Bitcoin (BTC), that most capricious of financial acrobats, has once again leapt upon the shoulders of its sycophantic acolytes, reclaiming the $115,000 mark like a Victorian dilettante rediscovering his monocle after a week of questionable decisions. Bulls, armed with spreadsheets and delusions of grandeur, now attempt to muster the energy for a bullish crescendo, as if the market were a recalcitrant poodle that might suddenly leap through hoops if bribed with enough liquidity.

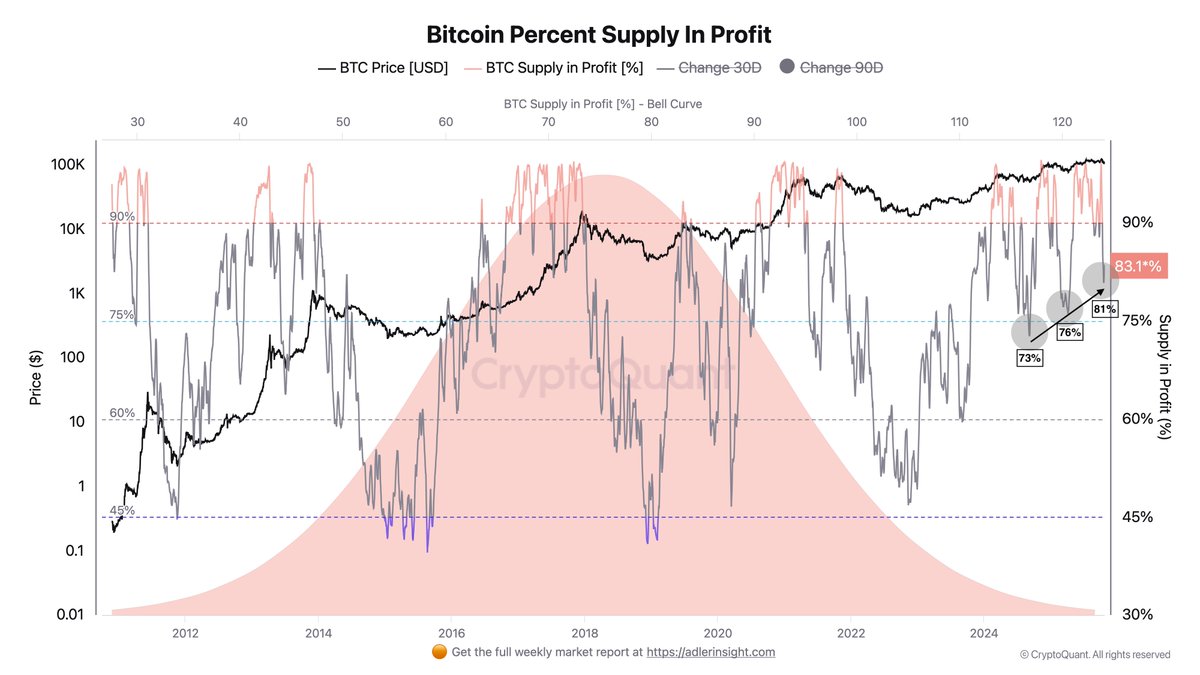

On-chain data, that most reliable of diviners, reveals a pattern as clear as a foggy London morning: when Bitcoin’s supply in profit exceeds 95%, the market enters a feverish state akin to a dinner party where everyone insists on clinking their glasses at once. Such euphoria, of course, is always followed by a correction-nature’s way of reminding us that gravity applies to portfolios as well as physics.

The consistent bottoming zones at 75% supply in profit are, in retrospect, merely the market’s way of saying, “Let me catch my breath before I collapse again.” One might almost admire the long-term holders, those stoic saints who reaccumulate during these dips, their patience rivaling that of a cat watching a mouse trap reset. Recent lows at 73%, 76%, and 81% suggest we are now in a “mid-cycle recovery phase”-a phrase that sounds far more dignified than it actually is.

Darkfost, that oracle of on-chain sorcery, reports that 83.6% of Bitcoin’s supply is now in profit, a figure that would make a Victorian stockbroker blush. This, he claims, is “encouraging,” as if optimism were a seasoning to be sprinkled liberally on volatile assets. Investors, it seems, are choosing to hold their BTC like a secret lover, whispering, “I’ll wait for the next rally” while ignoring the nagging voice of reason.

Historically, such behavior is as predictable as a British summer: fear fades, accumulation resumes, and retail investors, emboldened by a single winning trade, begin to believe they are Wall Street. Meanwhile, institutional players, with their spreadsheets and coffee-stained ties, quietly fortify their positions, creating a market structure as fragile as a house of cards built by a toddler.

Yet Darkfost warns that surpassing 95% supply in profit is akin to lighting a fuse on a powder keg. Euphoria, that most dangerous of emotions, tends to replace rational thought, and soon the market is a circus of leveraged traders and short-term speculators, all dancing on a tightrope until someone trips over their own hubris.

