Ah, Bitcoin! That digital currency that seems to have the emotional stability of a soap opera character. On-chain analytics firm Checkonchain has recently suggested that this latest dip below $80,000 isn’t just another dramatic twist in the plot-no, it’s actually part of a more drawn-out bear market saga. Grab your popcorn, folks!

Bitcoin: The Price Is Right… or Wrong?

In a recent post on X (formerly known as Twitter, because why not?), Checkonchain pointed out that Bitcoin has tumbled below two critical on-chain cost basis levels. It’s like watching your favorite sports team blow a lead in the last minutes of the game-heartbreaking, yet oddly fascinating.

The first hurdle Bitcoin managed to trip over was the ETF Cost Basis. This is basically the average price at which the US spot ETFs have decided to join the party. Prior to this tumble, Bitcoin had been strutting its stuff above this line since the latter half of 2024. There was a little drama in late 2025 when it almost fell, but it ultimately found a supportive friend in that line. Not this time, though! Down it goes!

Once the ETF Cost Basis was breached, Bitcoin went full-speed ahead and crashed through the True Market Mean-another fancy term for the average buying price of all those enthusiastic BTC investors. And just like that, many active investors found themselves nursing a net unrealized loss. Surprise!

Now, you might think this price plunge would send everyone running for the hills, but Checkonchain has warned that while the market is clearly feeling the pain, we may not have hit rock bottom just yet. “The underlying data suggests this is progression deeper into the bear, not the final capitulation event,” they say. Well, thanks for the pep talk!

Checkonchain also pointed out that, despite some hefty outflows from spot ETFs, it hasn’t quite reached that panic level where people are selling their grandma’s jewelry to escape the crypto apocalypse. Just a regular Tuesday, then!

Moreover, although on-chain losses have been climbing, they haven’t reached that dramatic ‘everyone is bailing’ level typically seen at the end of a cycle. It’s more like a slow burn rather than a raging bonfire.

Futures traders, bless their hearts, still seem to think they can catch the bottom of this rollercoaster ride. Checkonchain referred to the current market conditions as a “regime where durable lows rarely form.” Sounds like a fancy way of saying, “Good luck with that!”

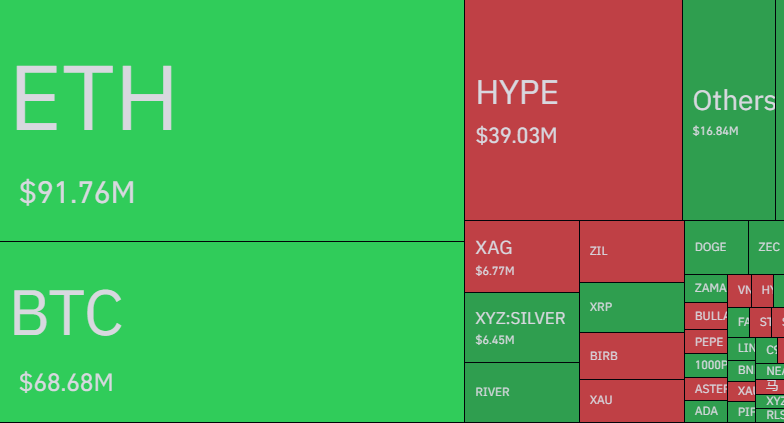

As if things weren’t spicy enough, the futures market has led to some mass liquidations. Just yesterday, long Bitcoin bets worth $50 million were wiped off the map as prices swung from around $79,000 down to under $76,500. Cue the dramatic music!

Overall, the cryptocurrency market has seen a staggering $185 million in long positions flushed away faster than your hopes of winning the lottery. It’s a wild world out there!

BTC Price Update

As I write this, Bitcoin is hovering around $76,100-a perilous 14% drop over the last week. Let’s hope it finds a nice safe place to rest before the next plot twist!

Read More

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- BTC PREDICTION. BTC cryptocurrency

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- 🔥Vienna’s Crypto Carnage: Ukrainians Burn Wallets & Souls! 💰💀

- ETH PREDICTION. ETH cryptocurrency

- Binance Now Fully Approved in Abu Dhabi-What This Means for Crypto!

2026-02-04 13:56