In the theater of finance, Cardano lounges under a velvet discount. Since early December, the price has sagged by nearly 45 percent and, having flirted with $0.26, has coyly retreated to around $0.28. On paper, this reads as a splendid buying zone, a jewel-box of temptation with a hiss of caution inside.

The chart, that sly parchment, hints at an early reversal. The retail chorus grows louder, accumulating anew. Yet the whales, those voluminous gourmets, nibble with caution. Despite the discount and improving indicators, buying lacks conviction. Three data points explain why.

Bullish Divergence Inside a Falling Channel Still Fails to Unite Whales

Technically, Cardano’s chart wears a double-faced smile: a bullish divergence peeks from behind the curtain while the price pirouettes within a falling channel-the market’s own waltz with gravity, gracefully stubborn.

Since November, ADA has been trading inside a falling channel, where the price makes lower highs and lower lows within parallel lines. This reflects a controlled downtrend, not panic selling, as the channel remains intact. Yet, the downside risk remains.

At the same time, momentum is improving.

Between November 21 and January 31, ADA formed a lower low. During the same period, the Relative Strength Index (RSI) made a higher low. RSI measures momentum on a 0-100 scale. When price falls, but RSI rises, it suggests selling pressure is weakening. This is known as a bullish divergence. This usually appears near early trend reversals.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

However, whales are not responding in a unified way despite the reversal sign.

On-chain data shows three major wallet groups behaving differently:

- Wallets holding over 1 billion ADA increased holdings slightly after January 28, but nothing during the Jan-end dip.

- Wallets holding 100 million to 1 billion ADA reduced holdings from about 2.58 billion to 2.47 billion.

- Wallets holding 10 million to 100 million ADA increased holdings from roughly 13.37 billion to 13.50 billion.

When whales strongly believe in a rebound, these groups usually accumulate together. That is not happening. The net buying strength is merely 20 million ADA. The reason is risk.

As long as ADA stays near the lower boundary of the falling channel, a breakdown remains possible. A confirmed break could trigger another 29% drop, highlighted later while discussing price. This structural risk keeps large investors defensive, even with bullish divergence forming.

Weak Social Dominance and Cautious Retail Buying Limit Momentum

The second barrier is sentiment.

Social dominance measures how much attention a coin receives compared to the rest of the crypto market. It tracks the share of online discussions focused on that asset. Rising dominance often signals growing speculation and inflows.

For Cardano, social dominance peaked near 1.08% in November 2025, when the ADA price touched $0.59. Since then, it has declined steadily. It now sits near 0.047%, close to a multi-month low.

Historically, this matters.

- In early December, a local social peak preceded a 12% rally.

- In late December, another peak was followed by a 16% rise.

When social interest rises, price often follows. Right now, interest is fading. Without narrative momentum, whales have little incentive to scale into positions. Retail behavior is more positive, but still cautious.

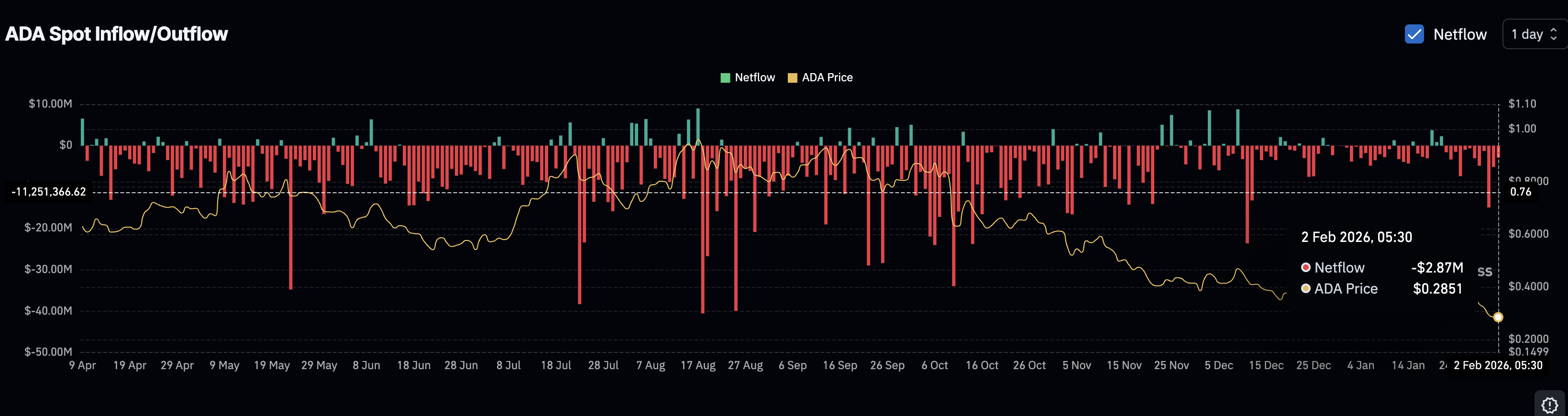

Since January 22, ADA has posted daily net outflows from exchanges. Outflows mean coins are leaving exchanges, usually for holding rather than selling. This reflects buying pressure.

Daily net buying peaked near $14.9 million on January 31 and later cooled to around $2.8 million. There have been no major selling days since late January.

This shows retail investors are slowly accumulating dips. But the pace is modest. Without rising social attention, retail demand alone cannot drive a strong trend.

Smart Money Weakness and Key Cardano Price Levels Keep Whales Defensive

The final warning comes from “smart money” and price structure.

The Smart Money Index tracks how experienced traders position during different market hours. It aims to reflect informed behavior rather than emotional trading.

Recently, this index has moved below its signal line and continued falling. In past rallies, around early January, it usually rose before the price. Its current weakness suggests professional traders are not positioning for a rebound yet. This also reinforces whale caution.

From a technical view, several levels now define February’s outlook.

On the upside, ADA must first reclaim $0.319. This would signal improving confidence. A move above $0.376 is more important. It would break the falling channel and shift the structure from bearish to neutral. That could attract coordinated whale buying.

On the downside, $0.268 remains critical. A confirmed break below this level would also confirm a channel breakdown and open downside toward $0.188, implying a 29% drop target from the breakdown point.

As long as the price stays between $0.268 and $0.319, uncertainty dominates. The bullish divergence shows that selling pressure is fading. But weak social momentum, fragmented whale behavior, and the absence of smart money support keep conviction low. Until sentiment improves and key resistance breaks, Cardano’s rebound remains possible, not proven.

Read More

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- BTC PREDICTION. BTC cryptocurrency

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- 🔥Vienna’s Crypto Carnage: Ukrainians Burn Wallets & Souls! 💰💀

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

- You Won’t Believe What Secretly Predicts Bitcoin’s Next Crash! 😱

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

- 🐳 XRP Whales Splash Cash: Is the Tide Turning? 🌊

2026-02-02 18:56