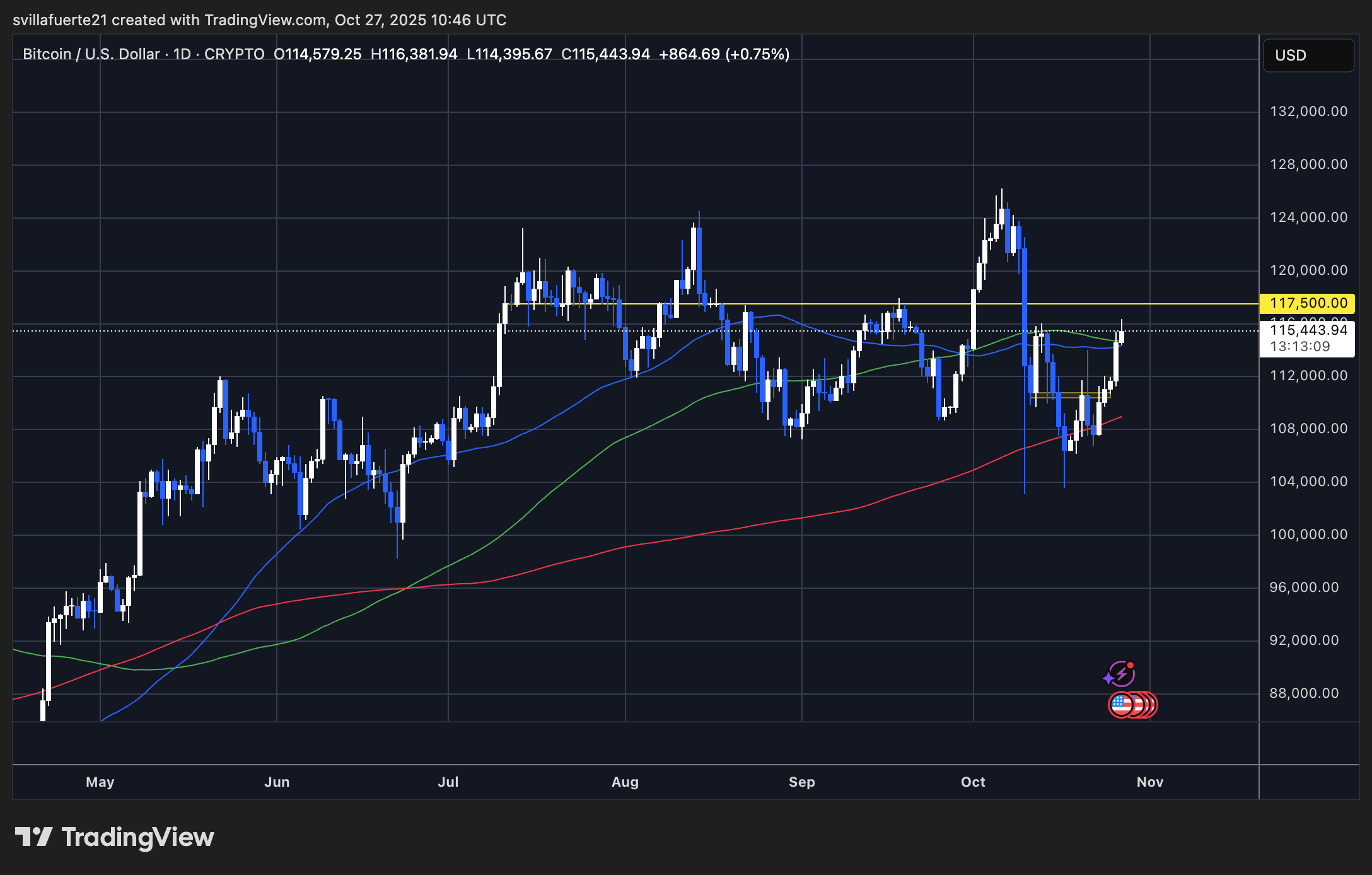

Bitcoin’s retest of $115,000 is less a technical analysis and more a farcical romp through chart lines. Bulls have reclaimed support levels with the tenacity of a dog chasing its tail, while the daily chart boasts a “strong recovery structure” that feels suspiciously like the market’s way of saying, “I’ll have another drink.” The 50-day and 100-day moving averages, once cold and unyielding, now bow to BTC’s whims, as if moved by a divine hand-or perhaps a very large margin call.

The next hurdle at $117,500 looms like a particularly stern uncle at a family gathering. A breakout would be the market’s way of saying, “I’m not just here for the snacks,” but failure could send BTC tumbling back to the $111K-$112K range, where it will presumably sulk until the next bullish tantrum. Momentum indicators, those ever-reliable cheerleaders, suggest buying pressure is mounting-but let’s not confuse momentum with momentum, shall we?

In conclusion, Bitcoin’s technical outlook is as optimistic as a man in a trench coat selling penny stocks on a rainy street corner. If bulls can maintain their grip above $115K and flirt with $117.5K, the market may yet enter a new bullish leg. But until then, it’s all just a very expensive game of hot potato, played by millionaires in suits and crypto bros in hoodies. May the odds be ever in your favor-or at least in your portfolio.

Read More

- EUR USD PREDICTION

- GBP CNY PREDICTION

- NEXO PREDICTION. NEXO cryptocurrency

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- CNY JPY PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- STX PREDICTION. STX cryptocurrency

- Get Ready for Rate Cuts: Morgan Stanley’s Shocking Forecast Will Leave You Speechless!

- Bitcoin’s Cosmic Cringe: Why the Crypto World Is Now a Black Hole 🌌💸

2025-10-28 02:34