Dearest ladies and gentlemen, I unfortunately must deliver the news that Bybit, our very own darling of the digital exchange world, has decided to temporarily stop allowing new fellow Japanese romantics from signing up. Why, you ask? Simply because Japan’s financial overseers are like busy socialites preparing for a grand ball with new regulations for digital assets.

The announcement takes immediate effect at high noon UTC on the last day of October, affecting all who might be joining in from Japan. Fear not, dear current patrons of Bybit; you can continue enjoying your digital dalliances uninterrupted.

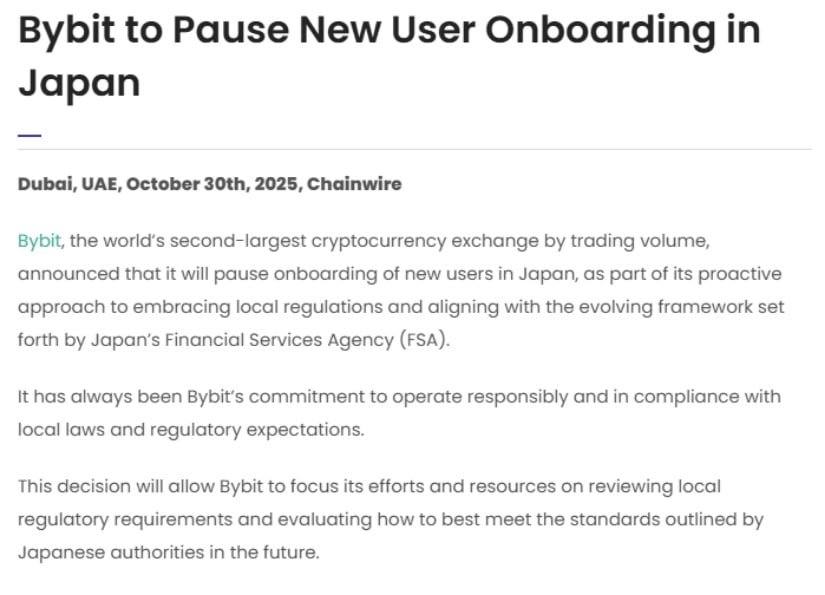

Bybit, ever so gallant in their approach, claims this step allows them to navigate the labyrinthine twists of the new standards dictated by Japan’s ever-watchful Financial Services Agency. They are, of course, ‘proactively’ adapting to local expectations with as much charm as they can muster.

Japan’s Regulatory Gala

Japan, as is its wont, is brushing up its regulatory dance shoes for a major change in cryptocurrency proceedings. Come September 2025, the Financial Services Agency proposed moving digital assets from a less restrictive act to one that dances to the tempo of securities – adding flair reminiscent of the stock and bond market tango.

The revised framework mandates standards more stringent than the ballet, requiring exchanges to embrace high professionalism in business conduct. Tokens and their issuers must be more transparent, and the sweet nothings of insider trading laws will now extend to cryptocurrencies as well.

With the birth of the Crypto Assets and Innovation Division in August 2025, the FSA hopes to balance the art of regulation with the innovation waltz. They are also flirting with the idea of allowing banks to dance their way into crypto investments, perhaps even hosting their own crypto exchanges.

Bybit’s Tangled Affair with Japanese Regulators

This tenderfoot tactic isn’t a new scene for Bybit and Japanese authorities. In December 2024, the FSA sent love letters of caution to lavish unregistered exchanges, including Bybit, warning them about oversight’s absence and the potential imprudence of unguarded user funds.

Previously, in May 2021, the Japanese regulators, with great charisma, reminded Bybit that offering services to the land of the rising sun without permission is a dance a few partners should not attempt. It seems Japan is pursuing its crypto rules with the determination of a Shakespearean love interest.

A Blossoming Market in Japan

The Land of the Rising Sun has seen its crypto market become more lush over the years. As of February 2025, over 12 million accounts blossomed, tripling in just half a decade, with digital assets valued over ¥5 trillion – a fortune in anyone’s account.

A fair 7.3% of experienced Japanese investors now dabble in crypto, surpassing those engaged in foreign exchange or corporate bonds. Most intriguingly, about 70% of crypto enthusiasts are the charming middle-income earners, proving that digital assets are not averse to democratic tastes.

However, not all is rosy in the land of sakura. With 80% of accounts holding less than ¥100,000, the regulators worry for the retail investors, much like a concerned governess, distressed by enticing but misleading carriage advertisements.

Depressing Taxes and Bitcoin Ballet

In a move sure to dance a smile onto investors’ lips, Japan is considering significant tax reforms, proposing to lower the capital gains tax on cryptocurrency to a harmonious 20%, akin to stocks. From progressive rates that would make anyone swoon, these new measures may see the light of fiscal year 2026.

The regulatory dance floor is being readied for Bitcoin and Ethereum exchange-traded funds (ETFs). Experts predict the curtain will rise on these attractions around fiscal year 2026, offering investors an elegant way to enter the crypto ballroom using familiar steps.

Speaking of familiar, Japan’s Finance Minister, ever a star at the Asia’s largest Web3 conference, gave his endorsement to cryptocurrencies, sprinkling advice that while volatility is a partner to be mindful of, proper regulation wields the power to make crypto a valid component of diversified portfolios.

What This Means for Crypto in Japan

Bybit’s courteous bow to new Japanese sign-ups is part of a grander performance by exchanges worldwide, all earnest in their quest for compliance. Having endured a rather unsightly $1.5 billion pirouette (I mean, hack) in February 2025, Bybit now hosts monthly proof-of-reserve soirées, independently audited to prove their solid solvency.

In a delightful aside, PayPay, Japan’s most preened digital payment society, has acquired a 40% stake in Binance Japan. With 70 million connections, they create a delightful bridge to link mainstream users with regulated crypto trading.

The comparison is clear: those engaging the regulators’ favor and rules are blossoming, while those who operate without invitation face mounting pressure.

The Road Ahead

Alas, the grande dame Bybit has not scheduled when it might again cast open its digital doors to forward-thinking Japanese novices. Upon their pursuit of fitting accreditation with the local authorities and adhering to new standards, only then can the music play again.

For the beloved 12 million crypto adherents of Japan, these adjustments suggest both challenges and the potential for evolution. While the immediate future may be trimmed a little, the long-term promises of enhanced investor security and the magnetism of institutional investments are intoxicating indeed. Let’s raise our champagne glasses to the promising horizon!

Read More

- EUR USD PREDICTION

- GBP CNY PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- NEXO PREDICTION. NEXO cryptocurrency

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- CNY JPY PREDICTION

- STX PREDICTION. STX cryptocurrency

- USD MYR PREDICTION

- Is XRP About to Soar or Crash? The $3.27 Dilemma Explained!

2025-10-31 03:28