Bitcoin Falls Below $93K: Is the Crypto Bottom Near? 🚀📉

Bitcoin, that mercurial dancer, stumbled to a fresh six-month low on Monday, its steps faltering as crypto sentiment, that fragile bird, took flight into the abyss. 🦋💸

Bitcoin, that mercurial dancer, stumbled to a fresh six-month low on Monday, its steps faltering as crypto sentiment, that fragile bird, took flight into the abyss. 🦋💸

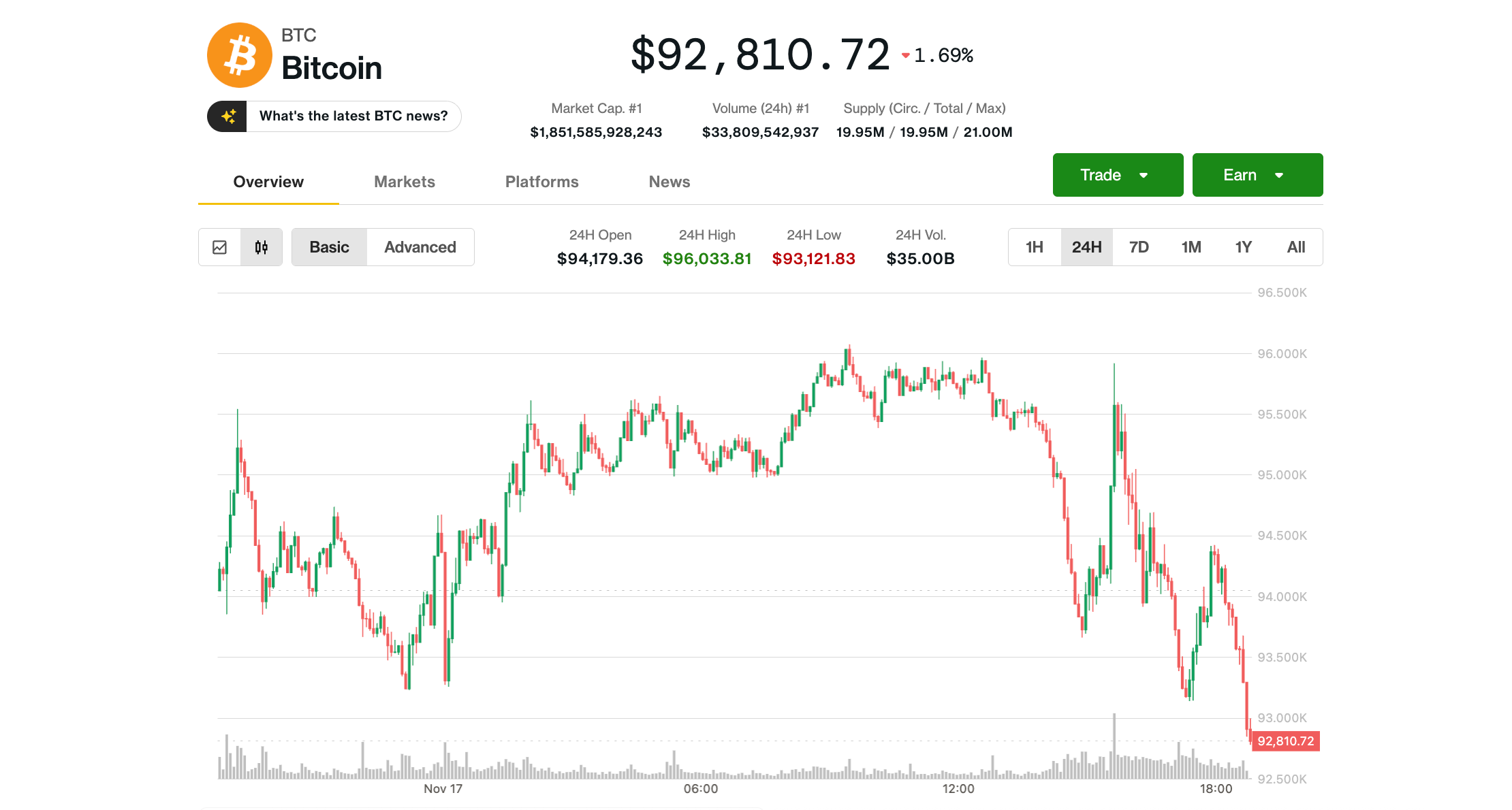

Meanwhile, BTC is currently trading at $93,500, which is either a steal or a trapdoor depending on your caffeine intake. And MSTR stock? It’s currently plummeting faster than a poorly timed TikTok dance. Down 2.28% in pre-market trading-because nothing says “confidence” like a stock price that looks like it’s been hit by a bear market piñata. 🐻💣

Solana is down 26% over the past month from its January 2025 high of $268.86.

With a dramatic flourish, Solana has slipped below this once formidable barrier, turning it into a resistance-a nuance lost on many, yet painfully obvious to those watching with keen eyes. The momentum, previously buoyant, now feels somewhat akin to a balloon punctured by a jealous child-deflating rapidly and leaving only the faintest hope of revival.

But fear not, dear spectators! Some clever clowns-er, analysts-say this volatility is just short-term holders panicking like they’ve seen a ghost 👻 and long-term holders playing a game of musical chairs. 🎶 As the big-top institutions and patient pachyderms (long-term holders) keep the show running, prices are bound to soar higher than a cannonball act. 🚀

The key question now is whether this rally still has fuel left-or if it’s just a sparkly fireworks show that ends with a poof. Can FIRO realistically revisit the $10+ zone? Let’s find out before we all forget what $10 feels like.

