USDT’s Triumph Amidst Crypto Chaos: A Record-Breaking Journey

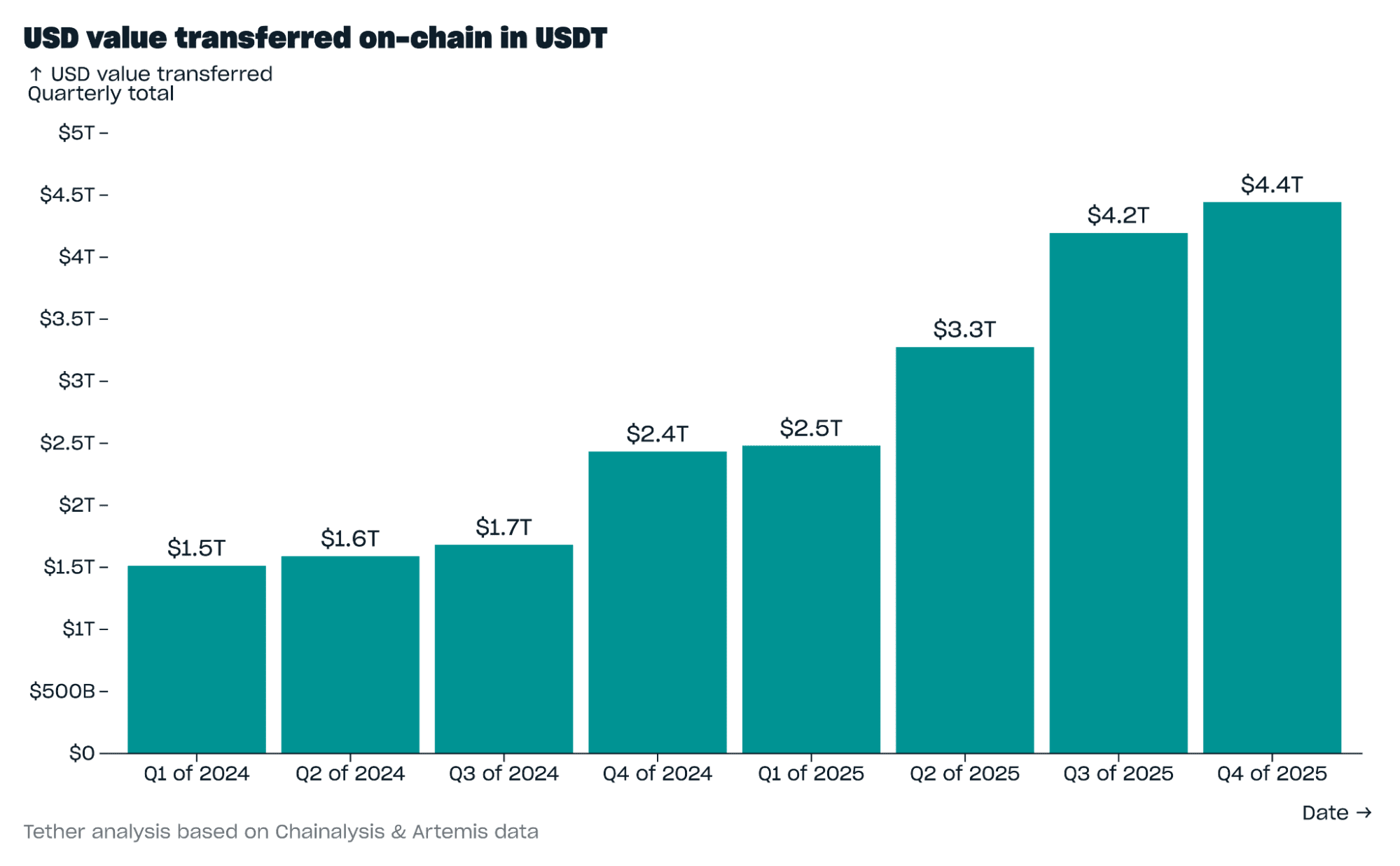

As 2025 drew to a close, Tether’s USDT not only survived but thrived, solidifying its status as the reigning champion of stablecoins. According to Tether’s Q4 2025 Market Report, USDT boasts a staggering market capitalization of $187.3 billion, an increase of $12.4 billion in just one quarter-impressive, considering the total cryptocurrency market cap plummeted by over a third post-October liquidation.