Well, well, well, look who’s swooping in for the kill! Bitmine Immersion Technologies decided to snatch up a staggering 128,718 ETH, worth a jaw-dropping $480 million, right after the market took a nosedive on October 10-11, 2025. Panic buying? Oh no, darling, this was pure strategy. One of the biggest institutional players in crypto, helmed by none other than Fundstrat’s very own Tom Lee, decided it was time to buy low while everyone else was clutching their pearls.

What Triggered the Crash

Ah, the plot thickens. Enter President Trump with a stunning announcement: a 100% tariff on Chinese imports starting November 1, 2025. Cue global market chaos! The tariffs were a response to China’s export restrictions on rare earth minerals-materials that are, quite frankly, indispensable for anything from smartphones to electric vehicles. The crypto market crumbled faster than a badly made soufflé. Bitcoin dropped 13%, while Ethereum-oh dear-plummeted a whole 20%. And just when you thought it couldn’t get worse, $19 billion in leveraged positions were wiped out in just 24 hours. Take that, March 2020 COVID crash!

More than 1.5 million traders were left holding the bag, with $8 billion of those losses coming from traders who thought prices were going up. Oops.

Bitmine’s Bold Move

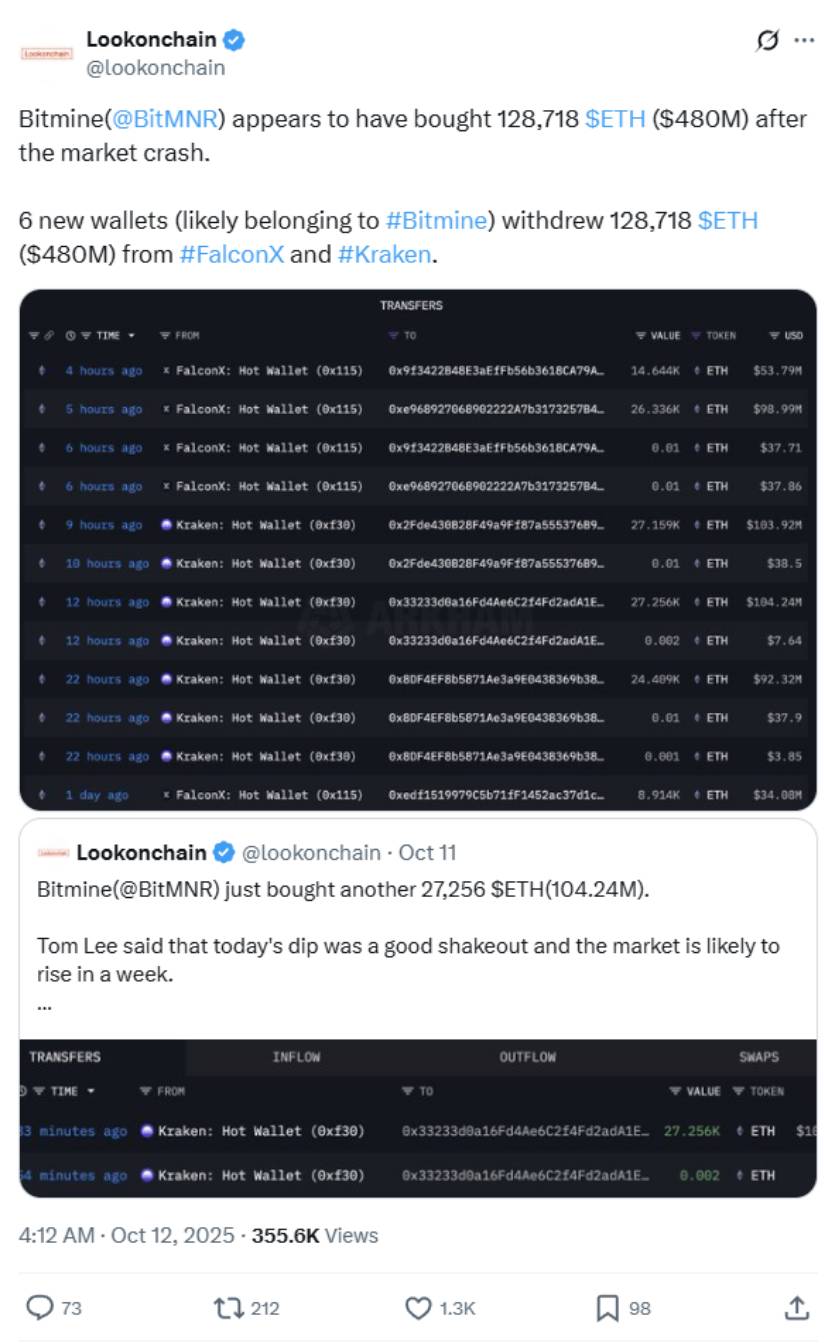

Now, here’s where Bitmine’s brilliance comes into play. According to blockchain analytics firm Lookonchain (bless them), Bitmine wasted no time-pulling over 128,000 ETH from major exchanges FalconX and Kraken using six freshly minted wallets. The blockchain records confirm this thrilling transfer of wealth occurred right when the market hit rock bottom.