In the past year, Bitcoin has surged like a penguin on a trampoline, posting returns that make traditional assets blush. Yet, while some see stability, others ponder: is this a golden goose or a goose with a penchant for fireworks? 🦆🧨

Ah, the inevitable question – will scarcity ignite a fire that no water can quell? The short answer, much like most human endeavors, is complicated. The supply of Bitcoin retards its pace, halving every now and then-a schedule as relentless as fate-causing the issuance to slow, not abruptly disappear. It is not a sudden famine, but a slow, grudging withdrawal. A century still stands between us and the last satoshi, that tiny, nearly insignificant fragment of a coin, which will drift into the world around 2140. The market, however, has grown weary of the headline that nearly all has been mined; no, dear reader, it is no more a story about impending scarcity than it is about the patience of saints. 😴

To make things more interesting, while Buffett’s busy passing the CEO baton to Greg Abel – a move as predictable as sunrise – folks keep yappin’ about Bitcoin like it’s some wild stallion runnin’ loose. These old comments about Bitcoin? They’ve been around longer than the Mississippi, but they still stir up a mighty fuss whenever folks talk shop about that particular shiny object. 🎩

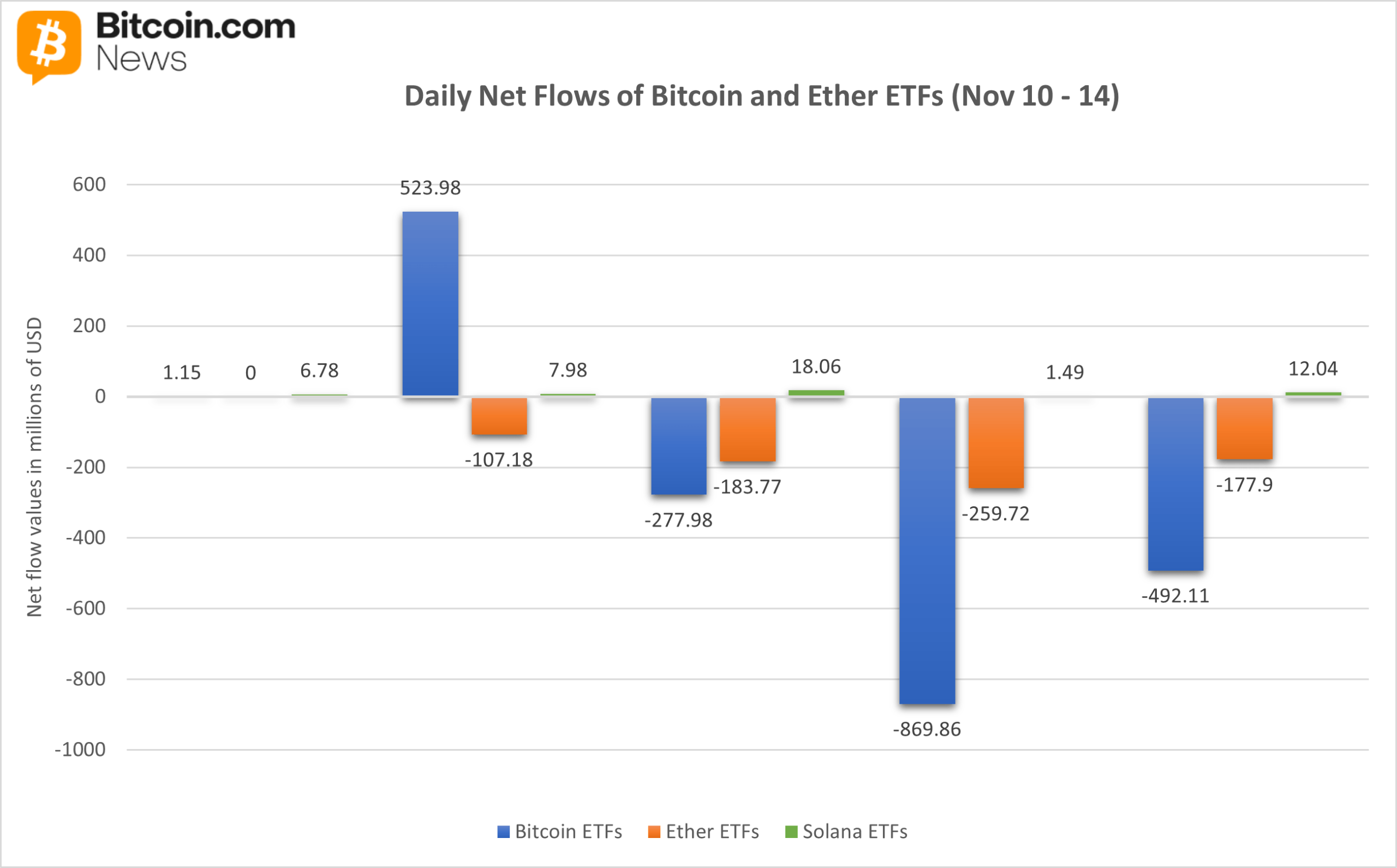

Some weeks unfold slowly; others tell the story of a market shifting beneath the surface. November 10-14 delivered the latter, with bitcoin and ether exchange-traded funds (ETFs) facing relentless pressure while solana quietly extended its winning streak. The contrast was striking, especially as major funds saw billions in assets rotate out. 🎢💸