Behold, the alchemy of capital! Of the $4.5B swirling in the crypto ether, $3.2B cascaded into Bitcoin ETFs – a deluge that would make a Tunguska meteor weep. Second only to November 2024’s $3.37B peak, this is no mere drizzle. It’s a monsoon of institutional greed and retail folly. 🌧️💸

ETF trading volumes? A staggering $26B, as if Wall Street had discovered a new religion. BlackRock’s iShares Bitcoin Trust, the undisputed czar of this financial ballet, siphoned $1.78B. Fidelity’s FBTC, Ark 21Shares, and Bitwise followed like peasants in the shadow of a tsar. A spectacle, no? 🎭

These inflows, my dear reader, are not mere numbers. They are the heralds of a new epoch – one where Bitcoin, the digital gold, dons the crown of institutional legitimacy. The ecosystem thrives, and with it, the likes of Bitcoin Hyper ($HYPER), a Layer-2 marvel, dares to ride this gilded tide. 🐉

Billions Flood into Bitcoin ETFs: The Institutional Liquidity Shock Powering BTC’s $125K Breakout

So why do ETF inflows stir the markets more than ordinary trading flows? Ah, let us not forget the alchemy of ETFs – they transmute institutional and retail capital into regulated, pooled investment vehicles. It’s like turning lead into gold, but with more spreadsheets. 📊

Secondly, these creation/redemption flows hoard Bitcoin like a miser in a garret. Less BTC available to sell? The market tightens, prices rise. A clever game of supply and demand, played with billions and a side of hubris. 🎲

And let us not overlook the traders and algos, those modern-day soothsayers, who watch ETF inflows like vultures at a feast. Significant inflows trigger momentum strategies, options hedging, and market-making flows – a symphony of greed and fear. 🎻

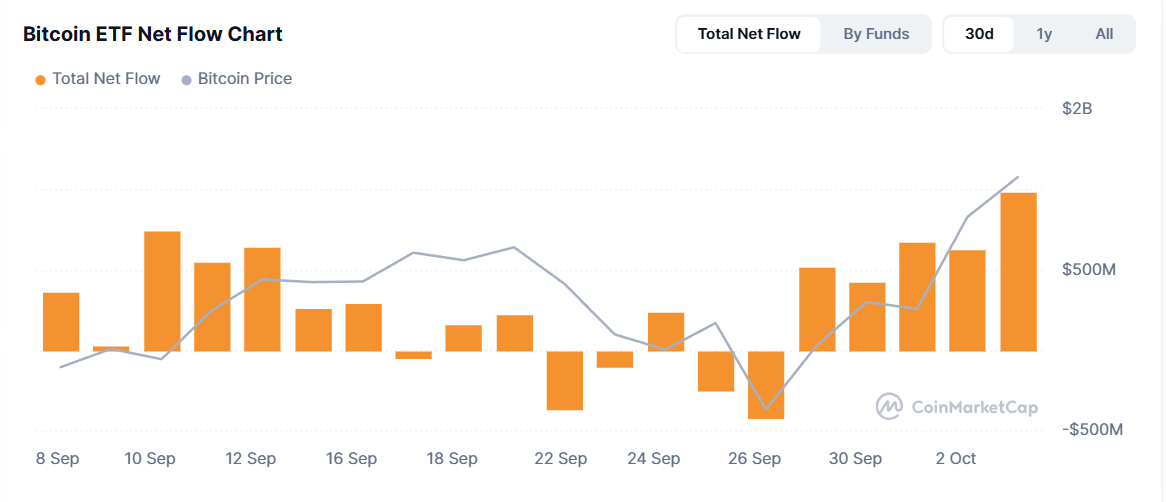

In late September, the inflows V-shaped back with a vengeance, marking a shift from outflows to buying frenzies. This “Uptober” effect? A phoenix rising from the ashes of October’s usual doldrums. 🔥

Indeed, corporate treasuries, asset managers, and wealthy family offices now waltz toward ETFs as a more accessible gateway to crypto. Tax/treatment clarifications? A cherry on top, encouraging on-balance-sheet holdings. 🍰

Psychologically, a new ATH legitimizes allocation decisions. It’s the financial equivalent of a coronation – attention, capital, and a touch of madness. 🤡

This momentum has electrified the crypto realm, and Bitcoin Hyper ($HYPER) now gleams as a prime beneficiary. A diamond in the rough, or perhaps just a glittering scam? You decide. ✨

Bitcoin Hyper ($HYPER): The High-Speed Layer-2 Poised to Dominate the Post-ETF Era

Bitcoin, the 58.5% titan, still rules – but its slow transactions, high fees, and 1 MB block limit are the Achilles’ heel of a digital Icarus. 🕊️

