Chainlink’s $11 Sneaky Trap!

//media.crypto.news/2025/11/LINKUSD_2025-11-03_12-47-26.webp”/>

//media.crypto.news/2025/11/LINKUSD_2025-11-03_12-47-26.webp”/>

The battleground? A social media post-oh, the modern-day pamphlets of revolution!-crafted by Warren on a fateful October day. The lawyers, those vultures of verbosity, now squabble over its meaning like starving dogs over a scrap of meat.

According to the fine folks at CryptoRank (who probably have charts for breakfast), XRP’s November performance is a coin flip-except one side is a sad trombone 🎺, and the other is a confetti cannon. Sure, the red months sulk into double-digit losses, but the green ones? Oh, they’re like a hyperactive caffeinated unicorn 🦄-triple-digit gains, baby!

Okay, so CZ – you know, the Binance guy – he bought some Aster tokens. Two million dollars worth! He even put up a screenshot. A screenshot! Like we needed proof. It\’s not like he\’s got, what, a few dollars lying around? 🙄

But what spectral hand is pulling the strings of this infernal carousel? 🌀

XRP hit a short-term high near $2.550 and then decided it was time for a mood swing, just like Bitcoin and Ethereum. Down it went, below $2.520 and $2.50. Because why have stability when you can have chaos? 🎢🤪

By linking with Bitcoin and real-world lending to draw new liquidity and break its DeFi stagnation loop. Because why not ask Bitcoin to babysit your DeFi dreams? 🤷♂️💸

By late in the blessed month of October, Bitwise Investment Advisers LLC alongside Canary Capital Group LLC played hopscotch with the U.S. Securities and Exchange Commission (SEC) by submitting their latest little amendments, and wouldn’t you know it, XRP just might be stepping up as the star child of this crypto show, dreaming its ETF debut.

Honestly, SOL’s momentum? It’s still four times weaker than BTC, making it look like the understudy who can’t quite take the stage. Its total value locked (TVL) remains flat-like a stagnant pond-showing liquidity hasn’t yet rushed in, despite the hype.

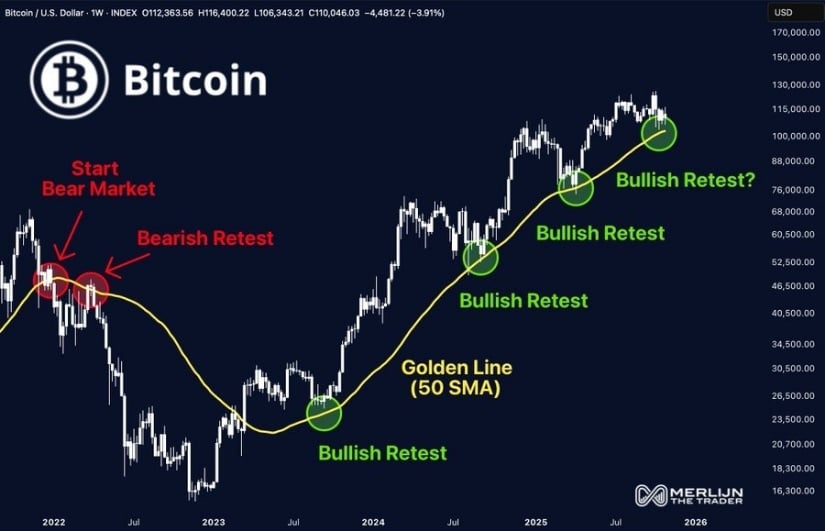

Merlijn The Trader, oracle of the charts, declares the 50 SMA a “divine arbiter” since 2021. In 2021, it summoned bears; in 2024, it blessed bulls. Now, Bitcoin hovers like a moth before a flame, daring to test this sacred threshold. “The 50 SMA decides everything,” he writes, as if the algorithm itself were a judge with a calculator. One wonders if the line knows its own power-or if it’s just a glorified spreadsheet. 📊