🤑 Trump’s Memes Make Crypto Great Again? 🌽️🚀

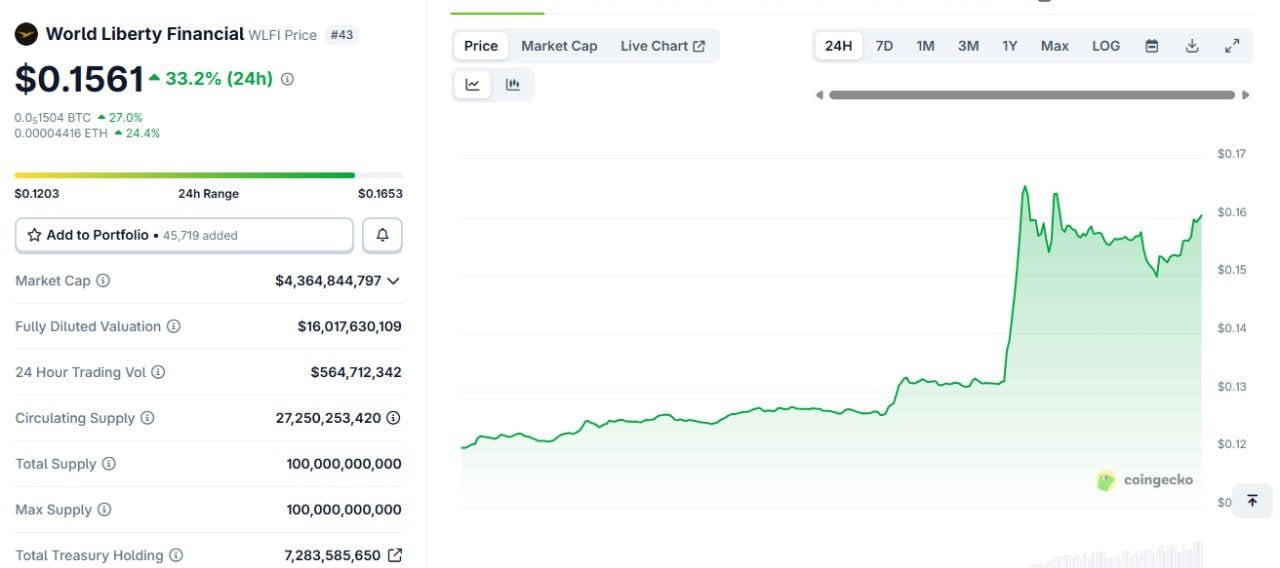

Yet, mark well, dear spectator, the true stars of this farce are the meme coins, those whimsical tokens tied to the grand personage of the American president, Donald Trump. Oh, the irony! The man who once declared tariffs with the fervor of a zealous merchant now sees his visage emblazoned upon digital trinkets, soaring in value like a goose chased by a fox. 🦆💨