Right. So, the US Department of Justice has… acquired… 127,195 Bitcoins. Apparently, it’s linked to a Cambodian “pig butchering” scam run by someone named Chen Zhi. Honestly, the names these people come up with. “Pig butchering.” It sounds like a particularly unpleasant culinary pursuit. 🐷 The value? Oh, only around $15 billion. A mere trifle. This, they tell us, is the largest forfeiture in DOJ history. Which just goes to show how much money is sloshing around in the digital ether, doesn’t it?

The indictment against Mr. Zhi, unsealed in Brooklyn – naturally – reveals a positively fiendishly complex international fraud. Thousands of victims, sophisticated scams, shell companies… it’s like a particularly irritating episode of a detective show, only with more cryptocurrency and significantly less charming investigators. They laundered billions, you see. Billions. One wonders what they were planning to *do* with all that money. Fund a particularly ambitious collection of garden gnomes, perhaps?

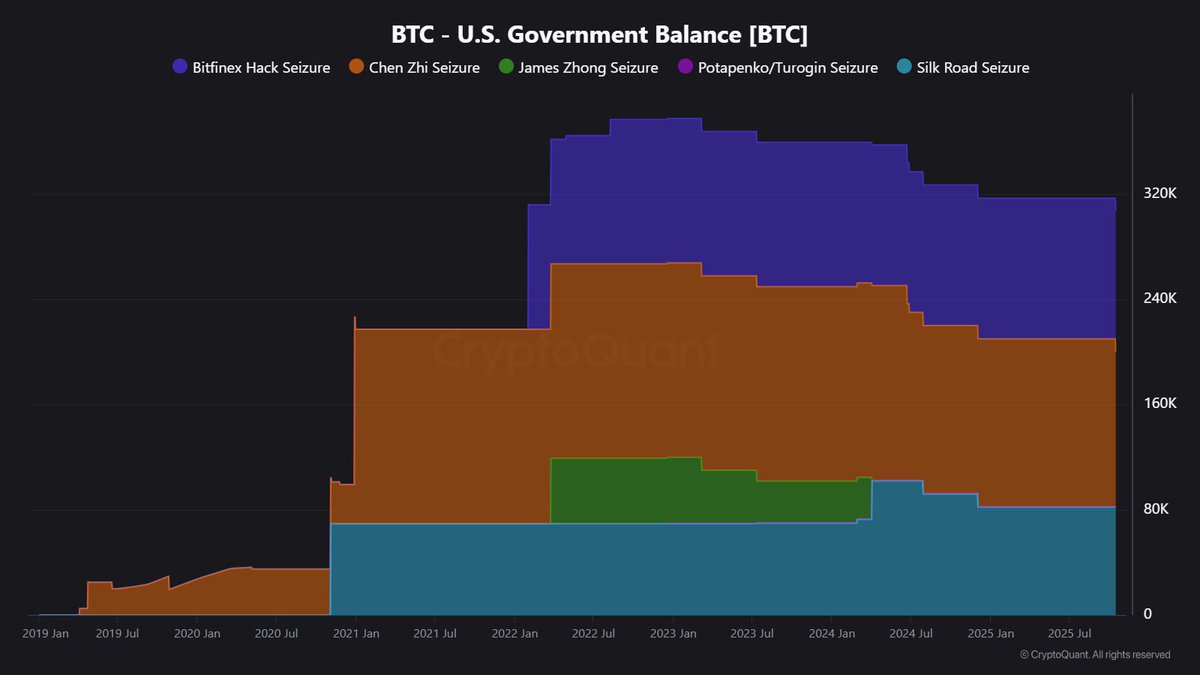

And this isn’t a one-off. Oh no. The US government already had a rather substantial Bitcoin stash from previous “enforcement actions.” Silk Road, Bitfinex, various other shadowy dealings… It now totals over 316,000 BTC. Nearly $36 billion! Which makes the US government one of the largest Bitcoin holders *on the planet*. It’s rather ironic, isn’t it? The champions of financial regulation becoming major players in the very market they’re supposedly regulating. 🤨

The Government’s Growing Digital Treasure Chest

CryptoQuant reports the government now owns 316,760 BTC-roughly $35.9 billion. The Chen Zhi haul (currently $13.2 billion-a truly staggering amount, when you stop and think about it), is the largest single Bitcoin seizure *ever*. At the peak of the Bitcoin madness earlier this year, that same pile of digital gold would have been worth a completely preposterous $15.5 billion. Imagine trying to explain *that* to your accountant.

Let’s break down this national digital reserve, shall we? It’s an impressive collection, built not on astute investment, but on… well, catching criminals. A truly singular achievement.

- Bitfinex Hack (2016) – 106,910 BTC recovered from individuals who, apparently, needed a lesson in discreet money laundering.

- Silk Road (2013) – 81,988 BTC from the dark web. A lovely little earner for the government, that.

- Potapenko/Turogin (2022) – A more modest 667 BTC. Still, every little helps, doesn’t it?

So there you have it. The United States of America: unlikely Bitcoin whale. Acquired not by genius, but by unrelenting pursuit of those who seemingly specialize in finding increasingly elaborate ways to part people from their money. It’s a bit… unsettling, really. 🤔

Bitcoin’s Current State of Mild Uncertainty

As for the Bitcoin itself, it’s currently bobbing around $111,142. Apparently, it’s “showing signs of stabilization” after a dramatic dip. It found some “support” near $110,000. Support. As if a number on a screen can actually *hold* something up. It is, as they say, a battleground. A battleground between those cautiously optimistic about future gains, and those eager to snatch up bargains. A very digital battleground, fought with keystrokes and algorithms.

It’s below all the moving averages (50-day, 100-day, and especially the ominous 200-day one). Traders, it seems, are waiting for something… anything… to give them a clue as to what’s going to happen next. Macro data, ETF flows, on-chain signals… Really, they’ll clutch at anything. The whole thing is, truthfully, a bit of a mess. But then again, what isn’t?

Read More

- BTC PREDICTION. BTC cryptocurrency

- EUR USD PREDICTION

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- 🐳 XRP Whales Splash Cash: Is the Tide Turning? 🌊

- 🔥Vienna’s Crypto Carnage: Ukrainians Burn Wallets & Souls! 💰💀

- Gold Rate Forecast

- Shocking Rally Ahead for NIGHT Token: Analyst Predicts 4x Surge to $0.20!

- Bitcoin’s Cosmic Cringe: Why the Crypto World Is Now a Black Hole 🌌💸

2025-10-17 05:21