Bitgo, that quiet custodian of digital holdings and the hopes of auditors, has endured only three and a half days on the NYSE stage since last Thursday. In that span, the shares have slipped by about 18 percent, as if the market itself were sighing over a dull harvest and a weak joke.

BTGO Shares Tumble Lower Than Debut Price

Bitgo, founded roughly fourteen years ago, has built its reputation on fortress-like security, custody, and the quiet machinery that keeps cryptocurrencies from mischief. It oversees about $104 billion in assets under management and only lately took a seat on the NYSE, as one might attend a provincial play to see if the actors remember their lines.

The start has been tremulous for BTGO, set against an orchestra of uncertain economies, geopolitical rustlings, and whispers that the crypto market may be slipping into a bear’s pocket. Even with a portfolio of services, publicly traded crypto firms are often tied to Bitcoin’s seasonal whispers, though the yarn does not bind every tale.

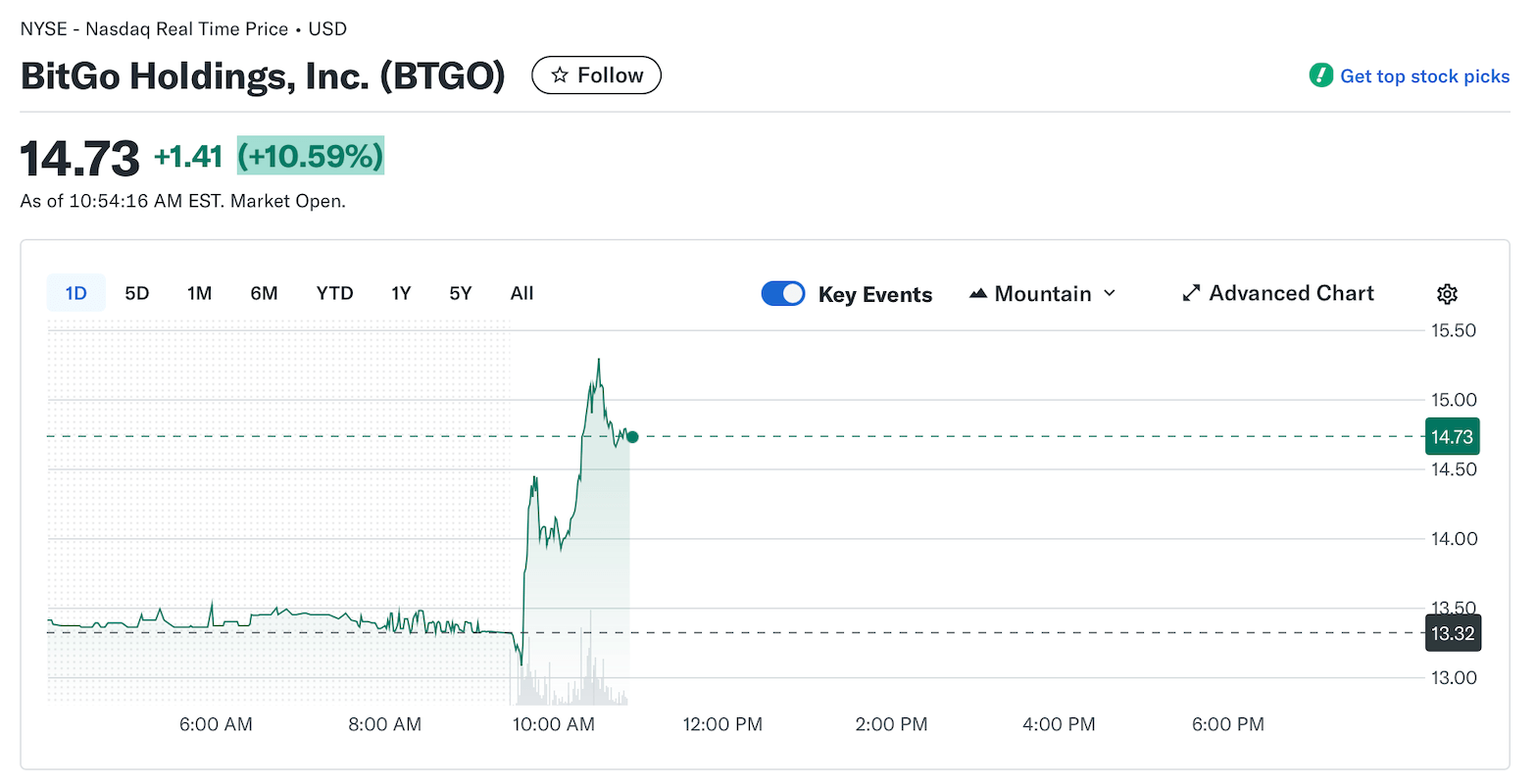

BTGO began trading on the NYSE on Jan. 22, opening at $18 per share before climbing to an intraday high of $23.85. By Monday’s close, Bitgo’s stock hovered about 26% below that crest at $13.32. Today, BTGO’s latest uptick in the afternoon light has softened that blow. While BTGO occupies a distinct corner of the industry, other crypto-linked names-Circle’s CRCL and Bullish’s BLSH-have wandered on their own peculiar paths.

Circle raised $1.1 billion through the sale of 34 million shares priced at $31, with shares opening at $69. As of today, CRCL sits modestly above that level at $70.90. Crypto exchange Bullish raised $1.1 billion by selling 30 million BLSH shares at $37, opening NYSE trading at $90-more than double its IPO price.

BLSH now trades around $35.66 per share. Despite the early wobble, Abra Global CEO and founder Bill Barhydt wrote on X that “Bitgo looks ridiculously undervalued to me right now.” Yahoo Finance’s Simply Wall St echoed a similar sentiment, noting Bitgo’s valuation checks score it as undervalued, 3 out of 6.

This week, Bitgo CEO Mike Belshe also posted on X, weighing in on the recent siphoning of crypto assets from U.S. government-seized wallets and noting that his firm has specialized expertise in handling such matters compared with outside contractors. “Government procurement often favors small business contractors run by insiders over the companies actually building the industry’s security standards,” Belshe said.

He added:

“We’ve warned for years that prioritizing bid-writing over battle-tested digital asset security experience would lead to this. A $40M hard lesson in why experience matters.”

FAQ ❓

- Why did Bitgo shares fall after the NYSE debut?

BTGO declined about 18% amid early post-IPO volatility, macro uncertainty, and cautious sentiment toward crypto-linked stocks. - When did Bitgo start trading on the New York Stock Exchange?

Bitgo began trading on Jan. 22, opening at $18 and briefly reaching $23.85. - How much does Bitgo manage in assets under management?

The firm oversees roughly $104 billion in assets under management, tied to institutional crypto custody and security services. - What are analysts saying about BTGO’s valuation?

Some market watchers argue the stock appears undervalued despite the early pullback, citing valuation models and long-term fundamentals.

Read More

- EUR USD PREDICTION

- GBP CNY PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- STX PREDICTION. STX cryptocurrency

- Gold Rate Forecast

- CNY JPY PREDICTION

- USD MYR PREDICTION

- WLD PREDICTION. WLD cryptocurrency

- DOGE PREDICTION. DOGE cryptocurrency

- EUR RUB PREDICTION

2026-01-27 20:37