Oh, Bitcoin, you saucy minx! After a morning of flirting with the financial dungeon below $88k, you decided to climb out, dust yourself off, and strut all the way up to $91,767. And let me tell you, it wasn’t just a casual rebound-it was a full-blown liquidation party 🎉, complete with deep-pocketed buyers handing out pink slips to shorts like they were going out of style.

Heavy Buyers Reappear (Like That Ex You Thought Was Gone)

Bitcoin’s weekend swing didn’t just arrive-it sashayed in with steel-toed boots, stomping on leveraged traders like they were ants at a picnic. After teasing us with a dip toward $87k, it snapped back harder than a rubber band in a middle school classroom. Green candles? More like green fireworks 🎆, signaling that the big boys were done watching this circus from the sidelines.

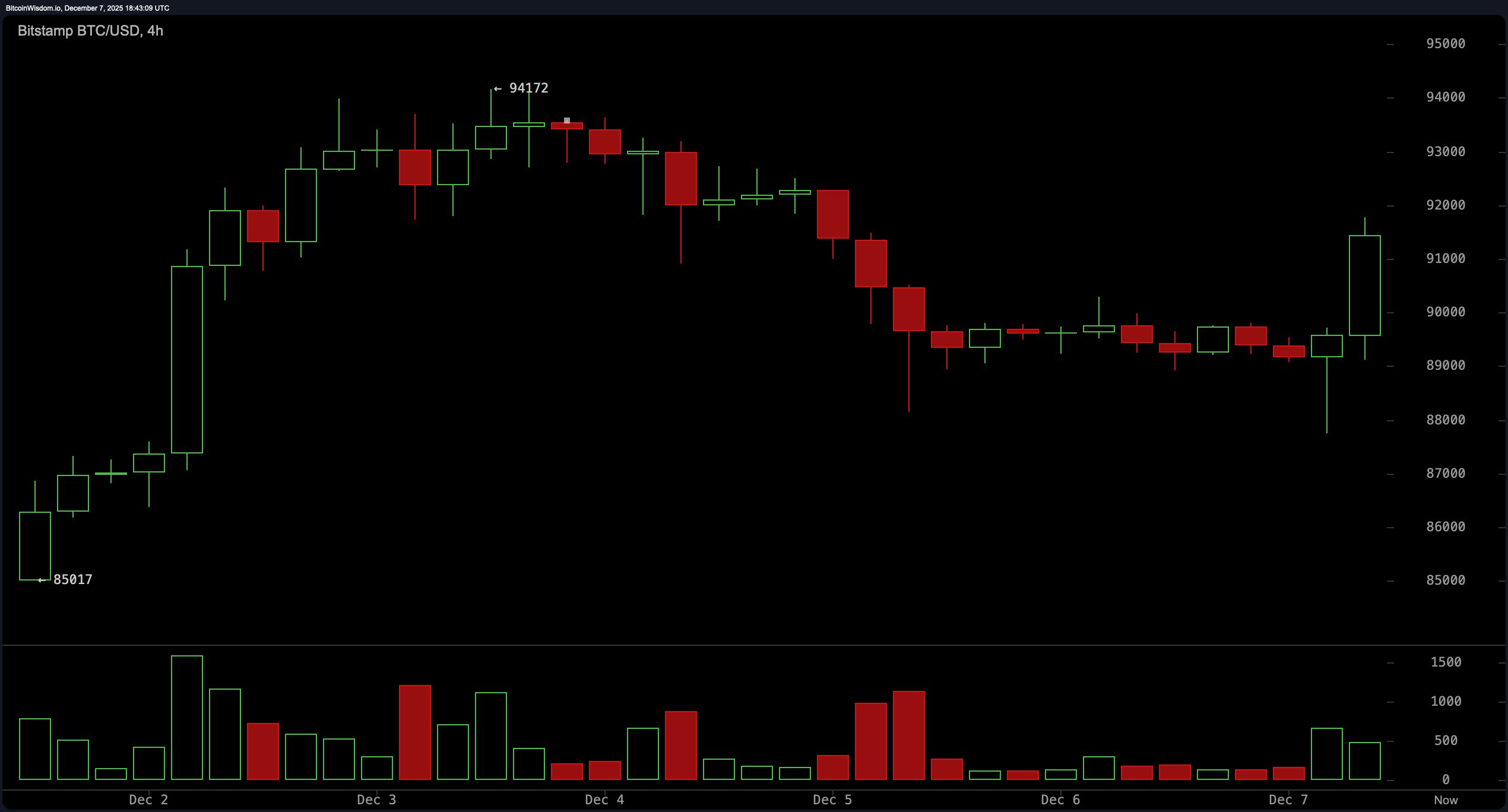

The 1-hour chart? Oh, it was chef’s kiss. A deep wick into $87,744, followed by buying pressure so fierce it turned the candles greener than a vegan’s smoothie. This wasn’t your grandma’s retail enthusiasm-this was a coordinated “we’re taking back control” moment. And the 4-hour chart? A thunderclap of a green candle, so loud it probably woke up the neighbors. Shorts? They’re fine. Just kidding-they’re not fine. 😅

Earlier in the week, Bitcoin hit a low near $80,537, but then-plot twist!-the whales showed up, sniffing out discounted BTC like it was a Black Friday sale. The rebound was as sharp as a paper cut, with green candles so thick you could practically lean on them. Someone with influence decided prices had gone too far, and well, here we are. 🤑

And then came the tears. According to Coinglass.com, $348.32 million in leveraged positions got erased in 24 hours. Longs? $229.46 million gone. Shorts? $118.86 million. ETH led the carnage with $135.14 million in liquidations, while Bitcoin added $78.48 million to the global sob fest. The biggest ouch? A $17.81 million ETH-USD position on Hyperliquid. Ouch. 😬

Across 122,572 liquidated traders, the lesson is clear: overconfidence is a great way to lose your lunch money. Shorts thought they had it in the bag, but the whales turned the market into a squeeze machine, and well, here we are. 🤡

This wasn’t just a bounce-it was a power move. Big buyers (possibly institutional, but who’s keeping track?) reclaimed the narrative, kicked out the crowded positions, and sent Bitcoin marching back toward $90k. Leveraged traders? They’re probably still picking up the pieces of their shattered accounts. 🧹

The real question now: Does this upswing have the stamina to stick around? After the messy unwind from $126k, holders are crossing everything-fingers, toes, eyes-hoping this momentum doesn’t fizzle out. 🕯️

FAQ ❓

- Why did Bitcoin bounce so sharply?

Big buyers absorbed sell pressure near support, triggering a fast reversal. Basically, they said, “Not today, Satan.” 😈 - What caused the massive liquidations?

Shorts got too cocky, and Bitcoin said, “Hold my beer.” 🍻 - Which crypto saw the most liquidations?

ETH, with over $135 million in liquidations. Poor ETH-always the drama queen. 👑 - How much was liquidated in total?

Roughly $348 million. That’s a lot of avocado toasts. 🥑

Read More

- Gold Rate Forecast

- EUR USD PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- Brent Oil Forecast

- Silver Rate Forecast

- USD MYR PREDICTION

- Bitcoin’s Downfall: Two Scenarios That’ll Make You Scream 😱

- EUR RUB PREDICTION

- CNY JPY PREDICTION

- USD KZT PREDICTION

2025-12-07 23:08