Bitcoin and Ether exchange-traded funds (ETFs) ended last week as if they had just discovered an intergalactic treasure chest, hoovering up a combined $865 million in fresh capital. Bitcoin logged its third consecutive inflow day, while Ether somehow managed to stretch its winning streak to four-presumably by bribing the universe with cookies 🍪.

Institutional Demand Soars As BTC ETFs Pull $404 Million, ETH ETFs Hit $461 Million

The past week concluded with all the subtlety of a supernova in the crypto ETF market, as institutional money flowed in at speeds that would make even a caffeinated cheetah jealous 🐆. Both Bitcoin and Ether funds wrapped up Friday, August 8, glowing greener than a Martian’s favorite smoothie 💚, signaling momentum that might carry into this week-or at least until someone trips over the power cord.

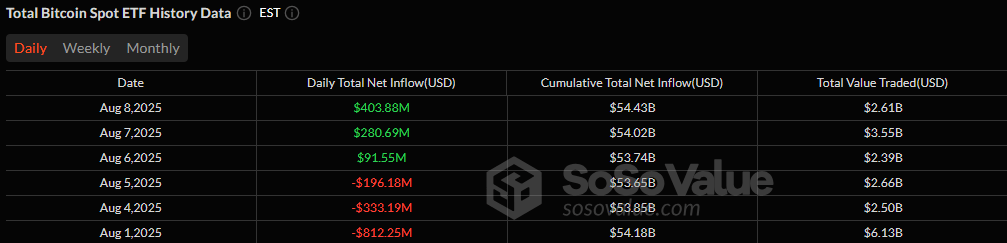

Bitcoin ETFs raked in $403.88 million, marking their third straight positive session. Blackrock’s IBIT took center stage like a diva at an opera, pulling in $359.98 million-that’s 88% of the total, which is either impressive or slightly terrifying depending on how you look at it. Fidelity’s FBTC chipped in $30.49 million, and Grayscale’s Bitcoin Mini Trust added $13.41 million. Notably absent? Any outflows whatsoever. Trading volume hit $2.61 billion, with net assets stubbornly clinging to $150.70 billion like a koala on a eucalyptus tree 🐨.

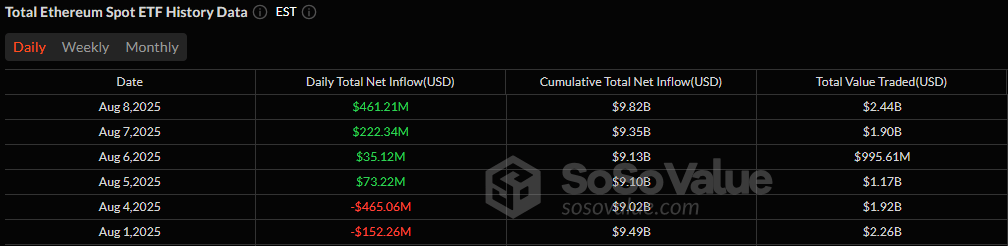

Ether ETFs decided not to be outdone and instead went full peacock mode, strutting their stuff with a whopping $461.21 million inflow-their fourth consecutive green day. Blackrock’s ETHA led the parade with $254.73 million, followed closely by Fidelity’s FETH at $132.35 million. If this were a race, everyone else would have been left eating dust 🏃♂️💨.

Grayscale’s Ether Mini Trust contributed $38.25 million, ETHE pulled in $26.84 million, Bitwise’s ETHW added $7.83 million, and Invesco’s QETH rounded things off with $1.22 million. Again, no exits were recorded, because apparently no one wanted to leave this party early. Trading volume skyrocketed to $2.44 billion, and net assets climbed to a record $23.38 billion-probably enough to buy several small planets 🌍🪐.

With Bitcoin extending its rebound and Ether ETFs breaking records faster than a toddler breaks toys, the week’s close paints a picture of institutional conviction so strong you’d think they’d invented indestructible glue. Whether this bullish setup will last or collapse under the weight of its own absurdity remains to be seen-but hey, isn’t that always the question? 🤷♂️✨

Read More

- EUR USD PREDICTION

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- BTC PREDICTION. BTC cryptocurrency

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- 🐳 XRP Whales Splash Cash: Is the Tide Turning? 🌊

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- 🔥Vienna’s Crypto Carnage: Ukrainians Burn Wallets & Souls! 💰💀

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- Cardano’s Melancholy Ballet: Death Cross Dances as Markets Pause for Dramatic Effect

2025-08-11 23:28