Cryptonews

Bitcoin’s Crown Shaken: Altcoins Like PEPENODE Rise 😂

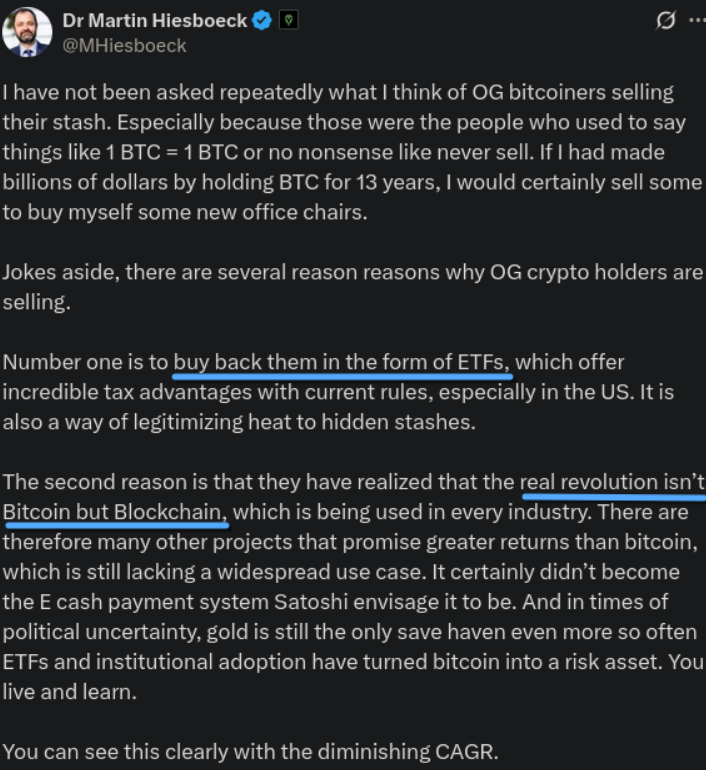

For years, crypto’s mantra was simple: “Bitcoin or bust!”-a creed as rigid as a Soviet plan. But now, like a thawing winter, maximalism melts. Bitcoin, once the alpha and omega, now slumbers as digital gold, while the real drama unfolds in altcoin realms. Spot ETFs, those capitalist saviors, have turned Bitcoin into a tax-advantaged savings account for the crypto bourgeoisie. OG whales? They’re not selling their BTC-they’re wrapping it in ETF silk and calling it a day.

Coinbase Flees Delaware’s Circus 🎪 for Texas BBQ 🥩 – Who’s Next?

Why, you ask? Oh, merely the “unpredictable outcomes” and rising uncertainty within Delaware’s legal framework. You know, the kind of unpredictability that makes even the most seasoned CFO break out in a cold sweat. 🥶 Joining the likes of SpaceX, Tesla, and Dropbox, Coinbase is now part of the “Texas or Bust” club, where the only thing hotter than the weather is the business-friendly climate. 🔥

🤑 Crypto Chaos: Billions in BTC & ETH Options Expire – Market Trembles! 🌪️

Simultaneously, Ethereum, the enfant terrible of the crypto world, saw 228,000 options worth $730 million expire, their Put-Call Ratio of 0.59 hinting at a market both hopeful and hesitant. The max pain point, a mere $3,475, seemed almost quaint in comparison, like a peasant’s dream in a palace of excess. 🏰

Fanatics & Crypto.com: A Most Peculiar Alliance? 🧐

According to sources – unnamed, naturally, for who would willingly attach their reputation to such outlandish speculation? – the plans are…fluid. As fluid as a politician’s promises, one might add. 🙄

HBAR Plunge: 📉 ETFs Can’t Save the Day?

HBAR, poor thing, retreated 3.5% during Thursday’s tedious session, meandering from $0.1617 to $0.1761. This little dip occurred, hilariously, even as the grown-ups (institutions) were tossing $68 million into the pool. The token, with a sigh of digital exhaustion, met rejection at the $0.1805 resistance level. There was a fleeting morning spike, reaching a pathetic $0.1802 on a surge of volume – 79% above the daily average! A veritable frenzy of interest, quickly extinguished, like a damp firework.

The SEC’s Crypto Project: New Rules, Old Drama, and More Red Tape!

The drive for clear crypto governance is accelerating faster than a bull on a caffeine rush. The U.S. Securities and Exchange Commission (SEC) is finally shaking off the fog, honing its vision under the mystifyingly elusive ‘Project Crypto.’ On November 12, SEC Chairman Paul S. Atkins spoke at the Federal Reserve Bank of Philadelphia, outlining how the SEC’s work is converging into something that might-just might-resemble clear rules for digital assets.

BNB’s Wild Ride: Crypto’s Most Boring Drama Unfolds 🤡💸

On November 13, 2025, crypto soothsayer CW pointed out the $945-$950 region as a “buy wall” on X. Let me guess: it’s a magical zone where buyers mysteriously appear every time the price dips. CW’s chart shows retests of this band, each met with “visible buyer absorption” – a fancy way of saying “somebody finally stopped selling their soul for gas fees.” 🤷♂️

🤑 dYdX’s Grand Buyback Bonanza: 75% or Bust! 🤑

Despite this audacious tokenomics coup, DYDX has taken a tumble, falling 3.53% to a humble $0.3060 on the day of the announcement. And since September? A dramatic 56% plunge from its lofty $0.70 perch. Oh, the irony! 😂

Bitcoin’s Wild Ride: $100K? More Like $98K and a Side of Chaos 🤑💥

At the time of me typing this (and probably you reading it), BTC is cozying up near $98,400. That brief flirtation with six figures? Gone. Poof. Like a Tinder match who ghosts after one date. Sentiment across trading desks? Cautious. Very cautious. 🧐