Gold-Backed Tokens Prove Resilient Amid Crypto Rout – But How Long Can They Last?

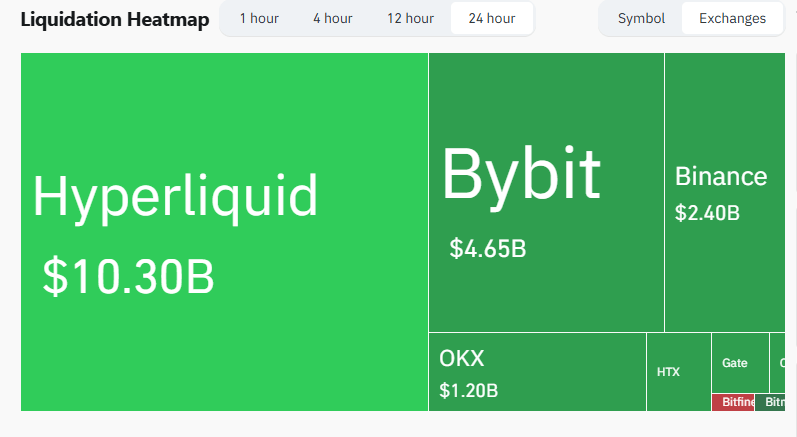

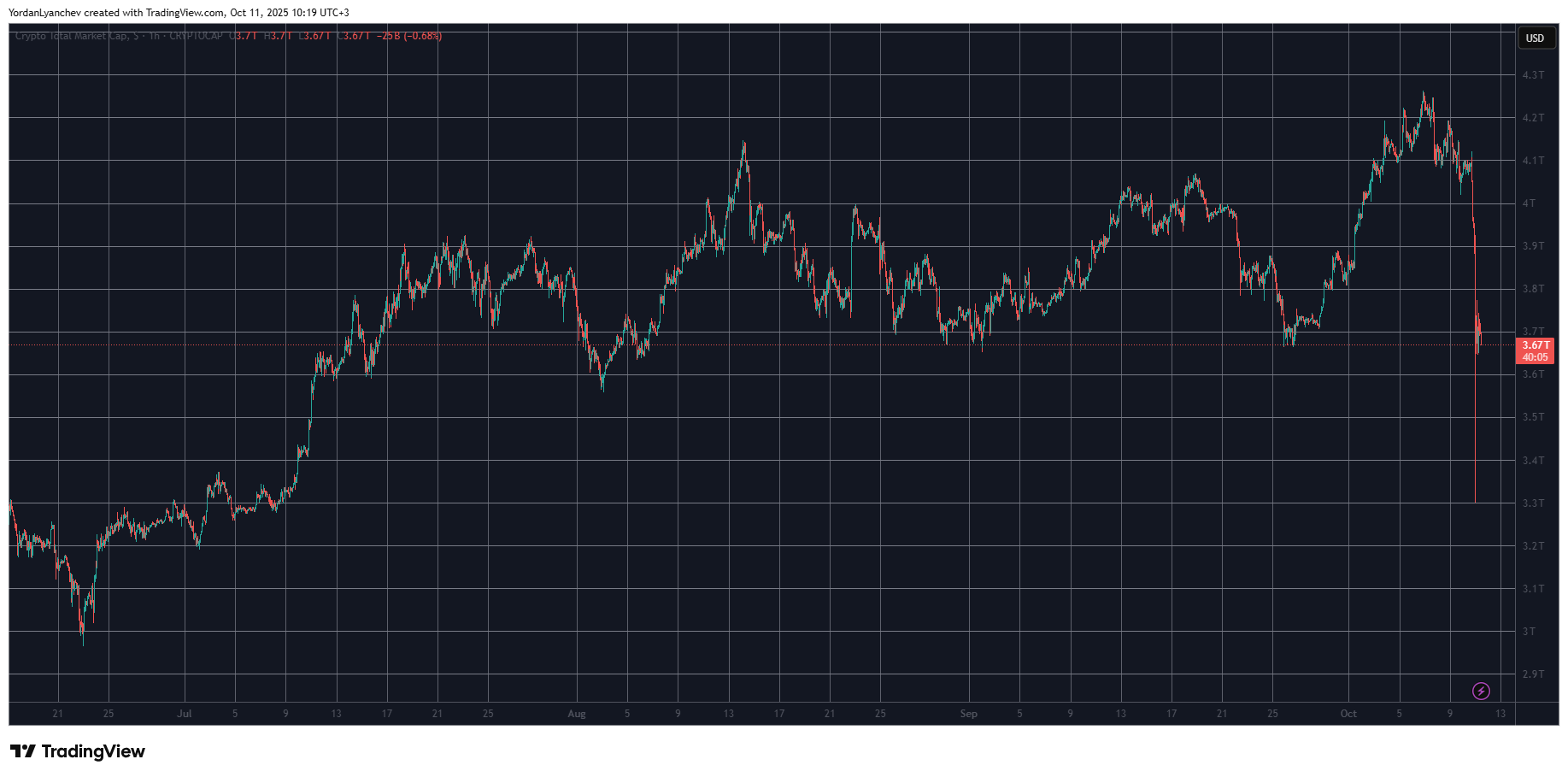

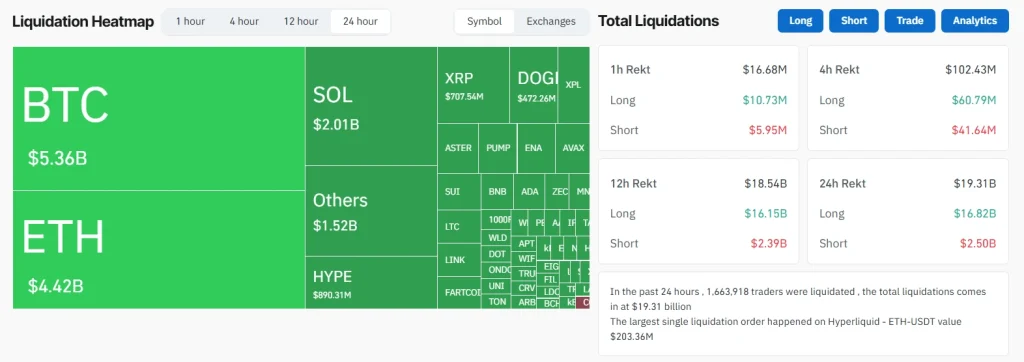