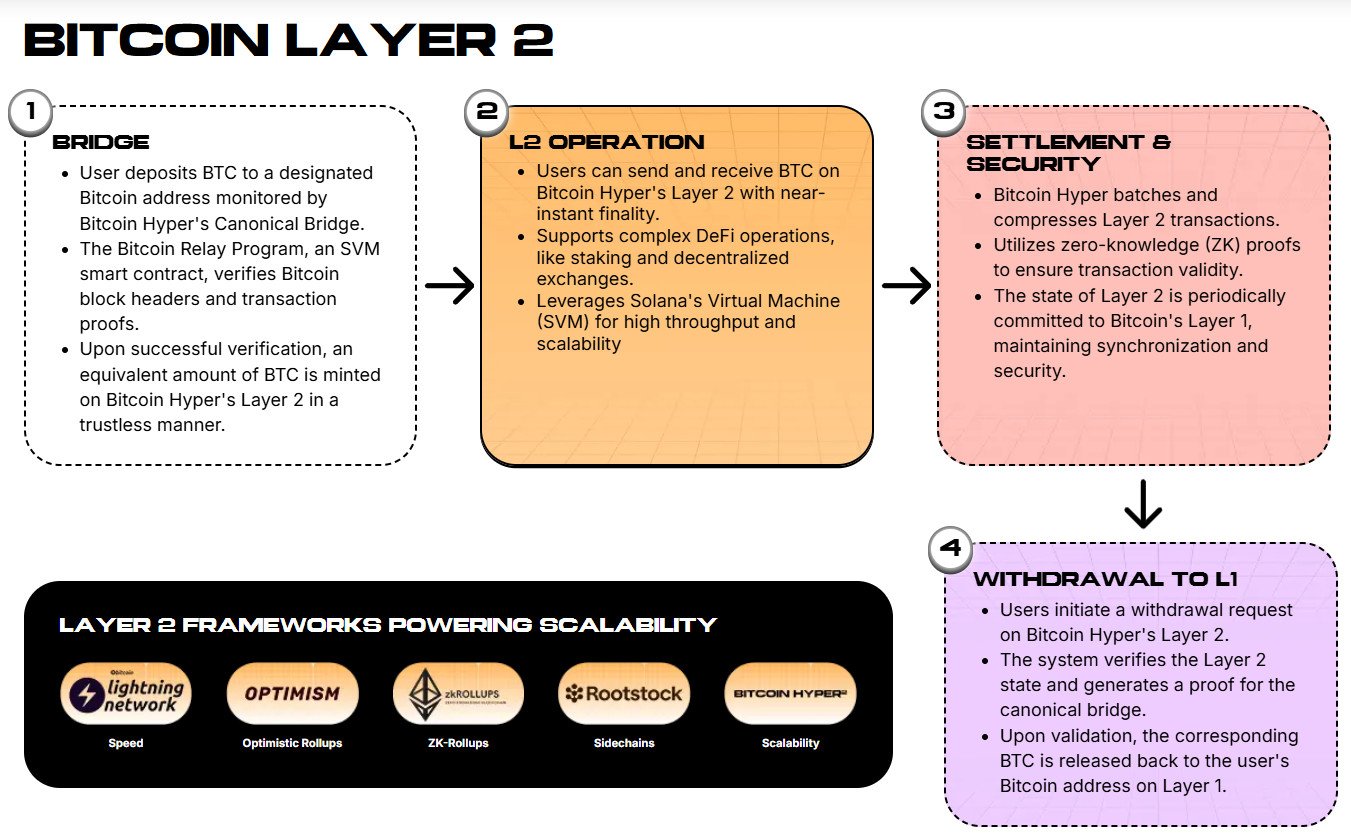

Enter Bitcoin Hyper ($HYPER), a Layer-2 solution built on Bitcoin’s bedrock, powered by the Solana Virtual Machine (SVM). It’s Bitcoin as the monetary base, Hyper as the execution layer – a digital Promethean spark. 🔥

With SVM’s Solana-level performance and cross-chain support for $BTC, $ETH, and $SOL, Hyper unlocks DeFi, DAOs, and micro-payments. A revolution in the making, or a bridge to nowhere? 🌉

The project has raised $21.6M in presale, with whales so voracious they could out-eat a Siberian tiger. This week alone, they devoured $196.6K, $145K, $56.9K, $29.8K, $11.8K, and $10.4K – a total of $450.5K. A feeding frenzy, if you will. 🦈

At $0.013065 per $HYPER, staking rewards offer a 55% APY. A peasant’s dream of a serf’s harvest, but one that tapers as more join the pool. Act now, lest you miss the boat – or the rocket. 🚀

Secure your tokens today from the $HYPER presale website. Before the ship sails, the rocket launches, or the emperor’s new clothes are revealed. 👑

Read More

- BTC PREDICTION. BTC cryptocurrency

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

- You Won’t Believe What Secretly Predicts Bitcoin’s Next Crash! 😱

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- Meet Vector: The Blockchain That Tosses Finality Speeds Out the Window! 🚀

- Ethereum Whale’s Bold $280M Short: Is the Market on a Cliff or Just a Cliffhanger? 🤔

- 🔥Vienna’s Crypto Carnage: Ukrainians Burn Wallets & Souls! 💰💀

2025-10-06 09:49