cryptocurrency

- Ethena’s $106M Token Unlock: Will Aave’s Liquidity Bust or Just a Bad Hair Day? 🤔

- 🔥Vienna’s Crypto Carnage: Ukrainians Burn Wallets & Souls! 💰💀

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

2026-02-07 14:25