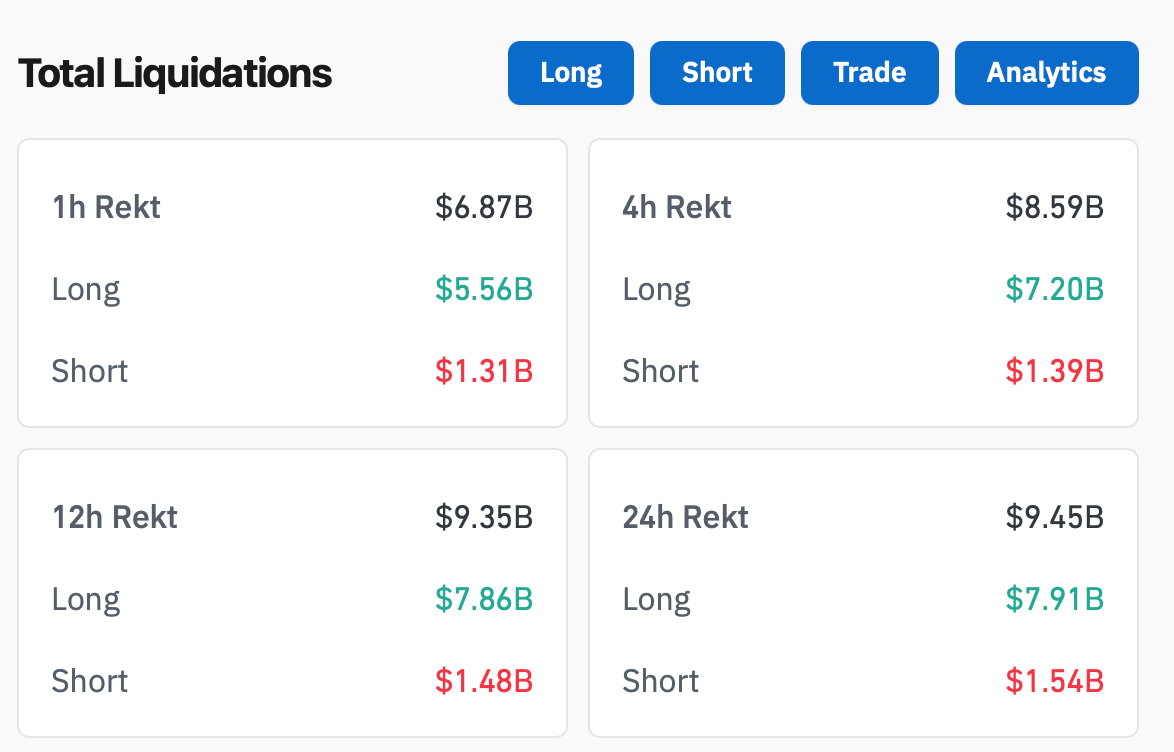

So, while bitcoin, ether, and other major cryptos were busy taking a nosedive in a $19 billion liquidation on Friday, gold-backed digital assets were over here just sipping their iced lattes and staying calm.