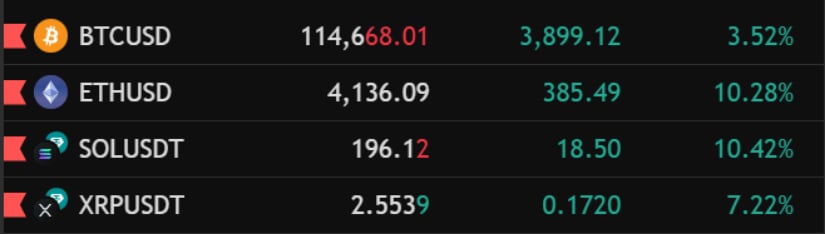

Analyst Predicts $150k Bitcoin, But First, A Crash! Prepare for ‘PUMPtober’?

But wait, it doesn’t end there. Ash Crypto, ever the optimist (or perhaps a secret contrarian), also foresaw that the last quarter of the year would be Bitcoin’s grandest hour. He boldly stated that Bitcoin would surge to $150,000, ushering in a glorious altcoin season. A truly thrilling ride… assuming you survive the initial plunge.