Oh, Bitcoin. You’re like that moody ex who keeps texting “we need to talk.” After a week of drama (volatility alert: 1.0%), BTC is clinging to $110,000 like it’s the last slice of pizza at a party. And guess what? It’s officially at a make-or-break moment. No pressure, right? 😅

For weeks now, Bitcoin’s been stuck in this weird financial purgatory between $104K and $116K. But here’s the tea: OG whales are dumping their BTC faster than you can say “Ethereum.” ETH, with its shiny $4,383 price tag, seems to be the new belle of the blockchain ball. Who knew whales could get FOMO too? 🐳✨

September: The Month Bitcoin Hates Most 🍂

Historically, September has been Bitcoin’s version of Monday morning-just awful. Crypto analyst Benjamin Cowen dropped this gem: Bitcoin tends to hit rock bottom in September during post-halving years. But don’t panic! This dip is often followed by a glorious rebound into Q4. So maybe, just maybe, we’re witnessing the calm before the crypto storm. 🌩️

“Historically, #Bitcoin finds a low in September of the post-halving year, and then bounces off of it into the market cycle top that occurs in Q4.”

– Benjamin Cowen (@intocryptoverse) September 3, 2025

But wait, there’s hope! The Fed might cut rates by 25bps on September 17, injecting liquidity into the market like a caffeine shot for BTC. Glassnode says Bitcoin is chilling in the $104K-$116K range after some serious investor absorption. A move above $116K? Cha-ching! Below $93K? Yikes. Let’s not go there. 😬

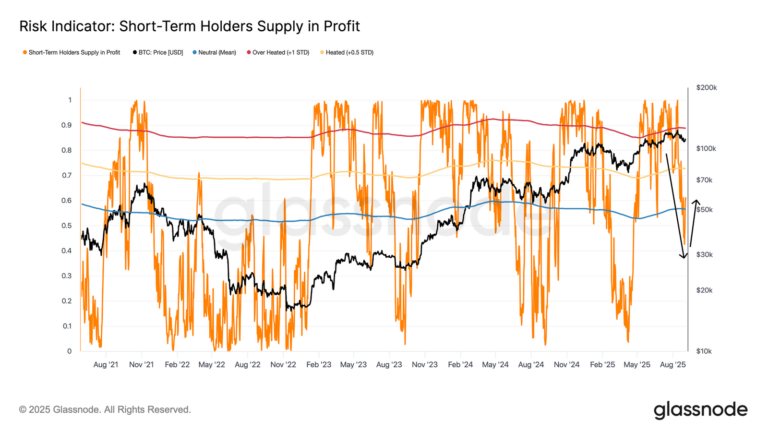

“Only a sustained recovery above $114k-$116k, where over 75% of short-term holder supply would return to profit, could provide the confidence necessary to attract new demand and fuel the next leg higher,” noted Glassnode.

Chart showing Bitcoin short-term holders’ supply in profit. | Source: Glassnode

ETFs Are Meh, Futures Are Meh, Whales Are Over It 🦈

Spot Bitcoin ETF inflows? Negative. Futures traders? Snoozing. Everyone’s sitting on the sidelines like they’re waiting for the season finale of their favorite show. Meanwhile, Satoshi-era whales are cashing out BTC to buy more Ethereum. Talk about a plot twist. 🍿

CryptoQuant points out that regional liquidity-not ETF flows-is calling the shots now. Asian markets start the trends; U.S. markets decide if they stick. It’s like a global game of financial hot potato. 🌏🔥

Enter Bitcoin Hyper (HYPER): The Cool Kid on the Block 🔥

While Bitcoin stumbles through its midlife crisis, Bitcoin Hyper (HYPER) is out here stealing the spotlight. With over $13.7 million raised in its presale, HYPER is tackling Bitcoin’s biggest flaws: slow transactions, high fees, and zero smart contracts. Imagine Layer 2 as Bitcoin’s personal trainer, whipping it into shape with faster, cheaper, and smarter moves. 💪

Bitcoin Hyper (HYPER) Token Snapshot

- Ticker: HYPER

- Presale Price: $0.012855

- Funds Raised: $13.79 million

And here’s the kicker: staking HYPER tokens gives you up to 79% APY. Yes, you read that right. Early investors are jumping in while the price is still a bargain. It’s like getting front-row tickets to the crypto concert of the year. 🎤🎸

So, will Bitcoin rise from the ashes or take a nosedive? Will HYPER save the day? Only time will tell. But one thing’s for sure: the crypto world is never boring. Cheers to that! 🥂🎉

Read More

- BTC PREDICTION. BTC cryptocurrency

- Bitcoin’s Cosmic Cringe: Why the Crypto World Is Now a Black Hole 🌌💸

- Ethereum Whale’s Bold $280M Short: Is the Market on a Cliff or Just a Cliffhanger? 🤔

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- You Won’t Believe What Secretly Predicts Bitcoin’s Next Crash! 😱

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- Upbit’s Wild Goose Chase: $1.77M Frozen, Hackers on the Run 🕵️♂️💰

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- Litecoin’s Wild Ride: $131 or Bust? 🚀💰

- 🔥Vienna’s Crypto Carnage: Ukrainians Burn Wallets & Souls! 💰💀

2025-09-04 17:57