Crypto Carnival: $3.5B Vanishes in a November to Remember

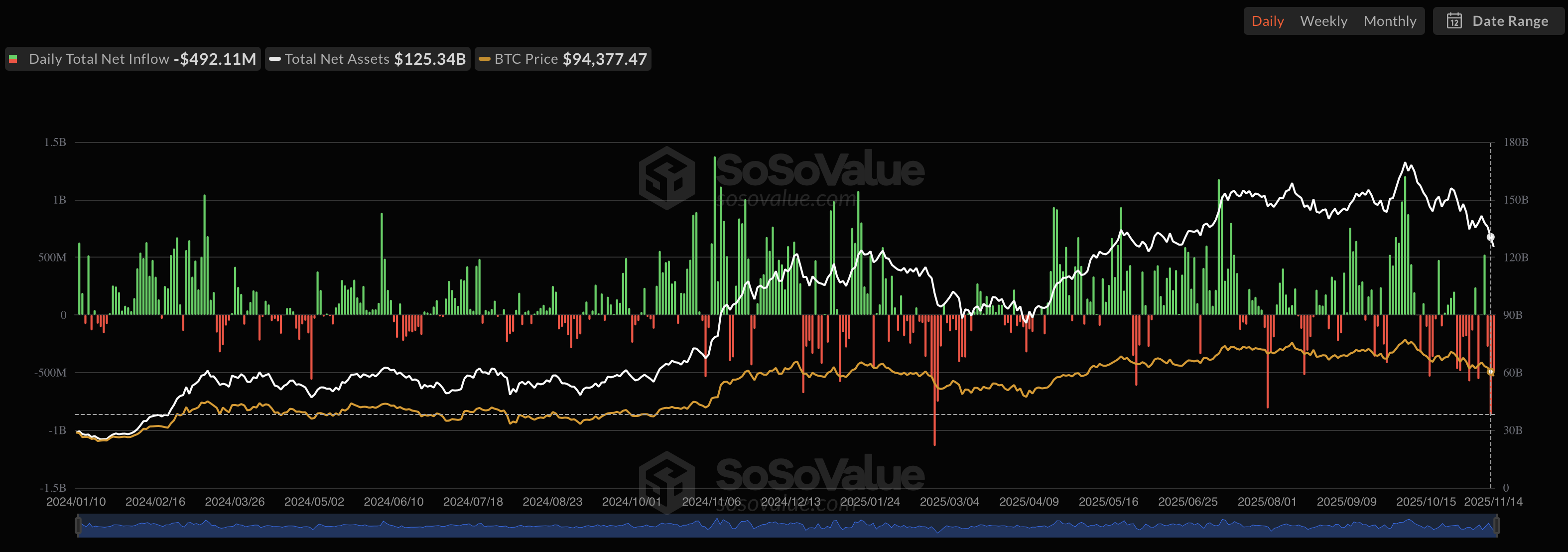

Our dear Bitcoin ETFs have been on a losing streak longer than a Sunday matinée, with three consecutive days of liquidity loss-peaking in chaos on November 13th, the worst since the dawn of the last nine months, according to SoSoValue. A staggering $1.6 billion evaporation in just three days-oh, the drama! November 2025 might just take the cake as the most theatrical month since Molière himself was alive.