And here’s the kicker: Bitmine bought Ethereum at prices as low as $3,728. That’s a deal, sweetheart, compared to the $4,500+ levels just days before. All while the other traders were practically tripping over themselves to get out of the door.

With this move, Bitmine’s Ethereum holdings reached a dazzling 2.96 million ETH-nearly 2.5% of all Ethereum in existence. That makes them the biggest corporate Ethereum holder in the world, and the second-biggest crypto treasury overall (right behind MicroStrategy’s Bitcoin stash). Not bad for a day’s work!

A Week of Heavy Buying

Oh, and the 128,718 ETH purchase? That wasn’t Bitmine’s only shopping spree that week. No, darling, they were on a roll! Earlier in the week, they grabbed another 179,251 ETH worth a cool $820 million, followed by 27,256 ETH valued at $104 million. In total, Bitmine spent over $1.4 billion on Ethereum in just seven days. Talk about making it rain!

By October 6, the company already held 2.83 million ETH, worth a grand total of $13.4 billion. Their endgame? To control 5% of all Ethereum, or about 6 million tokens. Tom Lee has dubbed this the “alchemy of 5%” strategy. Oh, how quaint!

Why Buy During a Crash?

You might wonder, why on Earth would they buy during a crash? Well, darling, when you’ve got deep pockets and major institutional backing (Cathie Wood’s ARK Invest, Peter Thiel’s Founders Fund, Pantera Capital, and Galaxy Digital, anyone?), you can afford to take a little risk. Besides, Bitmine isn’t just holding Ethereum-they’re staking it and earning between 3% and 5% annually from validator nodes. So while they’re raking in the crypto, they’re also supporting the Ethereum network’s security. Smart, right?

Even though Bitmine faced over $2 billion in unrealized losses from September’s market drop, they kept on buying. Tom Lee called the crash a “healthy shakeout” and predicted Ethereum could bounce back to $4,500-$5,000 by year’s end. One can only hope!

Other Whales Join the Hunt

Of course, Bitmine wasn’t the only one snapping up Ethereum during the crash. Other large investors were also making moves. One particularly massive over-the-counter whale bought up 14,165 ETH worth $55.5 million across multiple exchanges. Even Chainlink holders got in on the action, increasing their positions by 22.45%. All while prices were down. It’s almost as though institutional investors see market crashes as a chance to stock up, rather than flee the scene. Go figure.

The Bigger Picture

Bitmine’s stock trades on the NYSE under ticker BMNR and is among the most actively traded stocks in the U.S., averaging a daily trading volume of $2.5 billion. It’s ranked number 28-just behind JPMorgan and ahead of Nike. Not too shabby for a crypto player, eh?

Not everyone’s thrilled, though. Investment firm Kerrisdale Capital has bet against Bitmine, calling its business model unsustainable. They argue that Bitmine is diluting existing shareholders by issuing shares too quickly to buy Ethereum. But those in the Bitmine camp point to its strong institutional backing and Ethereum’s growing adoption as signs that the company’s on the right track.

When Lightning Strikes Twice

The October 2025 crash will be remembered as the biggest liquidation event in crypto history. But it also highlighted a clear divide: retail traders panicked and lost billions, while institutional players like Bitmine saw opportunity and grabbed it with both hands. Time will tell if Bitmine’s $480 million bet pays off, but for now, they’re clearly on a mission: accumulate during chaos, stake for yield, and bet on blockchain’s future. With nearly 3 million ETH in their treasury and ambitious plans to reach 5% of total supply, Bitmine isn’t just buying the dip-they’re taking control of Ethereum’s future. 🤑

Read More

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- BTC PREDICTION. BTC cryptocurrency

- EUR USD PREDICTION

- 🐳 XRP Whales Splash Cash: Is the Tide Turning? 🌊

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

- Bitcoin’s Cosmic Cringe: Why the Crypto World Is Now a Black Hole 🌌💸

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

2025-10-13 02:30